Encountering “insufficient liquidity for this trade” is a common issue on decentralized exchanges like Uniswap and PancakeSwap. This error pops up when you try to make a trade that’s too big for the liquidity pool.

To fix it, you can reduce your trade size, increase your slippage tolerance, or find a different liquidity pool. These simple steps can help you navigate through the complexities of trading on decentralized platforms, ensuring smoother transactions.

Decoding ‘Insufficient Liquidity for This Trade’

A Common Hurdle in Decentralized Exchanges

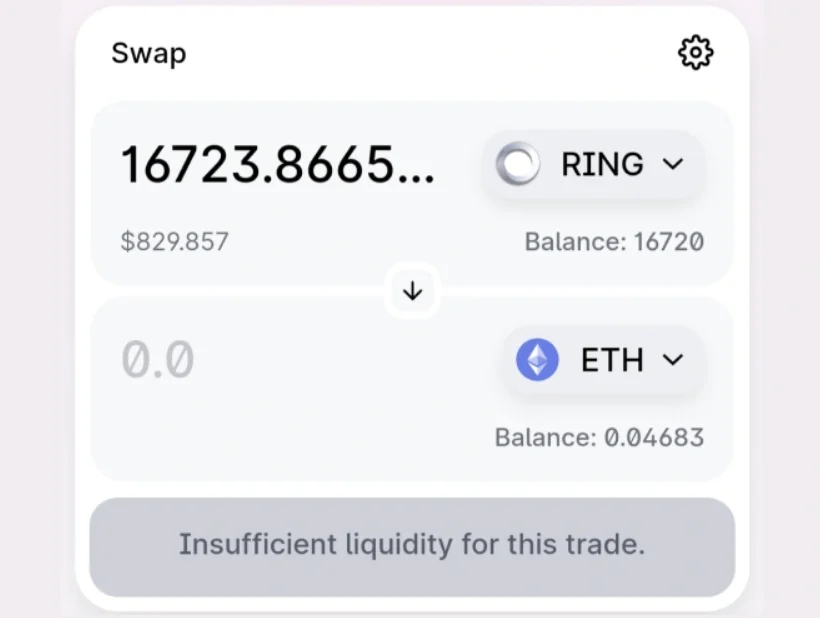

“Insufficient liquidity for this trade” is a phrase you might bump into on decentralized exchanges like Uniswap and PancakeSwap.

This happens when you’re trying to buy or sell, but the exchange can’t handle your request. It’s like wanting to buy a big bunch of apples, but the store only has a few left. The store, or in this case, the liquidity pool, just doesn’t have enough of what you need.

Why Does This Happen?

So, why do you see this message? It’s all about liquidity. In simple words, liquidity means how easily you can turn something into cash without losing value. In crypto, it refers to how much of a token is available to trade.

If a token isn’t popular or new, it might not have enough people buying and selling it, making it hard to complete big trades.

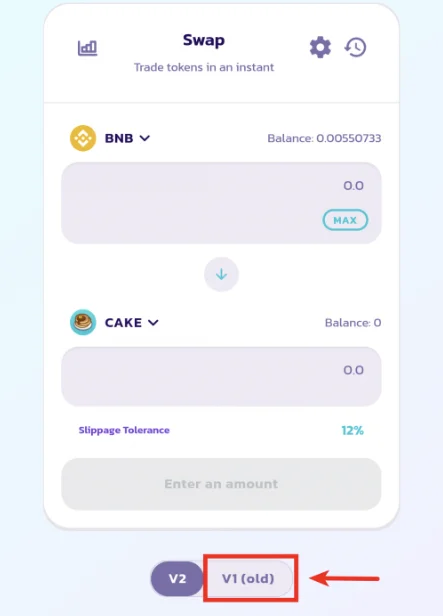

Also, if you’re using a newer version of an exchange like PancakeSwap V2 or Uniswap V3, and the token you want is only on the older version, you’ll face this issue. It’s like trying to play a new video game on an old console – it just won’t work.

How to Fix Insufficient Liquidity for Your Trade

Tweaking Your Trade

Did you get the “insufficient liquidity for this trade” error? Here’s what you can do.

First, try adjusting your trade size. If you’re aiming big, the pool might not have enough to cover it. Think smaller, and you might just get your trade through.

