Stablecoins, a blend of cryptocurrency stability and fiat currency reliability, are transforming digital transactions. Bridging the gap between volatile cryptos like Bitcoin and stable fiat currencies, stablecoins offer a dependable alternative for everyday use.

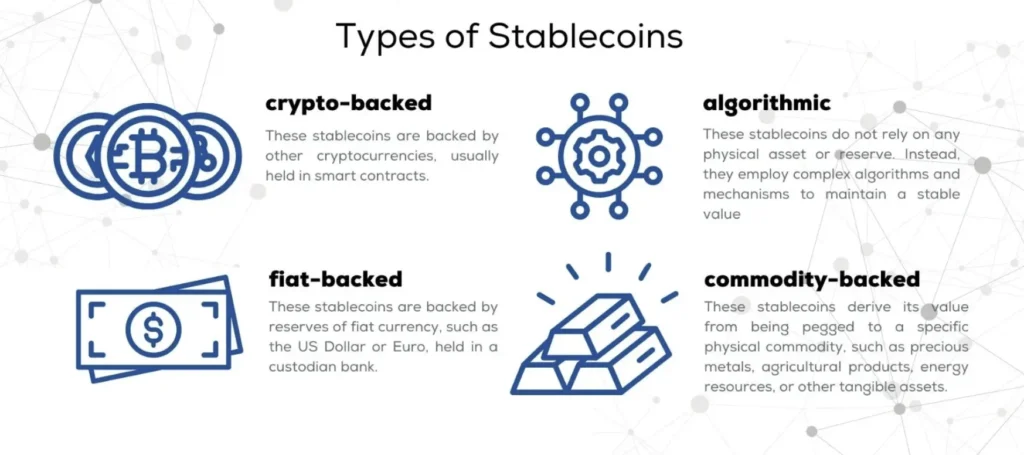

This article delves into the two types of stablecoins: fiat-collateralized and algorithmic, each ensuring price stability through unique mechanisms.

Understanding these stablecoins is crucial in today’s digital finance world, offering insights into their functioning, benefits, and growing influence in the crypto market.

Introduction to Stablecoins

What Are Stablecoins?

Stablecoins are a unique type of cryptocurrency, designed to offer the best of both worlds: the flexibility and innovation of crypto assets and the stability of traditional fiat currencies.

Unlike typical cryptocurrencies like Bitcoin, which can experience significant price fluctuations, stablecoins aim to maintain a consistent value. They achieve this stability by being pegged to more stable assets, such as the US dollar, gold, or even a basket of currencies.

This pegging is often backed by reserves of the asset they’re tied to, ensuring that the stablecoin’s value remains steady even when the crypto market is volatile.

Stablecoins in the Crypto Ecosystem

In the ever-evolving world of cryptocurrencies, stablecoins play a pivotal role. They act as a bridge between the traditional financial world and the digital currency space.

By offering price stability, stablecoins make it easier for people to use cryptocurrencies for everyday transactions, such as buying goods and services or transferring money.

This stability is crucial for both individual users and businesses that might be hesitant to accept cryptocurrencies due to their price volatility. Furthermore, stablecoins are integral in the crypto trading markets, providing a haven for traders during periods of high volatility in other cryptocurrencies.

Stablecoins have become essential in the cryptocurrency ecosystem, offering a reliable and stable digital currency option that addresses the volatility concerns of traditional cryptocurrencies.

Their role in facilitating transactions and enhancing the usability of digital currencies makes them a key player in the future of finance.

The Two Types of Stablecoins

Asset-Backed Stablecoins: A Reliable Anchor

Asset-backed stablecoins are the most common type of stablecoin, offering a reliable anchor in the volatile world of cryptocurrencies.

These stablecoins are pegged to tangible assets like fiat currencies (e.g., the US dollar), precious metals (like gold), or even a combination of different assets. The most popular example is Tether (USDT), which maintains a 1:1 peg with the US dollar and is backed by dollar reserves.

This type of stablecoin provides users with the confidence that their digital currency holds a stable value, making it suitable for everyday transactions and as a safe haven in the crypto market.

Algorithmic Stablecoins: Innovative Price Stability

Algorithmic stablecoins represent a more innovative approach to achieving price stability. Unlike asset-backed stablecoins, they don’t rely on tangible reserves but use a complex set of algorithms to maintain their value.

