What is stETH and how to use Steth? Staked ETH (stETH) is more than just a token; it’s a gateway to maximizing your crypto earnings. When you stake your Ether with Lido, it transforms into stETH, a liquid token that mirrors the amount of ETH you’ve staked. This transformation unlocks numerous opportunities in the DeFi ecosystem.

Unlike traditional staking, stETH remains fluid, allowing users to engage in various DeFi platforms like Curve and Aave to earn additional yield.

Whether it’s through liquidity pools, yield farming or lending, stETH empowers you to make your crypto work harder. With stETH, you’re not just holding crypto; you’re actively increasing its potential, making every stETH in your wallet a testament to smarter investing.

Introduction to stETH: Unraveling the Basics

Staked Ether, commonly known as stETH, is more than just a digital currency; it’s a pivotal element in the evolving landscape of decentralized finance (DeFi).

As a unique blend of technology and finance, stETH represents a significant leap in how we interact with blockchain assets, offering both flexibility and utility. Let’s dive into the core of stETH and its role in the DeFi ecosystem.

What is stETH?

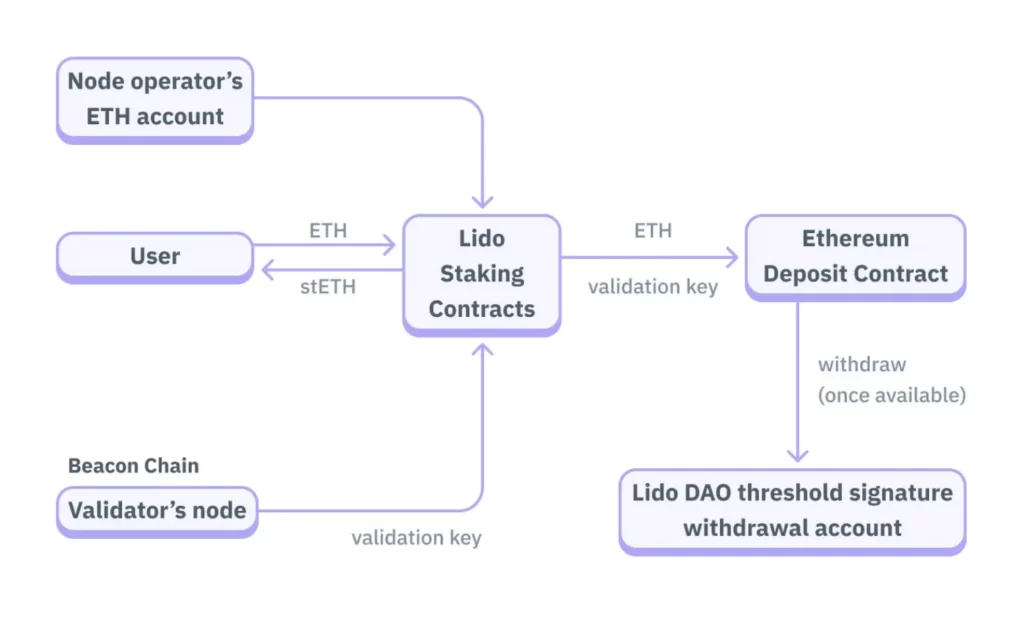

stETH stands for Staked Ether and is a token that mirrors the amount of Ether (ETH) staked on Lido, a leading DeFi platform. Introduced in 2020, stETH is a response to Ethereum’s transition to a proof-of-stake consensus mechanism.

It functions as a liquidity token, allowing users to deposit ETH into a smart contract on the Lido blockchain and receive an equivalent amount of stETH. This token can be traded, exchanged, borrowed against, or used for other liquidity purposes, making it a versatile tool in the DeFi space.

stETH in the DeFi Ecosystem

In the DeFi ecosystem, stETH plays a crucial role as a liquid token. It provides Ether holders with the ability to participate in network validation through staking while maintaining the liquidity of their assets.

