Introduction to AVAX Staking

Staking AVAX on the Avalanche network is an exciting opportunity for crypto enthusiasts and AVAX holders. It’s a way to earn rewards by supporting the network. When you stake AVAX, you’re locking up your tokens to help maintain the blockchain’s security and efficiency.

This process is crucial in proof-of-stake (PoS) systems like Avalanche, where validators are chosen based on the amount of crypto they hold and are willing to “stake” or lock up.

The Avalanche network offers two main options when it comes to “how to stake avax?” delegating your stake to a validator or running your validator node. The official Avalanche Wallet makes it easy to get started with staking.

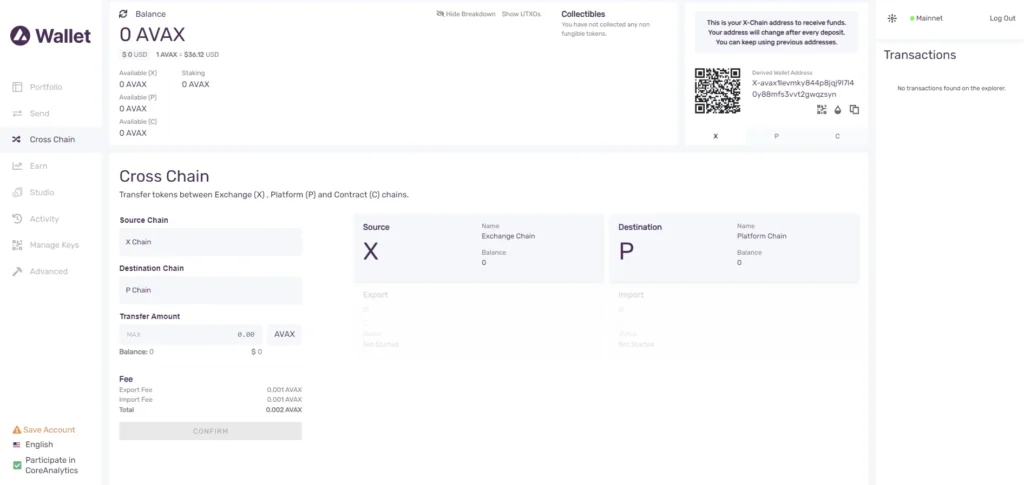

You’ll need to transfer your AVAX tokens to the P-Chain (platform chain) using an Avalanche chain swap, a unique feature of the network. Then, you can choose a validator node to delegate your stake or set up your own node if you meet the requirements (a minimum of 2000 AVAX).

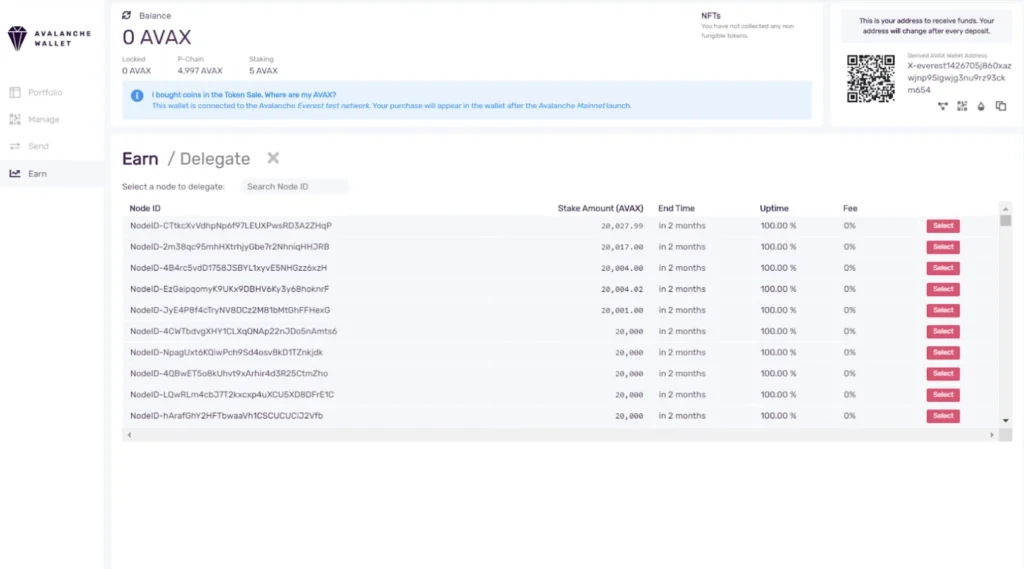

Choosing the right validator is crucial, as it affects your staking rewards. Important factors to consider include:

- The validator’s stake.

