Is crypto the future of currency? This burning question is at the heart of our rapidly evolving financial landscape.

As we dive into the world of Bitcoin, Ethereum, and blockchain technology, we uncover how these digital assets are reshaping the traditional financial system. From the surge in crypto market capitalization to the regulatory challenges posed by the SEC.

This article offers a concise, fact-based exploration of the future of money. Discover how cryptocurrencies are influencing global economies and what the future may hold for this dynamic sector.

The Evolution of Cryptocurrency: A 2024 Perspective

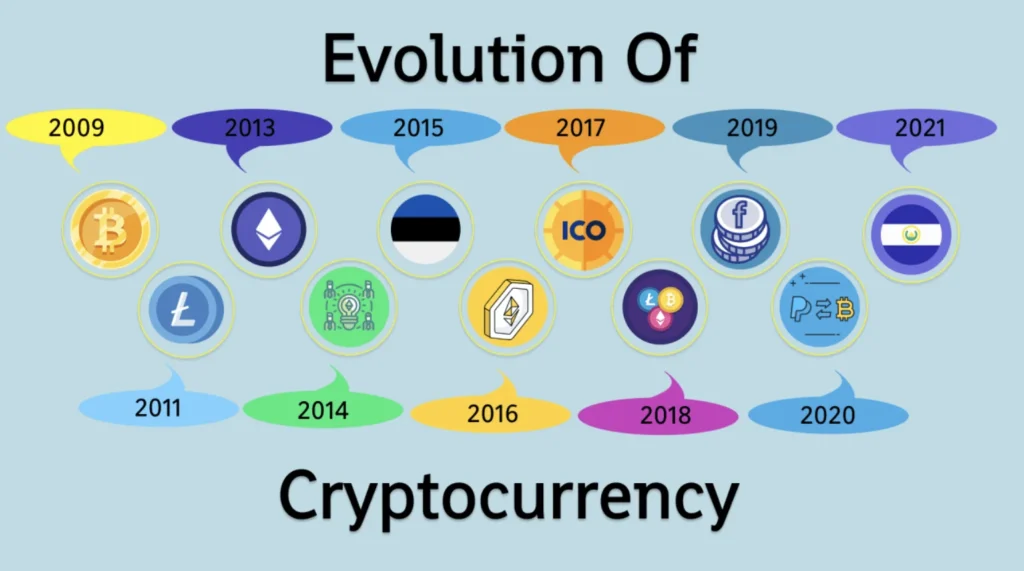

The cryptocurrency landscape has undergone a significant transformation by 2024, evolving from an emerging technology to a key player in the global financial system. This evolution is marked by increased adoption, regulatory developments, and technological advancements.

The journey of cryptocurrencies like Bitcoin and Ethereum into mainstream finance reflects a broader shift in how we perceive and utilize money in a digital age.

With a growing number of individuals and institutions embracing cryptocurrencies, the future of this innovative sector looks promising, albeit with challenges and uncertainties that continue to shape its path forward.