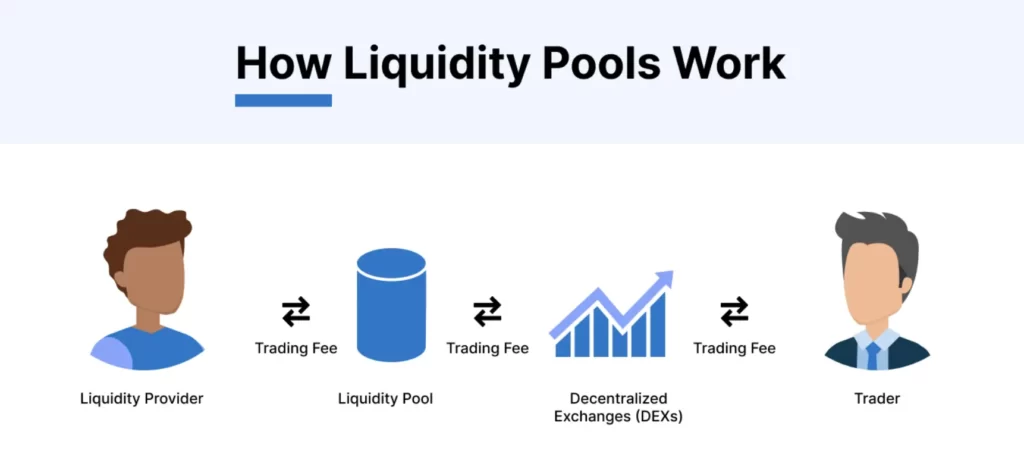

This liquidity is essential, as it allows stETH holders to engage in various DeFi activities like liquidity pools, lending, and yield farming. For instance, stETH can be pooled with ETH in liquidity pools, enabling users to swap stETH for ETH, effectively providing a way to “unstake” their assets.

Additionally, platforms like Aave and Harvest allow stETH to be used for lending and yield farming, respectively, offering more avenues for earning returns on staked assets.

Maximizing Returns with Lido Staked ETH

Lido has revolutionized the Ethereum staking landscape, offering a streamlined and efficient way for ETH holders to earn rewards.

This platform simplifies the staking process, eliminating the complexities and technical barriers often associated with it. With Ethereum’s shift to proof-of-stake, Lido’s role has become increasingly significant, presenting new opportunities for ETH holders to enhance their returns.

Lido Finance and Its Role with stETH

Lido Finance has emerged as a key player in the Ethereum staking arena. By staking ETH with Lido, users receive stETH, a token that represents their staked Ether.

This process provides a liquid form of staked ETH, allowing users to maintain flexibility and access to their funds. Lido’s stETH is designed to mirror the value of the staked ETH, providing a seamless experience for users who want to participate in Ethereum’s proof-of-stake mechanism without locking up their assets.

Strategies for Earning Rewards

Lido’s stETH opens up various strategies for earning rewards in the DeFi ecosystem. Users can engage in yield farming, liquidity provision, and lending, utilizing their stETH in different DeFi platforms.

For instance, stETH can be used in liquidity pools on decentralized exchanges (DEXs) like Uniswap and Curve, allowing users to earn trading fees.

Additionally, platforms like Aave offer opportunities for lending stETH, enabling users to earn interest. These strategies not only provide additional income streams but also enhance the liquidity and utility of stETH in the broader DeFi market.

How to use stEth in Liquidity Pools on Decentralized Exchanges

Depositing stETH in liquidity pools on decentralized exchanges (DEXs) like Uniswap, SushiSwap, and Balancer is a popular way to earn fees.

By providing liquidity, you’re essentially allowing others to trade stETH with different assets, earning a portion of the trading fees in return. This process not only generates income but also contributes to the overall liquidity and health of the stETH market.

Each DEX offers unique features, such as Balancer’s customizable pools and SushiSwap’s SUSHI token rewards, making them attractive options for stETH holders.

Yield Farming and Mining Platforms

Yield farming and liquidity mining are other lucrative strategies for stETH holders. Platforms like Curve Finance and Yearn Finance are at the forefront of this trend.

Curve Finance, known for its low-slippage swaps between stETH and ETH, offers several staking pools where you can earn CRV rewards. Yearn Finance, on the other hand, is a yield aggregator that maximizes stETH earning opportunities through auto-compounding and dynamic allocation.

These platforms not only provide higher yield potential but also simplify the process, making it accessible to a broader range of investors.