- The amount of AVAX they can still receive in delegations.

- The number of delegators.

- The node’s uptime.

- The validator’s fee.

A balance of high validator stake, good uptime, and a reasonable fee typically indicates a reliable validator node.

Staking AVAX can yield an average of approximately 10% APY, with a maximum yield of 12% APY for those who maintain more than 60% uptime and never miss a day of staking throughout the year.

This makes staking AVAX an attractive option for earning passive income while contributing to the network’s security and stability.

Step-by-Step Guide on How to Stake AVAX

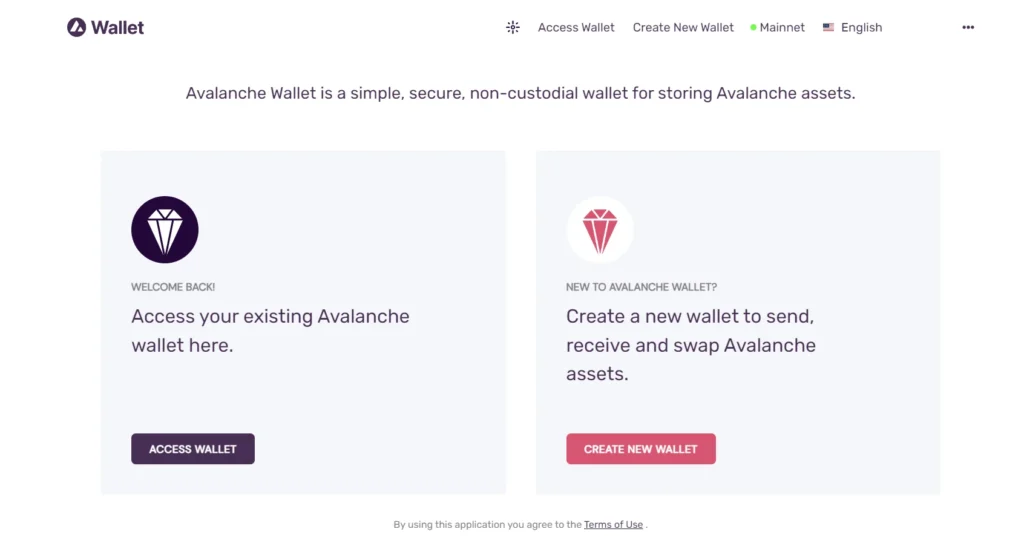

Step 1: Accessing the Avalanche Wallet

To start staking AVAX, the first thing you need is access to the Avalanche Wallet. You can do this using a key phrase, a Keystore file, or a Ledger hardware wallet.

This step is crucial because it’s where you’ll manage your AVAX tokens. The Avalanche Wallet is the official and supported method for staking, ensuring your tokens stay secure in your wallet throughout the process.

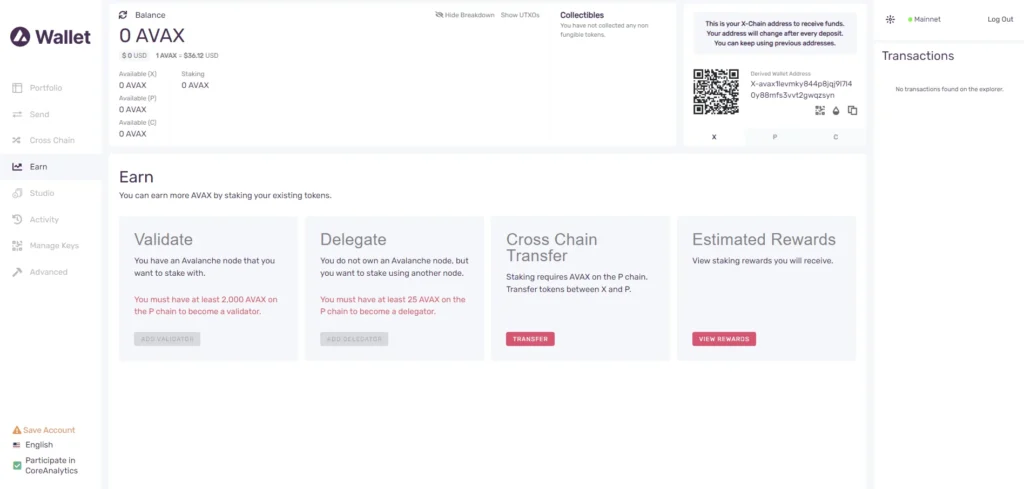

Step 2: Navigating to the “Earn” Section

Once you’re in the Avalanche Wallet, head over to the “Earn” section. This is where the staking action happens.