Cryptocurrency’s Journey to Mainstream

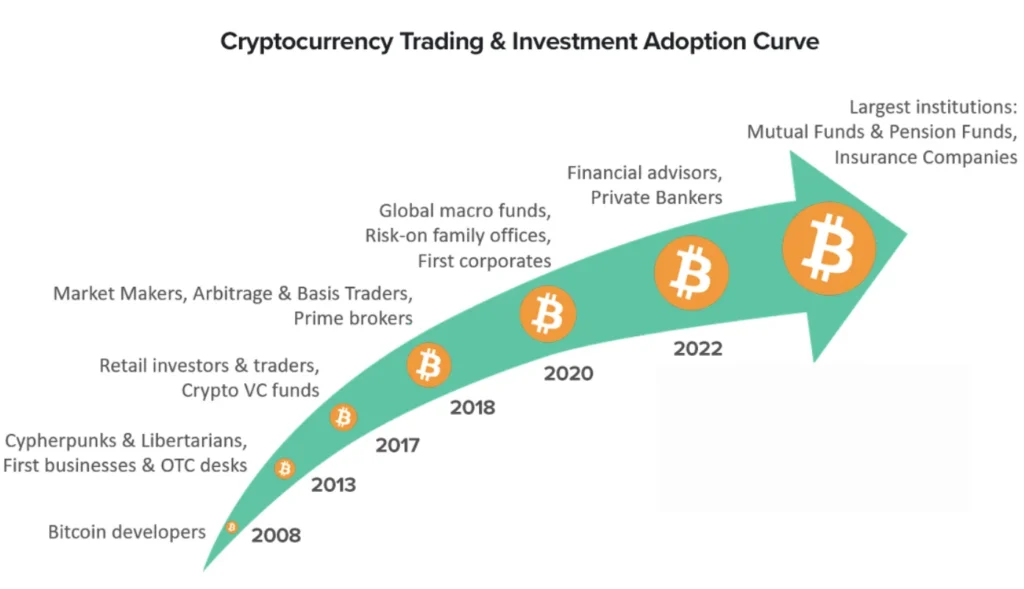

In 2024, cryptocurrency has firmly established itself in the mainstream financial landscape. The journey from a niche digital novelty to a widely recognized financial asset has been remarkable. A significant factor in this transition is the increasing awareness and ownership of cryptocurrencies, such as Bitcoin and Ethereum, among the general public.

In the United States alone, cryptocurrency ownership has surged, with 40% of American adults now owning crypto, up from 30% in 2023. This equates to approximately 93 million people holding cryptocurrencies.

The rise in crypto ownership is not limited to any specific demographic. While men continue to dominate the space, there has been a notable increase in the rate of crypto ownership among women, jumping from 18% to 29% at the start of 2024.

This change is attributed to the growing visibility of women in the blockchain industry and their active participation in investing and covering developments in the sector.

Also read: Exploring the Two Types of Stablecoins: A Comprehensive Guide

The Crypto Market’s Ups and Downs

The crypto market has experienced its fair share of volatility, with a tumultuous bear market in 2022 followed by a healthy recovery in 2023. The market’s fluctuations are closely tied to Bitcoin’s supply halving, a significant event in the crypto world occurring approximately every four years. The next halving is scheduled for April 2024, which is expected to have a considerable impact on the market.

Another critical development shaping the crypto landscape is the potential approval of a Bitcoin ETF (Exchange-Traded Fund) by the Securities Exchange Commission (SEC). This approval is anticipated to drive further adoption among investors and add legitimacy to the crypto market.

The approval of a Bitcoin ETF could lead to an influx of new investors, as it allows people to invest in Bitcoin through the stock market without directly purchasing the cryptocurrency.

The price of Bitcoin and other cryptocurrencies has been subject to dramatic swings, with the value of Bitcoin having fallen by more than 50% six times in its history. Despite these challenges, the crypto market continues to attract investors, buoyed by the promise of high returns and the allure of a decentralized financial system.

Cryptocurrency in Today’s World: Adoption and Regulation

The landscape of cryptocurrency in 2024 is marked by its growing adoption and the evolving regulatory environment. As digital assets like Bitcoin and Ethereum become more integrated into the mainstream financial system, the need for clear regulatory frameworks has become increasingly apparent.

This section delves into the current state of cryptocurrency adoption and the challenges and opportunities presented by the regulatory landscape.

The Growing Adoption of Digital Assets

Cryptocurrency adoption has reached new heights in 2024, with a significant portion of the American population now owning digital assets. According to a study by Security.org, 40% of American adults own cryptocurrency, up from 30% in 2023. This increase in ownership indicates a broader acceptance and understanding of cryptocurrencies as a legitimate form of investment and currency.

The demographic of crypto owners has also diversified, with more women participating in the market.

The rate of crypto ownership among women has surged to 29% at the start of 2024, up from 18% a year ago. This shift is attributed to the increased visibility and involvement of women in the blockchain industry, as well as successful female investors and influencers in the space.

Navigating the Regulatory Landscape

The regulatory landscape for cryptocurrencies is in a state of flux, with governments and financial authorities worldwide grappling with how to effectively regulate this new asset class.

The anticipated approval of a Bitcoin ETF by the Securities Exchange Commission (SEC) in early 2024 is a significant development that could further legitimize cryptocurrencies and attract more investors to the market.

Regulatory clarity is crucial for the continued growth and stability of the cryptocurrency sector. While some crypto enthusiasts advocate for minimal government intervention, a regulated environment could provide the necessary safeguards and protections for investors, potentially leading to wider adoption. The challenge for regulators is to strike a balance between fostering innovation and ensuring consumer protection and financial stability.

Also read: What is a Subnet Crypto? Unraveling the Avalanche Network’s Unique Feature

Looking Ahead: The Future of Crypto in 2024 and Beyond

The future of cryptocurrency in 2024 and beyond is shaping up to be a period of significant innovation and transformation. As the crypto industry continues to evolve, we are likely to witness new developments in technology, regulatory frameworks, and market dynamics.

