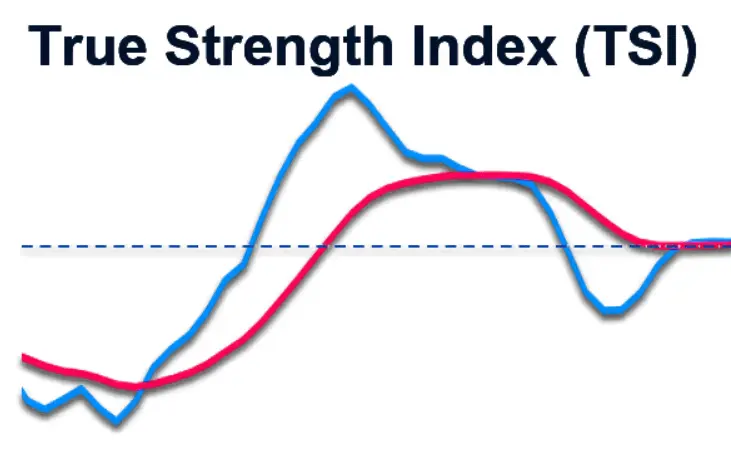

The True Strength Index (TSI) is a momentum oscillator that helps traders assess the strength and direction of a price trend. Developed by William Blau and introduced in 1991, the TSI provides insights into both trend momentum and potential overbought or oversold conditions.

Introduction to TSI

The TSI measures the momentum of price changes by applying double smoothing to price fluctuations. This process reduces market noise, offering a clearer view of the underlying trend. By oscillating around a zero line, the TSI indicates bullish momentum when above zero and bearish momentum when below.

Purpose and Key Functions of the TSI Indicator

Traders use the TSI to:

- Identify Trend Direction: A rising TSI suggests an uptrend, while a falling TSI indicates a downtrend.

- Detect Overbought or Oversold Conditions: Extreme positive values may signal overbought conditions, and extreme negative values may indicate oversold conditions, pointing to potential trend reversals.

- Spot Momentum Shifts: Crossovers of the TSI line with its signal line can highlight changes in market momentum, aiding in timing entry and exit points.

History and Development by William Blau

William Blau introduced the True Strength Index in the early 1990s, aiming to create a momentum indicator that combined the benefits of momentum analysis with the smoothing properties of moving averages.

By double-smoothing price changes, Blau’s TSI reduced the lag associated with traditional moving averages, providing a more responsive tool for technical analysis.

The TSI has since become a valuable component of technical analysis, assisting traders in evaluating trend strength and making informed trading decisions.

Mathematical Formula Behind the TSI Indicator

The TSI is calculated using the following formula:

TSI = 100 × (Double Smoothed PC / Double Smoothed |PC|)

Where:

- PC = Current Price – Previous Price (Price Change)

- |PC| = Absolute value of Price Change

- Double Smoothed PC = EMA(EMA(PC, Short Period), Long Period)

- Double Smoothed |PC| = EMA(EMA(|PC|, Short Period), Long Period)

This calculation involves applying two exponential moving averages (EMAs) to both the price change and its absolute value. The result is then multiplied by 100 to express the TSI as a percentage.

The Role of Double Smoothing in TSI Calculations

Double smoothing involves applying two successive EMAs to the price change data. This technique reduces the impact of short-term volatility, allowing traders to focus on the underlying trend.

By smoothing the data twice, the TSI minimizes false signals and provides a more accurate representation of trend strength.

Related: Vara Price Prediction 2025: VARA Crypto Market Cap Insights

Key Components – Signal Line and Centerline

- TSI Line: The main line that oscillates above and below the zero line, indicating bullish or bearish momentum.

- Signal Line: An EMA of the TSI line, typically set to a short period (e.g., 7 periods), used to identify potential buy or sell signals when crossovers occur.

- Centerline (Zero Line): A reference line at zero; readings above suggest bullish momentum, while readings below indicate bearish momentum.

Calculation Steps Explained with Examples

- Calculate Price Change (PC): PC = Current Closing Price – Previous Closing Price Example: If today’s closing price is $105 and yesterday’s was $100: PC = $105 – $100 = $5

- Calculate Absolute Price Change (|PC|): |PC| = Absolute value of PC Example: |PC| = |$5| = $5

- Apply First EMA (Short Period) to PC and |PC|: Use a short period EMA (e.g., 25 periods) to smooth PC and |PC|. Example: EMA₁(PC) and EMA₁(|PC|) are calculated over 25 periods.