Lending stETH for Interest

Lending platforms such as Aave and Compound offer another avenue for stETH holders to earn interest. By depositing stETH on these platforms, you can lend it out to other users and earn interest in return.

The interest rate is determined by the supply-demand dynamics of stETH on these platforms. This strategy is particularly appealing as it provides a passive income stream while contributing to the DeFi ecosystem’s liquidity.

Advanced stETH Strategies

For those looking to take their stETH investments to the next level, advanced strategies offer opportunities to significantly boost returns.

These methods leverage the unique capabilities of platforms like Convex Finance, Concentrator, and StakeWise, each providing a different approach to maximize the potential of stETH.

These strategies are ideal for users who are comfortable with a higher level of complexity and risk in pursuit of greater rewards.

Boosting Returns with Convex Finance

Convex Finance provides a method to enhance yield farming rewards for stETH holders. By leveraging stETH’s staking rewards, Convex Finance allows users to create leveraged positions, amplifying their potential returns.

This strategy involves using platforms like AAVE and Balancer for borrowing and staking, effectively multiplying the staking yield. It’s a sophisticated approach that combines the benefits of staking with the power of leverage, offering higher returns compared to traditional staking methods.

Automating Rewards with Concentrator

Concentrator streamlines the reward collection process for stETH holders. It automates the claiming and compounding of rewards, simplifying the management of yield farming and liquidity mining strategies.

By depositing stETH into Concentrator, users can benefit from automated reward optimization, which includes auto-claiming and selling reward tokens for additional stETH.

This automation not only saves time but also ensures that users are consistently maximizing their yield potential.

Exploring Liquid Staking with StakeWise

StakeWise presents an alternative liquid staking solution for those seeking higher yields on their stETH. It allows users to stake ETH and receive staking derivatives, which can then be used across various DeFi platforms for additional earning opportunities.

StakeWise differentiates itself by offering a higher staking APR compared to other platforms, making it an attractive option for users looking to maximize their staking rewards.

Smart Investment Practices

Investing in stETH requires a blend of strategic thinking and risk management. Understanding the intricacies of stETH investments, including the associated risks and effective management techniques, is crucial for anyone looking to navigate this space successfully.

This section delves into the key aspects of smart investment practices, focusing on risk awareness and efficient management of stETH.

Risk Awareness in stETH Investments

Investing in stETH, like any crypto asset, comes with its set of risks, particularly concerning smart contracts and liquidity pools. Smart contracts, while automated and efficient, can be vulnerable to bugs or exploits, potentially leading to loss of funds.

Liquidity pools, on the other hand, may expose investors to impermanent loss, especially in volatile market conditions. Additionally, the value of stETH can decouple from ETH, as seen in the past, which can impact the overall investment strategy.

Understanding these risks and staying informed about the latest developments in the DeFi space is crucial for any stETH investor.

Effective stETH Management

Smart Investment Practices

Investing in stETH requires a blend of strategic thinking and risk management. Understanding the intricacies of stETH investments, including the associated risks and effective management techniques, is crucial for anyone looking to navigate this space successfully.

This section delves into the key aspects of smart investment practices, focusing on risk awareness and efficient management of stETH.

Risk Awareness in stETH Investments

Investing in stETH, like any crypto asset, comes with its set of risks, particularly concerning smart contracts and liquidity pools. Smart contracts, while automated and efficient, can be vulnerable to bugs or exploits, potentially leading to loss of funds.

Liquidity pools, on the other hand, may expose investors to impermanent loss, especially in volatile market conditions. Additionally, the value of stETH can decouple from ETH, as seen in the past, which can impact the overall investment strategy.

Understanding these risks and staying informed about the latest developments in the DeFi space is crucial for any stETH investor.

Effective stETH Management

Efficient management of stETH involves diversifying investment strategies and keeping a close eye on the stETH balance.

Diversification can be achieved by participating in various DeFi platforms, such as Curve for liquidity provision or Lido for staking. It’s also important to regularly review and rebalance your stETH holdings, considering factors like the current DeFi landscape, stETH’s performance, and your overall investment goals.

Efficient management ensures that you are not overly exposed to any single platform or strategy, thereby mitigating risk and optimizing returns.

Conclusion

As we conclude our exploration of stETH and its various applications in the DeFi ecosystem, it’s clear that stETH represents a significant innovation in the world of cryptocurrency.