Note that the minimum amount you can stake is 25 AVAX. Here, you’ll enter the amount of AVAX you wish to transfer to your P-Chain.

The P-Chain, or Platform Chain, is where the staking mechanism operates on the Avalanche blockchain. After entering the amount, complete the transfer by clicking the “Transfer” button.

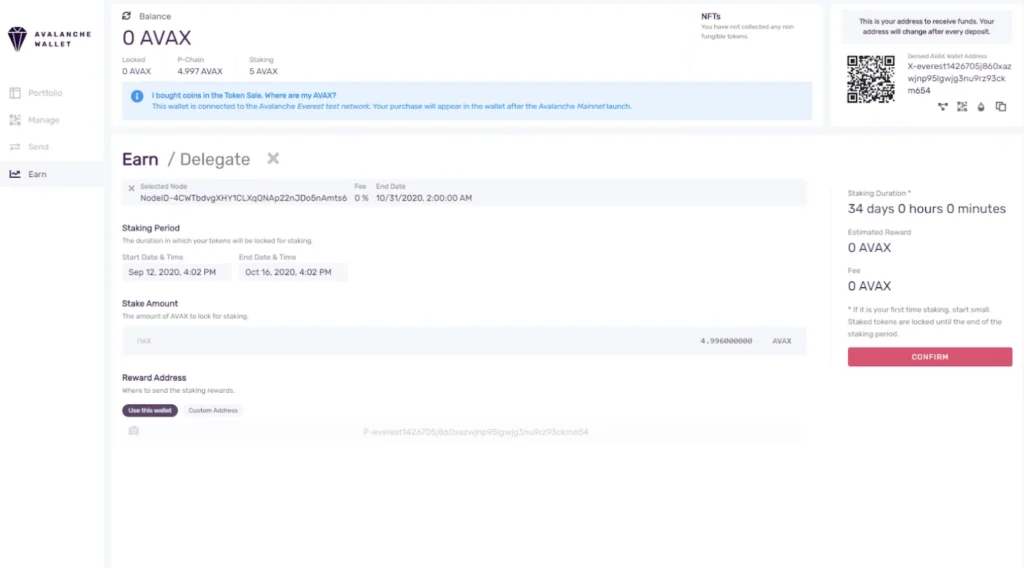

Step 3: Adding a Delegator

The final step in staking AVAX is adding a delegator. This involves selecting a validator node to which you’ll delegate your tokens. It’s important to specify the staking period and the amount of AVAX you want to stake.

Be mindful of the end time of the selected validator, as your delegation period cannot extend beyond the validator’s end date. Once you’ve confirmed all the details, your AVAX is staked, and you’re set to start earning rewards.

By following these steps, you can participate in the Avalanche ecosystem and potentially earn staking rewards. Remember, staking involves certain risks, so it’s important to do your research and understand the process fully.

Different Ways to Stake AVAX

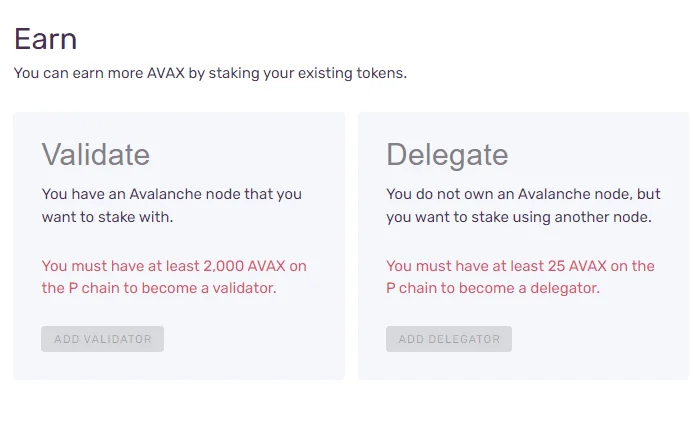

Running Your Own Validator Node

One exciting way to stake AVAX is by running your validator node. This option is for those who are more technically inclined and want to actively participate in the Avalanche network’s consensus mechanism.