These algorithms adjust the supply of the stablecoin based on market demand, mimicking the role of a central bank but in a decentralized manner. This type of stablecoin is relatively new and can be more volatile, as seen with TerraUSD (UST), which experienced significant price fluctuations.

However, the innovative mechanism behind algorithmic stablecoins offers a glimpse into the future of decentralized finance and the potential for a more autonomous financial system.

Both types of stablecoins play crucial roles in the crypto ecosystem, offering stability and innovation. Asset-backed stablecoins provide a dependable value peg, while algorithmic stablecoins explore new frontiers in maintaining price stability through technology.

Understanding these two types of stablecoins is key to navigating the complex world of digital currencies.

Asset-Backed Stablecoins

Fiat-Collateralized Stablecoins: The Traditional Approach

Fiat-collateralized stablecoins are the most traditional form of stablecoins, offering a straightforward approach to maintaining value stability.

These stablecoins are backed by fiat currencies like the US dollar, Euro, or other national currencies, held in reserve by a custodian, typically a bank. The most well-known examples include Tether (USDT) and USD Coin (USDC), which are pegged to the US dollar on a 1:1 basis.

The backing by fiat currency ensures that these stablecoins maintain a stable value, making them a popular choice for users seeking a digital currency with minimal volatility.

The reserves are regularly audited to ensure transparency and trust in the stablecoin’s value.

Crypto-Collateralized Stablecoins: A New Age Solution

Crypto-collateralized stablecoins represent a newer approach in the world of stablecoins. These stablecoins are backed by other cryptocurrencies, which are held as collateral.

Due to the inherent volatility of cryptocurrencies, these stablecoins are often over-collateralized to ensure stability. For example, a crypto-collateralized stablecoin might hold cryptocurrency worth $150 for every $100 of stablecoin issued.

This over-collateralization acts as a buffer against market fluctuations. MakerDAO’s Dai (DAI) is a prominent example of a crypto-collateralized stablecoin, backed by Ethereum (ETH) and other cryptocurrencies. The use of blockchain technology and smart contracts in these stablecoins adds a layer of security and transparency, allowing for decentralized control and management of the collateral.

Asset-backed stablecoins, whether fiat-collateralized or crypto-collateralized, provide users with a stable digital currency option, backed by tangible assets. These stablecoins have become essential in the cryptocurrency ecosystem, offering stability and trust in a market known for its volatility.

Algorithmic Stablecoins

The Mechanics Behind Algorithmic Stablecoins

Algorithmic stablecoins are a unique breed of digital currencies that use smart contracts and algorithms to maintain their value stability. Unlike asset-backed stablecoins, they don’t rely on physical reserves but instead use a dynamic approach to control their supply based on market demand.

A common structure in algorithmic stablecoins is the “two-coin” system, where one coin absorbs market volatility, and the other aims to maintain the peg.

This system often involves a governance token, which plays a crucial role in the stabilization process. For example, in the Terra blockchain system, the interaction between TerraUSD (a stablecoin) and Luna (a governance token) is designed to keep TerraUSD’s value stable.

If the stablecoin’s price deviates from its peg, the algorithm adjusts the supply to bring it back to equilibrium, either by issuing more coins when the price is high or reducing the supply when the price is low.