- Apply Second EMA (Long Period) to the Results: Apply a longer period EMA (e.g., 13 periods) to the previously smoothed values. Example: EMA₂(EMA₁(PC)) and EMA₂(EMA₁(|PC|)) are calculated over 13 periods.

- Compute the TSI: TSI = 100 × [EMA₂(EMA₁(PC)) / EMA₂(EMA₁(|PC|))] Example: If EMA₂(EMA₁(PC)) = 2 and EMA₂(EMA₁(|PC|)) = 4: TSI = 100 × (2 / 4) = 100 × 0.5 = 50%

- Plot the TSI and Signal Line: Plot the TSI values on a chart, and add the signal line by applying an EMA (e.g., 7 periods) to the TSI. Example: If the TSI value is 50% and the 7-period EMA of TSI is 45%, these lines are plotted accordingly.

By following these steps, traders can calculate the TSI to assess trend strength and identify potential entry and exit points in the market.

Interpreting the TSI Indicator for Trading

The True Strength Index (TSI) is a momentum-based technical indicator that helps traders assess the strength and direction of a trend by analyzing price movements.

Identifying Overbought and Oversold Conditions

The TSI oscillates around a zero line, with higher positive values indicating overbought conditions and lower negative values indicating oversold conditions. Traders watch for these extremes to anticipate potential reversals in price action.

However, it’s important to note that overbought or oversold readings do not always guarantee a reversal; strong trends can maintain extreme TSI values for extended periods.

Spotting Trend Direction and Momentum Shifts

A rising TSI suggests increasing bullish momentum, while a falling TSI indicates growing bearish momentum. By observing the TSI’s direction, traders can gauge the underlying strength of a trend and identify potential shifts in momentum.

For instance, if the TSI changes from descending to ascending, it may signal the beginning of an uptrend.

Using Zero Line Crossovers for Trade Signals

The zero line, or centerline, serves as a reference point in TSI analysis. When the TSI crosses above the zero line, it suggests a shift to bullish momentum, potentially signaling a buying opportunity.

Conversely, a cross below the zero line indicates bearish momentum, which may suggest a selling opportunity. These centerline crossovers help traders identify changes in trend direction.

Recognizing Divergences for Trend Reversals

Divergences between the TSI and price movements can indicate potential trend reversals. A bullish divergence occurs when the price forms lower lows while the TSI forms higher lows, suggesting weakening bearish momentum and a possible upward reversal.

A bearish divergence happens when the price makes higher highs, but the TSI forms lower highs, indicating diminishing bullish momentum and a potential downward reversal.

By understanding and applying these aspects of the TSI, traders can make more informed decisions regarding entry and exit points, as well as anticipate potential trend changes in the market.

Practical Applications of the TSI Indicator

The True Strength Index (TSI) is a momentum-based indicator widely used in technical analysis of stocks to measure the strength of a trend and identify potential trend changes.

Traders apply it in both day trading and swing trading to spot overbought and oversold levels, track price movements, and confirm signals using centerline crossovers or signal line crossovers.

It works well in conjunction with other technical indicators like Moving Averages and MACD to reduce false signals and improve accuracy. The TSI also helps traders recognize divergences between price action and the indicator, signaling trend reversals or weakening trends.

Related: ORN Coin Price Prediction: ORN Outlook for 2025 and 2030 Market Cap

Using TSI for Day Trading vs. Swing Trading

- Day Trading: In day trading, traders seek to capitalize on short-term price movements within a single trading session. The TSI can assist by identifying intraday overbought and oversold levels, signaling potential entry and exit points. However, due to the rapid nature of day trading, the TSI may produce false signals in highly volatile markets. Therefore, it’s advisable to use the TSI in conjunction with other technical analysis tools to confirm signals.

- Swing Trading: Swing traders aim to profit from price swings over several days or weeks. The TSI is particularly useful in this context, as it helps identify the underlying strength of a trend and potential reversals. By analyzing the TSI’s movements, swing traders can make informed decisions about entering or exiting positions based on the momentum of price changes.

Combining TSI with Moving Averages and Other Indicators

To enhance the effectiveness of the TSI, traders often combine it with other indicators:

- Moving Averages (MA): Using moving averages alongside the TSI can provide additional confirmation of trend direction. For instance, if the TSI indicates bullish momentum and the price is above the moving average, it reinforces the likelihood of an uptrend. Conversely, if the TSI shows bearish momentum and the price is below the moving average, it suggests a downtrend.