To run a validator node, you must stake a minimum of 2000 AVAX. This higher stake requirement ensures that validators are committed to maintaining network security and stability. Running your own node means you’ll be responsible for validating transactions and blocks on the network.

It’s a more hands-on approach but comes with the potential for higher staking rewards due to the increased responsibility and investment.

Delegating to a Validator

If running your own node sounds too complex or if you don’t have enough AVAX to meet the minimum requirement, you can choose to delegate your AVAX to an existing validator. This process is much simpler and accessible for most AVAX holders.

You can start with as little as 25 AVAX. Delegating involves selecting a validator and specifying the amount of AVAX you want to stake, along with the staking period. The validator then uses your AVAX along with their own and other delegators’ stakes to participate in the consensus process.

In return, you receive a portion of the staking rewards generated by the validator minus any fees they charge for their service.

Both methods of staking AVAX contribute to the security and efficiency of the Avalanche network. Whether you choose to run your own validator node or delegate to an existing one, you’re playing a part in the Avalanche ecosystem and earning rewards for your contribution.

Rewards and Risks in Staking AVAX

Staking AVAX on the Avalanche network offers an attractive blend of potential rewards and manageable risks.

It’s a process where you lock up some of your AVAX tokens to help verify transactions, contributing to the network’s security and efficiency. In return, you can earn rewards in the form of additional AVAX tokens.

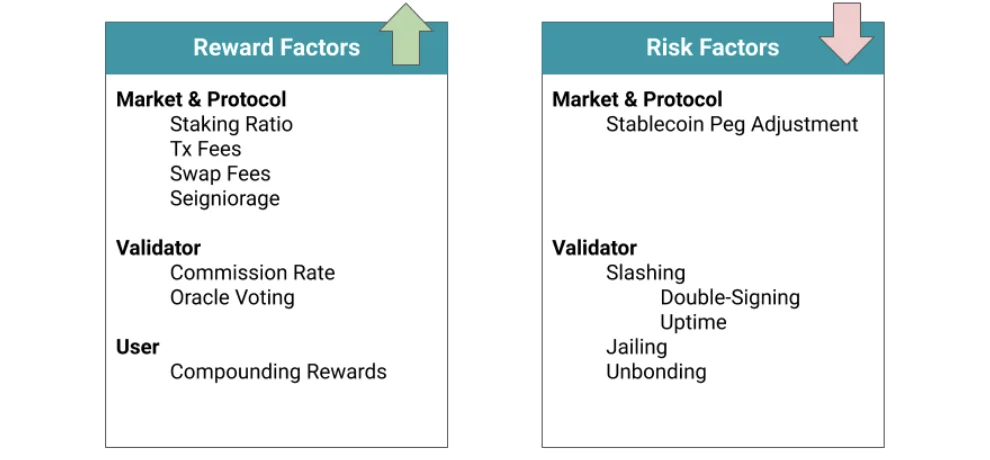

Earning Rewards through Staking

The annual percentage rate (APR) for staking AVAX is currently about 9%. This rate can slightly increase to around 9.5% APR if you choose to run your own validator node, though this option involves higher startup and ongoing server costs.

The minimum amount required to stake as a delegator is 25 AVAX, making staking accessible to a broader range of investors.

Rewards vary based on the staking duration. The longer you commit your AVAX tokens, the higher the potential yield.

For example, a full-year commitment could yield around 9% APR, while a six-month stake might yield approximately 4.5% net yield. Rewards are paid out at the end of the staking period in AVAX tokens.

Understanding the Risks

While staking AVAX is generally considered less risky compared to other blockchains, it’s not without its challenges. One of the main risks is the lock-up period. Once you commit to a staking duration, you cannot access or sell your AVAX until the period ends. This could mean missing out on other investment opportunities or being unable to react to market changes.

Another risk involves the performance of the validator you delegate to. If the validator experiences significant downtime or fails to meet the network’s performance standards, you might not earn the expected rewards. It’s important to choose a reliable validator with a good track record to mitigate this risk.