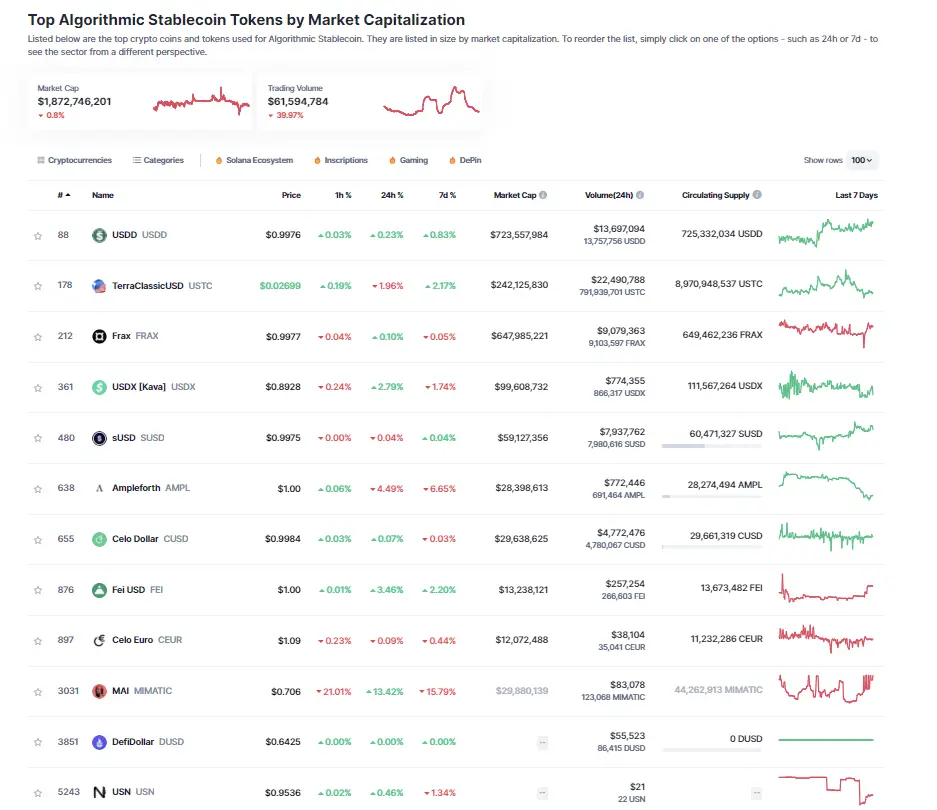

Real-World Examples of Algorithmic Stablecoins

TerraUSD is a notable example of an algorithmic stablecoin that uses the Luna token to maintain its peg to the US dollar. In this system, if TerraUSD’s price rises above $1, Luna holders can exchange $1 of Luna for TerraUSD, benefiting from the higher price, and vice versa.

This mechanism helps regulate supply and demand, stabilizing the price. However, the stability of algorithmic stablecoins can be challenged during market crises, as seen with TerraUSD, which experienced significant devaluation.

The reliance on market-driven actors for price stabilization and the absence of physical collateral make algorithmic stablecoins inherently riskier compared to their asset-backed counterparts.

Algorithmic stablecoins represent an innovative approach to achieving price stability in the cryptocurrency market. They offer a decentralized solution but come with increased risks due to their reliance on market mechanisms and the absence of physical collateral.

Understanding the mechanics and real-world examples of algorithmic stablecoins is crucial for anyone interested in the evolving landscape of digital currencies.

Similar Articles:

- What is an NFT Airdrop? Your Easy Guide to Free Digital Treasures

- Understanding “What is a Fiat Wallet?” in the Digital World

Advantages and Challenges of Stablecoins

Why Stablecoins Matter in the Crypto Market

Stablecoins have emerged as a vital component in the cryptocurrency market, offering a stable medium of exchange in contrast to the high volatility of traditional cryptocurrencies like Bitcoin and Ethereum. Their stability is achieved by pegging their value to more stable assets such as fiat currencies, commodities, or other cryptocurrencies.

This stability is crucial for facilitating everyday transactions, trading on crypto exchanges, and supporting decentralized finance (DeFi) applications. Stablecoins provide a bridge between the digital currency world and traditional financial systems, making them indispensable for the growth and adoption of cryptocurrencies.

They enable efficient and rapid circulation of transactions between currencies, playing a fundamental role in the healthy development of financial markets.

Navigating the Risks of Stablecoins

Despite their advantages, stablecoins also present several challenges and risks. The primary concern is the stability mechanism, which depends on the type of stablecoin. For asset-backed stablecoins, the risk lies in the management and custody of the backing assets.

For algorithmic stablecoins, the risk is associated with the effectiveness of the algorithm in maintaining stability, especially during market crises. Regulatory scrutiny is another significant challenge, as the rapid growth of the stablecoin market could impact the broader financial system. Additionally, the globalization and anonymity of stablecoins pose threats to financial systems and government control over various crimes, such as money laundering.

Navigating these risks requires careful consideration of the stablecoin’s design, the transparency of its operations, and the regulatory environment in which it operates.

Stablecoins play a crucial role in the crypto market by offering stability and efficiency, but they also present unique challenges that need to be addressed to ensure their safe and effective use. Understanding both the advantages and the risks associated with stablecoins is essential for users, developers, and regulators in the digital finance ecosystem.

The Future of Stablecoins

Innovations in Stablecoin Technology

The future of stablecoins is poised for significant technological advancements. Innovations are expected to focus on enhancing the stability mechanisms of stablecoins, whether they are asset-backed, commodity-backed, or crypto-backed.

Improvements in the algorithmic stablecoin system are particularly anticipated, as these types of stablecoins strive to maintain price stability through smart contracts and algorithms without relying on physical collateral.

