Introduction

Investing in the stock market is like joining a big game where you can own tiny parts of big companies. Imagine it’s like a playground, but instead of swings and slides, there are stocks. When you buy a stock, you’re hoping the company does well and grows over time. It’s a bit like planting a seed and watching it grow into a tree.

You can start playing this game by putting money into an online investment account. This lets you buy shares of stock or stock mutual funds. Think of mutual funds as a collection of different stocks in one package. It’s like having a bunch of different toys instead of just one.

The stock market can be exciting, like a Cash Frenzy Casino, where prices go up and down. But it’s not just about quick wins. Investing is more about making smart decisions for the long term. It’s like choosing the right toys that you know you’ll enjoy for a long time, not just the ones that are popular right now.

Remember, the stock market can be unpredictable, like a game with ups and downs. But if you’re smart, and patient, and keep learning, you can make good choices and watch your investments grow over time.

What is a Cash Frenzy?

Cash Frenzy Explained

A cash frenzy in the stock market is like a whirlwind of excitement where everyone’s buying and selling stocks super fast. It’s like when every kid in school suddenly wants the same cool toy. This frenzy happens when people think they can make quick money because a stock’s price is shooting up.

Starting a Frenzy

So, what sparks this frenzy? It could be something like a cool new gadget from a tech company or a big brand announcing a surprise partnership. This news spreads super fast, just like gossip on the playground. TV, social media, and market news all play a part in hyping it up. Suddenly, everyone wants a piece of this hot stock. It’s like everyone rushing to get the latest, trendiest toy.

When a lot of people start buying a stock, its price can climb quickly. This is where the frenzy heats up. But remember, just like any game, there are risks. Sometimes, the excitement can create a bubble in the stock price. This means the price might be higher than what the company is worth. And just like a bubble, it can burst, causing prices to crash down. The Ups and Downs of a Cash Frenzy

The Rush to Buy

In a cash frenzy, people buy stocks quickly, causing prices to surge. It’s like when a new ice cream flavor comes out, and everyone rushes to try it. This rush is driven by the excitement of making quick money, similar to the thrill of winning at a Vegas casino.

The surge in buying can be sparked by market news, a trending stock, or even a speculative condition in the market. It’s a movement where everyone wants to get in on the action, pushing stock prices higher.

The Risks

However, this frenzy can lead to risks, like a bubble that might burst. When prices soar too high, they often don’t match the real value of the stocks, creating a speculative bubble. This is risky because what goes up quickly can come down just as fast. It’s like playing a game at a real casino; the excitement is high, but so is the risk of losing.

Buying stocks just because everyone else is can lead to poor investment decisions. It’s crucial to understand the impact of cash flow in the stock market and be cautious of market volatility. In a bear market, these frenzies can lead to significant losses.

Real Stories of Cash Frenzies

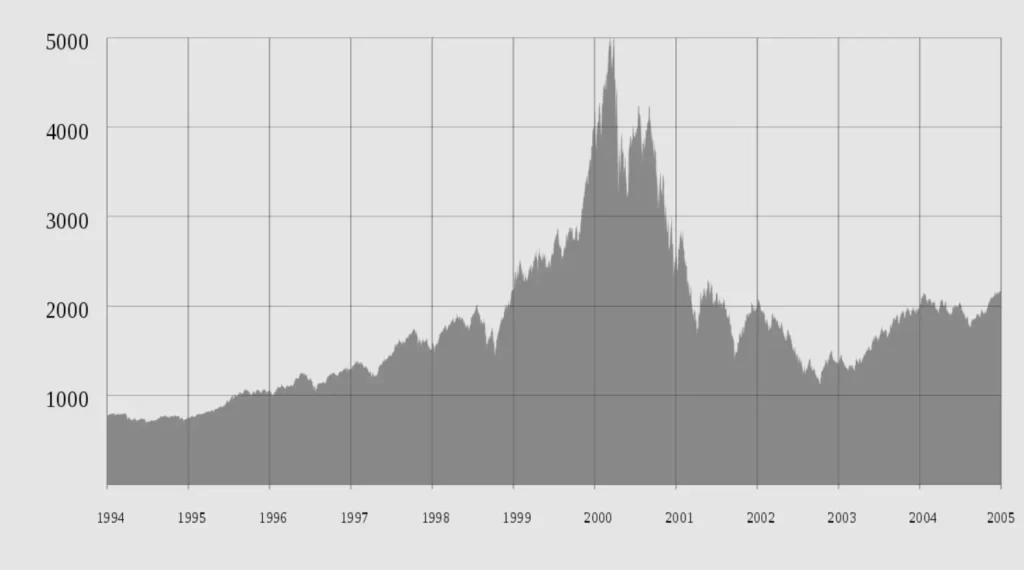

The Dot-Com Bubble

In the late 1990s, the dot-com bubble was a classic example of a cash frenzy. Internet company stocks skyrocketed as investors were driven by the excitement of new technology and the potential of the online world.

This frenzy led to inflated stock prices, far beyond the actual value of the companies. However, this bubble eventually burst, leading to a dramatic crash in the market. Many investors, caught up in the frenzy, faced significant losses. This event serves as a reminder of the risks associated with speculative investment and the volatility of market trends.