This section explores the anticipated innovations and the role of Central Bank Digital Currencies (CBDCs) in shaping the future of digital finance.

Innovations and Predictions for the Crypto Space

In 2024, the crypto space is expected to see several key developments:

- Spot Bitcoin ETFs: The potential approval of spot Bitcoin ETFs could significantly boost market adoption and investor confidence.

- Bitcoin Halving: The upcoming Bitcoin halving in April 2024 is anticipated to impact the price and market dynamics of Bitcoin.

- Technological Advancements: Continued advancements in blockchain technology are expected to enhance the efficiency, security, and scalability of cryptocurrencies.

- Increased Institutional Involvement: More financial institutions and traditional finance players are likely to enter the crypto market, bringing in new investment and expertise.

- Growth of Decentralized Finance (DeFi): The DeFi sector is poised for further growth, offering innovative financial services and products.

- NFTs and Web3: Non-fungible tokens (NFTs) and Web3 technologies are set to drive further adoption and create new use cases.

The Role of Central Bank Digital Currencies (CBDCs)

- Enhancing Digital Payments: CBDCs aim to modernize the payment systems, offering faster, cheaper, and more secure transactions.

- Financial Inclusion: CBDCs have the potential to increase financial inclusion, especially in regions with limited access to traditional banking services.

- Central Bank Control: CBDCs allow central banks to maintain control over the monetary system and implement policies more effectively.

- Competition with Cryptocurrencies: CBDCs could compete with existing cryptocurrencies, offering a government-backed digital alternative.

- Privacy and Security Concerns: The implementation of CBDCs raises questions about user privacy and the security of digital currencies.

- Global Collaboration: The development of CBDCs may require international collaboration to ensure interoperability and standardization.

Conclusion: Is Crypto the Future?

As we look at the trajectory of cryptocurrencies, it’s clear that they have evolved from digital novelties to significant players in the global financial system. The rise of Bitcoin, Ethereum, and other digital currencies has challenged traditional financial models and introduced new possibilities for how we think about money. However, the future of crypto is not without its challenges and uncertainties.

Cryptocurrencies have been both praised for their potential to democratize finance and criticized for their association with illicit activities and market volatility. The regulatory landscape is still evolving, with governments around the world grappling with how to balance innovation with consumer protection. The introduction of central bank digital currencies (CBDCs) is a response to the crypto boom, offering a government-backed digital alternative that could compete with existing cryptocurrencies.

Despite these challenges, the popularity of cryptocurrencies continues to grow. They offer a level of decentralization and potential for innovation that traditional financial systems cannot match. As the technology behind cryptocurrencies matures and regulatory frameworks become more defined, the role of digital currencies in our financial system is likely to expand.

In conclusion, while it’s difficult to predict the future with certainty, the impact of cryptocurrencies on the financial world is undeniable. They have opened new avenues for investment, transaction, and financial inclusion, suggesting that crypto will continue to be an important part of the financial landscape in 2024 and beyond.

FAQ: Future of Cryptocurrency

Is there any future for cryptocurrency?

Cryptocurrency is expected to continue evolving, with growing adoption and technological advancements. Its potential to reshape finance suggests a significant future role.

Will crypto be big in 2025?

By 2025, crypto is anticipated to see increased mainstream adoption and integration into various sectors, potentially becoming a more significant part of the financial landscape.

Will crypto be big in 2030?

By 2030, crypto could become more entrenched in the global economy, with advancements in blockchain technology and wider acceptance as a legitimate financial asset.

Will crypto ever go back up?

Market trends indicate that crypto prices may fluctuate, but long-term growth is possible due to increasing adoption and technological improvements.

Where will crypto be in 5 years?

In the next five years, crypto is likely to see broader adoption, more sophisticated technology, and possibly more regulatory clarity, enhancing its role in finance.

Will Bitcoin crash to zero?

While market fluctuations are common, Bitcoin crashing to zero seems unlikely given its established position and growing institutional interest.

Will crypto end in future?

The end of crypto is not anticipated; instead, it is expected to evolve and integrate more deeply into financial systems and everyday transactions.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- Council on Foreign Relations: The Crypto Question: Bitcoin, Digital Dollars, and the Future of Money

- Security: 2024 Cryptocurrency Adoption and Sentiment Report

- Coindesk: Crypto 2024

- The Motley Fool: The Future of Cryptocurrency

- Investopedia: The Future Of Cryptocurrency in 2019 and Beyond

- Stanford Online: What Does the Future Hold for Cryptocurrency?