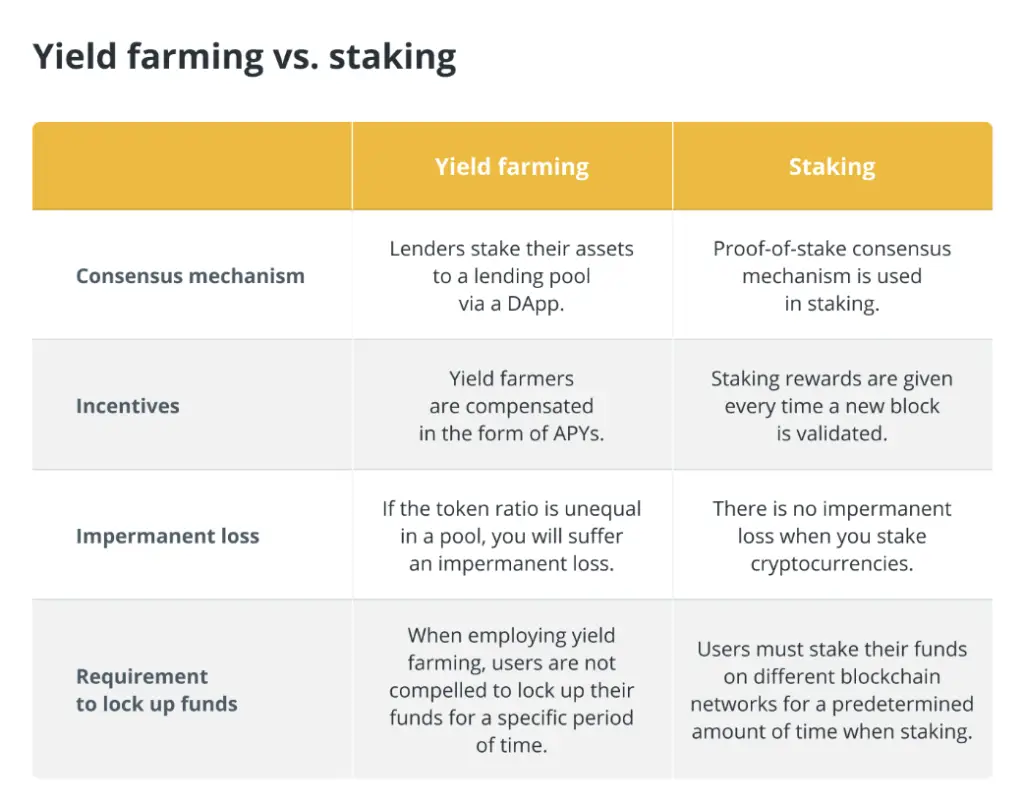

Liquid Staking and Yield Farming Alternatives

For those concerned about the lock-up period, liquid staking offers a more flexible alternative. Platforms like Benqi allow you to stake AVAX and earn rewards while retaining the option to unstake your tokens, albeit with a cooldown period.

However, liquid staking typically offers lower yields compared to traditional staking.

Yield farming is another option for maximizing returns on your AVAX tokens. This involves using decentralized finance (DeFi) strategies, such as providing liquidity or lending your tokens, to earn higher yields.

However, yield farming introduces additional risks, including smart contract vulnerabilities and exposure to other assets.

Extra Help and Information

When it comes to staking AVAX, there are several resources available to help you understand the process and make informed decisions.

These resources provide detailed information on various aspects of staking, including how to stake, rewards, and the overall staking ecosystem on the Avalanche network.

Understanding Staking on Avalanche

Staking on Avalanche involves locking up AVAX tokens to secure the network and, in return, earning rewards. This process is crucial for the network’s consensus mechanism and overall security.

The Avalanche network offers a staking calculator to help you estimate your potential rewards based on the amount of AVAX you stake and the staking duration.

Validator and Delegator Resources

For those interested in running their own validator node or delegating to an existing validator, the Avalanche network provides comprehensive guides and FAQs.

These resources cover the technical requirements for running a validator node, the rewards structure, and the process of delegating AVAX to a validator.