The development of new types of stablecoins, such as those that are collateralized by a combination of assets or those that use more advanced algorithms, is also on the horizon.

These innovations aim to increase the efficiency, reliability, and scalability of stablecoins, making them more suitable for a wider range of applications in the digital economy.

Stablecoins’ Impact on Global Finance

Stablecoins are expected to have a profound impact on global finance. As they become more integrated into the financial system, stablecoins could transform how money is stored, transferred, and used across borders.

Their ability to offer stability, speed, and lower transaction costs makes them attractive for international trade, remittances, and as a means of payment in digital marketplaces.

The increasing adoption of stablecoins may also influence monetary policies and financial regulations worldwide, as governments and financial institutions seek to address the challenges and opportunities presented by these digital assets.

The potential for stablecoins to facilitate financial inclusion and democratize access to the global financial system is another significant aspect of their impact on global finance.

The future of stablecoins is marked by technological innovation and a growing influence on the global financial landscape. As they evolve, stablecoins are expected to become more stable, efficient, and widely used, potentially reshaping the way we think about and use money in the digital age.

Key Takeaways on Stablecoins

- Stablecoins are cryptocurrencies that aim to peg their market value to an external reference, such as a fiat currency or a commodity, to provide stability.

- Types of Stablecoins: There are fiat-collateralized, crypto-collateralized, and algorithmic stablecoins, each with its own mechanism to maintain value stability.

- Fiat-Collateralized Stablecoins: These stablecoins maintain reserves of fiat currency or other assets like gold as collateral, with popular examples including Tether (USDT) and TrueUSD (TUSD).

- Crypto-Collateralized Stablecoins: Backed by other cryptocurrencies, these stablecoins are often overcollateralized to insure against volatility in the reserve cryptocurrency, like MakerDAO’s Dai (DAI).

- Algorithmic Stablecoins: These stablecoins use algorithms to control their supply, aiming to maintain value stability without relying on physical reserves.

- Stablecoin Regulation: Stablecoins are under increasing regulatory scrutiny due to their potential impact on the financial system, with calls for tighter regulation and regular audits of stablecoin issuers.

- Stablecoins’ Role: They offer an alternative to the high volatility of popular cryptocurrencies, making them more suitable for common transactions and as a medium of exchange.

- Popular Stablecoins: Tether (USDT) is the most popular and largest stablecoin by market capitalization, pegged to the U.S. dollar and backed by gold reserves.

Stablecoins play a crucial role in the cryptocurrency ecosystem by offering stability and efficiency. Understanding their types, mechanisms, and regulatory environment is essential for anyone interested in digital finance.

Frequently Asked Questions:

What are types of stablecoin?

Stablecoins are primarily categorized into fiat-backed, commodity-backed, and crypto-backed stablecoins, each offering different mechanisms for maintaining stability.

What are two types of stablecoins fiat and digital?

The two main types are fiat-backed stablecoins, pegged to fiat currencies like the US dollar, and digital stablecoins, pegged to other cryptocurrencies or digital assets.

What are the different types of stable currency?

Different types include fiat-backed, commodity-backed (like gold), crypto-backed, and algorithmic stablecoins, each with unique backing assets and stability mechanisms.

What are the stablecoins classification?

Stablecoins are classified based on their backing: fiat-backed, commodity-backed, crypto-backed, and algorithmic stablecoins.

How many different stablecoins are there?

There are hundreds of different stablecoins in circulation, each with varying mechanisms and backing assets.

What is the main stablecoin?

Tether (USDT) is often considered the main stablecoin due to its widespread use and large market capitalization.

What is the full form of USDT?

USDT stands for “Tether,” a popular fiat-backed stablecoin pegged to the US dollar.

Which is the first stablecoin?

BitUSD, created in 2014, is often recognized as one of the first stablecoins in the cryptocurrency market.

Why is it called stablecoins?

They are called stablecoins because they aim to maintain a stable value, unlike other cryptocurrencies that experience high volatility.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- Investopedia: Stablecoins: Definition, How They Work, and Types

- ScienceDirect: On Stablecoin: Ecosystem, architecture, mechanism and applicability as payment method

- FederalReserve: The stable in stablecoins

- Cointelegraph: A beginner’s guide on algorithmic stablecoins

- Harvard Business Review: Stablecoins and the Future of Money

- BIS: BIS Working Papers