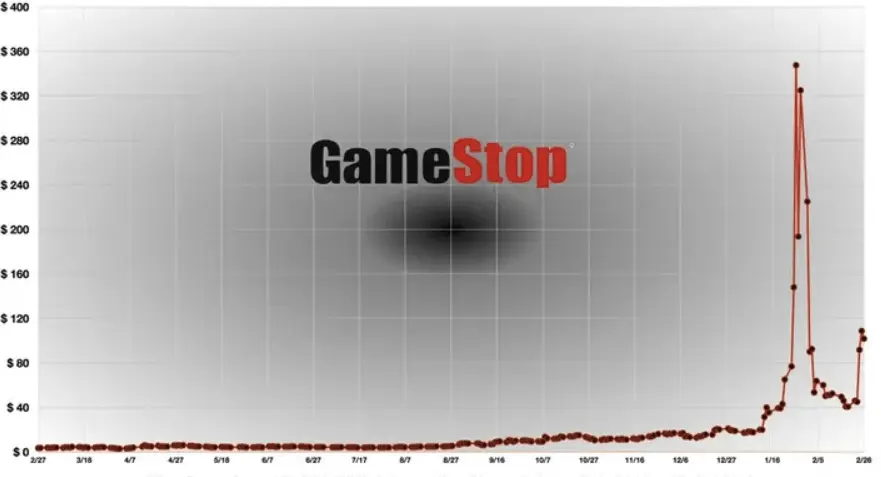

The GameStop Frenzy

In 2021, the GameStop frenzy became a headline story, showcasing the power of retail investors in the age of social media. Small investors, coordinating through online platforms, challenged big hedge funds by driving up the price of GameStop stocks.

This surge in price was fueled by a mix of speculative trading and a desire to challenge established market participants. However, as the frenzy subsided, the stock prices plummeted, leading to losses for many. The GameStop frenzy highlighted the impact of social media and public sentiment in driving market trends and the potential risks of participating in such frenzies.

Smart Moves in a Cash Frenzy

Spotting a Frenzy

To spot a cash frenzy in the stock market, look for signs like a sudden surge in trading volume, especially around a specific sector or company. It’s like knowing when a new, cool game is about to come out because everyone’s talking about it.

A cash frenzy often comes with widespread media coverage, public excitement, and a sense of euphoria. It’s crucial to monitor market news and trends, as these can give insights into potential price movements before they hit the mainstream.

How to Play It Safe

Playing it safe during a cash frenzy means not just following the crowd. Do your homework before buying stocks. Look into the fundamental aspects of the businesses you’re considering, like their financial stability and growth potential. Diversifying your portfolio across different asset classes and sectors can help mitigate risks associated with market volatility.

Remember, investing in the stock market is not just about quick money; it’s about making informed decisions for long-term success. Avoid emotional decision-making based on fear or greed, and stay informed about current events and trends to navigate through potential market downturns or cash frenzies effectively.

Conclusion

In the stock market, a “Cash Frenzy” can be like a wild ride at a casino, full of ups and downs. It happens when everyone’s buying or selling stocks super fast, often driven by news or hype, just like people rushing to play the newest slot game at Cash Frenzy Casino.

But remember, this frenzy can lead to risky bubbles, like the dot-com crash or the GameStop surge. Smart moves? Look for signs of frenzy, don’t just follow the crowd, and think long-term. It’s crucial to understand the market, do your research, and not get swept up in the excitement. Just like in a casino, the key to success is playing smart, not just fast.

Frequently Asked Questions

What is the term “cash frenzy” in the context of the stock market?

The term “cash frenzy” commonly refers to a market condition where investors aggressively buy a particular stock or asset. This is often driven by a strong belief in the success or potential of the company or asset, creating a surge in its demand and usually results in a rapid increase in its price.

How can a cash frenzy impact my investment strategy?

A cash frenzy can heavily impact an investor’s strategy. In a frenzy, prices can reach much higher than their initial value due to high demand. While this may present a short-term gain opportunity, it also carries the risk of market corrections when the frenzy ends. Investors must understand cash frenzies and their possible implications when building their investment strategy.

Can cash frenzy be a long or short-term investment strategy?

Typically, a cash frenzy refers more to short-term market conditions driven by emotional buying rather than a sustainable, long-term investment strategy. However, understanding cash frenzies, their signs, and the timing of the market around them can be a part of an investor’s approach.

What are some signs of a cash frenzy on the stock market?

Signs of a cash frenzy on the stock market include a rapid increase in a particular stock or asset’s price, an above-average volume of trades, and an unusually high level of hype or positivity about the asset in question. However, it’s essential to keep in mind that recognizing these signs does not guarantee success at real money gambling.

What can drive a cash frenzy in investment?

Several factors can drive a cash frenzy, such as a new initial public offering (IPO), positive news about a company, or favorable market conditions. In some cases, speculative buying or selling stocks based on rumors can also trigger a cash frenzy.

What is the impact of cash frenzies on the bear market?

During a bear market, a cash frenzy can temporarily boost an asset’s or a stock’s value. However, once the frenzy subsides, prices often fall back to normal or even lower levels. It’s essential to understand the risk of participating in a cash frenzy, especially during a bear market condition.

Are there particular stocks that are more susceptible to cash frenzies?

While any stock has the potential to experience a cash frenzy, it is generally more common among small-cap stocks or companies with new, innovative products or services. These companies tend to have less established track records, which can increase the risk of market corrections post-frenzy.

How can I take advantage of a cash frenzy?

An investor can potentially take advantage of a cash frenzy by buying a stock before the frenzy begins and selling at its peak. However, this is an incredibly risky strategy that relies heavily on timing the market perfectly, which is very difficult to do. It’s crucial to understand the potential consequences and ensure that this strategy aligns with your overall investment goals and risk tolerance.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.