Next, check the market for your token pair. Not enough liquidity for the one you’re eyeing? Switch it up and try a different pair that’s got more action.

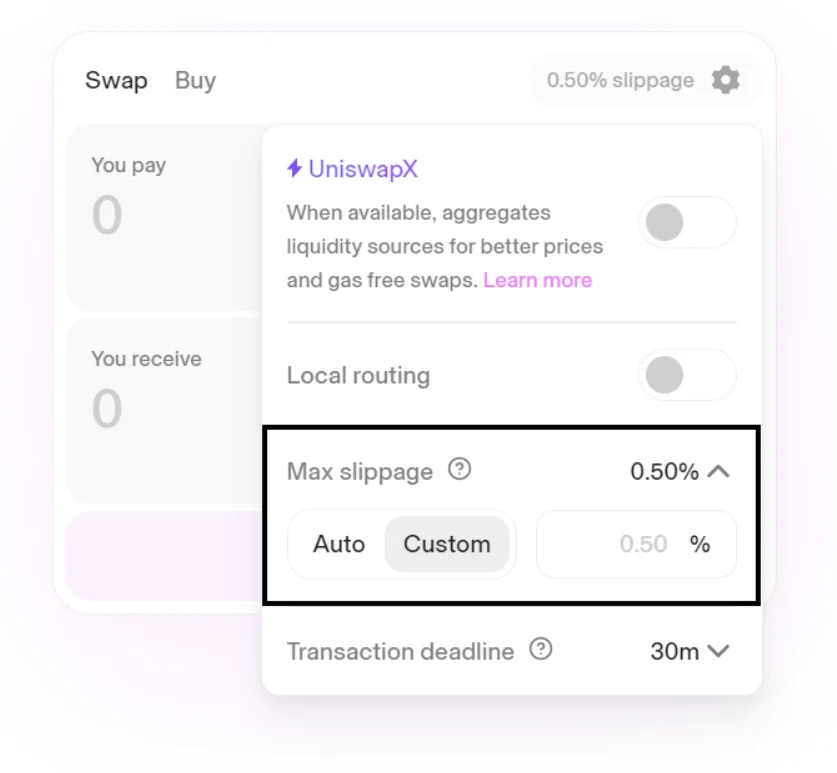

Slippage Tolerance to the Rescue

Slippage tolerance is your next go-to. Uniswap’s automated market maker system means prices can change fast. By increasing your slippage tolerance, you’re giving your trade more room to breathe and a better chance to succeed, even with price fluctuations.

Remember, higher slippage tolerance might mean a less favorable price, but it could be the key to completing your trade.

The Interplay of Slippage and Liquidity

Slippage in the World of Automated Market Makers

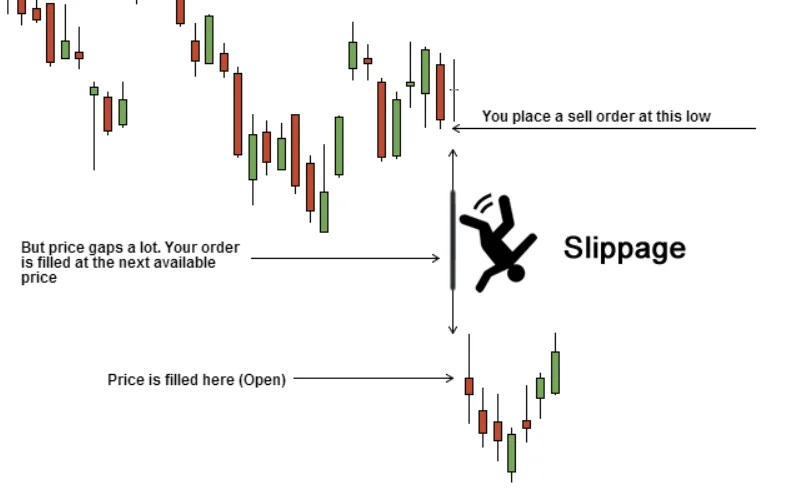

In decentralized exchanges like Uniswap and PancakeSwap, slippage is a common challenge. It’s the difference between the price you expect for a trade and what you get. This happens because of the time lag between when you confirm a trade and when it’s processed on the blockchain.