- Moving Average Convergence Divergence (MACD): Both the TSI and MACD are momentum oscillators, but they calculate momentum differently. Using them together can provide a more comprehensive view of market conditions. For example, if both indicators signal a bullish crossover, it strengthens the case for a potential upward price movement.

- Support and Resistance Levels: Incorporating support and resistance analysis with the TSI can help traders identify potential reversal points. If the TSI indicates overbought conditions near a known resistance level, it may suggest a forthcoming price decline. Similarly, oversold conditions near support could indicate a potential price increase.

Creating Trading Strategies with TSI Signals

Traders can develop various strategies using TSI signals:

- Centerline Crossovers: When the TSI crosses above the zero line, it indicates bullish momentum, suggesting a potential buying opportunity. A cross below the zero line signals bearish momentum, indicating a possible selling opportunity.

- Signal Line Crossovers: The TSI often includes a signal line, which is an exponential moving average of the TSI itself. A crossover of the TSI line above the signal line can be interpreted as a buy signal, while a crossover below may serve as a sell signal.

- Divergences: Identifying divergences between the TSI and price can signal potential trend reversals. For instance, if the price reaches new highs but the TSI forms lower highs, it may indicate weakening bullish momentum and a possible downturn.

Examples and Case Studies of Real-World Usage

Consider a scenario where a trader observes the following:

- The TSI crosses above the zero line, indicating a shift to bullish momentum.

- Simultaneously, the price moves above a key moving average, reinforcing the bullish signal.

- The trader enters a long position, setting a stop-loss below the recent support level to manage risk.

- As the price continues to rise, the TSI approaches overbought levels.

- The trader monitors for a TSI crossover below the signal line as an exit indicator.

By integrating the TSI with other technical analysis tools and adhering to a disciplined trading strategy, traders can enhance their decision-making process and potentially improve trading outcomes.

Advantages and Limitations of the TSI Indicator

The True Strength Index (TSI) offers traders insights into trend momentum by smoothing price fluctuations. It reduces noise and highlights trend changes, but traders must also recognize its limitations to avoid misleading signals.

Benefits of Smoothing Price Momentum Analysis

TSI calculates double-smoothed price changes to filter out short-term noise and provide a clearer picture of price trends. This smoothing process helps traders identify momentum shifts and reduces the impact of false signals caused by sudden price movements.

It works well for detecting trend strength and potential reversals by analyzing price data over time.

Key Limitations to Watch Out For

The TSI may produce misleading signals in strong trending markets where prices continue to rise or fall, even when the indicator suggests a trend is weakening.

It can also be less effective during sideways markets with low volatility, leading to false crossovers and unclear signals. Traders may need confirmation from other indicators to improve accuracy.

Comparing TSI with RSI and MACD

TSI vs RSI: The RSI tracks overbought and oversold levels, focusing on momentum strength without smoothing, which makes it more reactive to short-term price fluctuations. TSI, on the other hand, applies double-smoothing to highlight underlying trends and reduce noise.

TSI vs MACD: The MACD focuses on the relationship between two moving averages to identify trend direction, but it may lag behind actual price changes due to its reliance on moving averages. TSI calculates momentum-based signals faster by using double-smoothed absolute price changes, making it more responsive to trend reversals.

Frequently Asked Questions (FAQ)

How is the TSI Indicator Calculated?

The True Strength Index (TSI) calculates momentum by double-smoothing price changes. It divides the double-smoothed price change by the double-smoothed absolute price change, then multiplies by 100.

What is the Best Setting for the TSI Formula?

Common TSI settings use a 25-period EMA for initial smoothing and a 13-period EMA for further smoothing. These settings balance sensitivity and noise reduction.

Can TSI Be Used for Intraday Trading?

Yes, traders use TSI for intraday trading to spot short-term momentum shifts. Combining it with other indicators can improve signal accuracy.

How Accurate is the TSI in Predicting Trends?

TSI helps identify trend strength and potential reversals. However, like all indicators, it’s not foolproof and should be used with other analysis tools to confirm signals.

Conclusion

The True Strength Index (TSI) is a momentum-based indicator that measures trend strength and highlights potential reversals using double-smoothed price changes. TSI uses centerline crossovers and signal line crossovers to generate entry and exit signals for trades.

It helps traders identify overbought and oversold levels, reducing false signals caused by short-term price fluctuations. TSI works well for day trading and swing trading but performs better when combined with moving averages and other technical indicators.

Traders should watch for divergences between price action and the TSI line to confirm trend reversals and momentum shifts. While TSI calculates trends accurately, it may need additional tools for validation in strong trending or sideways markets.