By enabling Ethereum holders to stake their ETH with Lido and receive stETH in return, investors gain access to a liquid form of their staked assets.

This liquidity allows for a range of investment strategies, from participating in liquidity pools on DEXs like Uniswap and Balancer to engaging in yield farming and lending on platforms like Curve Finance and Aave.

The versatility of stETH is evident in its ability to be used as collateral, traded, or even converted back to ETH, providing investors with numerous options to optimize their crypto holdings.

However, it’s crucial to approach these opportunities with an understanding of the associated risks, such as smart contract vulnerabilities and market volatility.

Frequently Asked Questions

How does stETH work?

stETH represents Ethereum (ETH) staked through Lido Finance. When you stake ETH, you receive stETH in return, which is a liquid token. This means you can trade, lend, or use stETH while still earning staking rewards. It combines the value of your initial deposit plus any staking rewards.

How to earn money with stETH?

How does stETH work?

stETH represents Ethereum (ETH) staked through Lido Finance. When you stake ETH, you receive stETH in return, which is a liquid token. This means you can trade, lend, or use stETH while still earning staking rewards. It combines the value of your initial deposit plus any staking rewards.

How does Lido work?

Lido allows users to stake their ETH without locking it up, enabling them to participate in Ethereum’s proof-of-stake consensus mechanism. When you stake ETH with Lido, you receive stETH, which can be used across various DeFi platforms. Lido combines the benefits of staking with liquidity.

Is buying stETH the same as staking?

Buying stETH is not the same as directly staking ETH. When you buy stETH, you’re purchasing a token that represents staked ETH. However, staking involves actively depositing your ETH into a staking contract, like Lido, to earn rewards.

How safe is stETH?

While stETH aims to be safe, it’s important to understand the risks involved, such as smart contract vulnerabilities and market volatility. The safety of stETH also depends on the security and performance of the Lido platform and Ethereum’s staking mechanism.

Can I convert stETH to ETH?

Yes, you can convert stETH to ETH. Lido provides a mechanism for stETH holders to swap their stETH for ETH. This process involves unwrapping stETH to ETH, which can be done through the Lido platform.

How often is stETH paid?

stETH rewards are typically updated daily. The rewards represent the staking yields earned on the Ethereum network. These rewards are reflected in the rebasing of stETH token balances.

What is the cost of stETH?

The cost of stETH varies and is influenced by the market. It’s generally close to the value of ETH. However, factors like demand and supply, liquidity in the market, and overall DeFi ecosystem health can affect its price.

Where can I buy steth token?

You can buy steth tokens from cryptocurrency exchanges or directly from the lido DAO. You may find some steth liquidity pools on DEXs which also allow for eth to steth conversion.

What are some use cases for steth?

STETH is a token that represents your staked Ether in Lido. So, you can use steth as collateral in DeFi protocols, earning rewards both from the DeFi protocol and Lido staking rewards. Some other use cases for steth include liquidity provision and yield farming.

How does the liquid staking solution work with steth?

When you stake your ETH on Lido, you receive a corresponding amount of steth. This steth is a liquid token which represents staked ether on Lido. So, your steth balance rebases when rewards are given out, promising greater liquidity compared to traditional staking.

Can I trade steth for ether?

Yes, you can readily trade your steth for eth. In fact, a common method to swap the steth for eth is by providing liquidity to steth liquidity pools on several decentralized exchanges.

What advantages does steth liquidity provide?

Steth liquidity provides advantages such as increased utility and capital efficiency. Since steth is a liquid representation of staked ETH, users can use it within DeFi protocols, trade it, sell it or convert it back to eth. Steth liquidity lends flexibility to the previously illiquid staking system.

How does Lido facilitate staking with Steth?

After you stake your ETH with Lido, you receive an equivalent amount of steth, a token that represents the staked ETH on Lido. This offers you liquidity and enables you to utilize your staked eth within various DeFi protocols.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- Investopedia: Staked Ether (stETH): What It is, How It Works

- BeInCrypto: 11 Best DeFi Platforms To Earn With Lido’s Staked ETH (stETH)

- Foresightnews: stETH-Leveraged Staking Strategy