High trading volume can increase slippage, especially during busy market times. For example, you might expect to get 122 UNI tokens for 1 ETH, but end up with 121 or even 118 if the market is hot.

Striking a Balance Between Slippage and Liquidity

Liquidity pools in decentralized exchanges are key to understanding slippage. These pools contain a mix of two crypto assets, like ETH and UNI. When you trade, you’re adding one token to the pool and taking another out.

The bigger your trade or the pool’s trading volume, the more you can unbalance the pool, leading to price slippage. Low liquidity in a pool means higher slippage.

So, managing slippage is about finding the right balance in liquidity pools and adjusting your trade size or timing to minimize price differences.

Exploring Alternatives When Trading Gets Tough

Considering Different Token Pairs

When you’re stuck with “insufficient liquidity for this trade” on a decentralized exchange (DEX), one smart move is to consider different token pairs.

If your usual pair isn’t working out due to liquidity issues, switching to another pair might be the solution.

This is because some pairs have more active trading and better liquidity, making your trades more likely to go through. It’s like switching lanes in traffic; sometimes, another lane just moves faster.

Switching Exchanges for Better Liquidity

If changing token pairs doesn’t solve the problem, consider switching to a different exchange. Different DEXs have varying levels of liquidity for certain tokens.

For instance, if you’re facing issues on Uniswap, trying out PancakeSwap or SushiSwap might yield better results.

Each exchange has its unique set of liquidity pools and trading volumes, so hopping over to another platform could be the key to successful trading when your usual DEX is giving you a hard time.

Key Takeaways for Navigating Decentralized Exchanges

- Insufficient Liquidity: This common error means there’s not enough of a token available to complete your trade. It often occurs in newer or less popular token pairs.

- Fixing Insufficient Liquidity: Reduce your trade size, check for more liquid token pairs, increase slippage tolerance, or switch to a different exchange.

- Understanding Slippage: Slippage is the difference between the expected and actual price of a trade. It’s influenced by trading volume and liquidity.

- Automated Market Makers (AMMs): These are crucial in DEXs for setting prices and providing liquidity, but they can also cause slippage.

- Liquidity Pools: Essential for DEXs, they enable trading by pooling two crypto assets. Large trades or high trading volume can unbalance these pools, leading to price slippage.

- Decentralized vs. Centralized Exchanges: DEXs offer peer-to-peer trading without intermediaries, using smart contracts. They provide more control over your assets but require a good understanding of blockchain and trading risks.

- DEX Aggregators: These tools help find the best prices across multiple DEXs, minimizing slippage and optimizing trades.

Remember, trading on decentralized exchanges requires a solid understanding of blockchain technology, smart contracts, and the risks involved. Always do your research and consider your options carefully.

Frequently Asked Questions

What does not enough liquidity mean?

Not enough liquidity means there aren’t enough tokens in a liquidity pool to support your trade. It’s like trying to buy more apples than what’s available in the store.

Why does Uniswap say insufficient liquidity?

Uniswap says “insufficient liquidity” when the liquidity pool doesn’t have enough tokens for your trade. It’s common with new tokens or less popular trading pairs.

How do I fix price impact too high on Uniswap?

To fix high price impact on Uniswap, try reducing your trade size, or switch to a token pair with better liquidity. This helps align your trade with available tokens.

How do I increase my Uniswap liquidity?

Increase Uniswap liquidity by becoming a liquidity provider. Deposit a pair of tokens into a pool to help others trade and earn transaction fees in return.

How do you fix price impact too high?

Fix high price impact by reducing your trade size or choosing a different trading pair with more liquidity. This minimizes the gap between expected and actual trade prices.

How do I fix insufficient liquidity on Uniswap?

Fix insufficient liquidity on Uniswap by reducing your trade size, increasing slippage tolerance, checking if you’re trading the correct token, or using another DEX with better liquidity for your token.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- CoinCodex: How to Fix “Insufficient Liquidity For This Trade”?

- BuidlBee: How to Fix “Insufficient Liquidity for This Trade” for PancakeSwap and UniSwap

- CoinTelegraph: What are decentralized exchanges, and how do DEXs work?

- Bitkan: How to Fix the “Insufficient Liquidity for this Trade” Error on Uniswap? Why Does Slippage Affect Liquidity on Uniswap?

- Gemini: The Decentralized Exchange Landscape