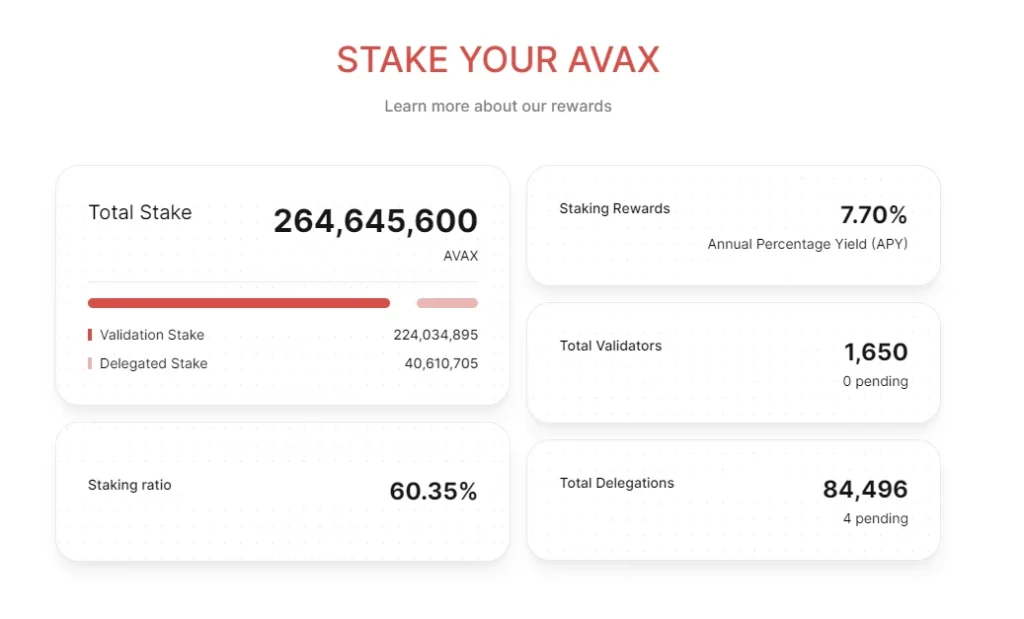

Staking Rewards and APY

The current Annual Percentage Yield (APY) for staking AVAX is approximately 7.70%. This rate can vary based on market conditions and network participation. Stakers can earn up to 11% APY on staked AVAX, and validators have the option to set their own fee for accepting delegations.

Avalanche Staking Ecosystem

The Avalanche network is continuously growing, with new applications and assets launching regularly. By participating in staking, you contribute to this growth and become part of the future of the Avalanche ecosystem.

Support and Community Engagement

Avalanche offers various support channels, including a dedicated support page and community forums. These platforms are ideal for asking questions, sharing experiences, and staying updated on the latest developments in the avalanche-staking ecosystem.

Wrapping It Up

Staking AVAX on the Avalanche network offers a unique opportunity for both passive income and network participation. Here’s a bullet-point summary of the most important things to remember:

- Understanding AVAX Staking: Staking involves locking your AVAX tokens in the network to support transaction validation, earning rewards in return.

- Staking vs. Mining: Unlike Proof-of-Work (PoW) systems like Bitcoin, Avalanche’s Proof-of-Stake (PoS) mechanism is more energy-efficient and requires staking coins in a wallet.

- Two Ways to Stake:

- Become a Validator: Requires a minimum of 2000 AVAX and technical know-how.

- Delegate to a Validator: Easier and accessible with a minimum of 25 AVAX.

- Rewards and APY: The current Annual Percentage Yield for staking AVAX is approximately 7.70%, with potential earnings up to 11% APY.

- Staking Platforms: Centralized exchanges like Binance, Crypto.com, and Nexo offer staking services with varying rewards and requirements.

- Security and Risks: While Avalanche eliminates the risk of slashing, be aware of market volatility, lock-up periods, and the security of staking platforms.

- Staking Pools and Liquid Staking: Options for those seeking more control or flexibility over their staked assets.

- Tax Implications: Be mindful of potential tax liabilities on staking rewards based on local laws.

- Entry Barriers: High for validators but lower for delegators.

- Market Volatility: AVAX price fluctuations can impact the value of staked tokens and rewards.

Staking AVAX can be a rewarding venture, but it’s essential to understand the process, choose the right method for your needs, and stay informed about the network and market conditions.

FAQ: Staking AVAX

What is the best way to stake AVAX?

The best way to stake AVAX depends on your technical expertise and investment amount. You can either run your own validator node (requires a minimum of 2000 AVAX) or delegate to an existing validator (minimum of 25 AVAX).

How much do you earn staking AVAX?

The reward percentage for staking AVAX in the Avalanche Wallet is roughly 7.86%. This rate can vary based on network conditions and validator performance.

Is AVAX staking safe?

AVAX staking is generally safe, but like all crypto investments, it carries some risks. These include market volatility and the potential loss of rewards if your chosen validator doesn’t meet the network’s uptime requirements.

How to stake AVAX on the C chain?

Staking AVAX on the C-chain isn’t directly possible as staking occurs on the P-chain. However, you can transfer AVAX from the C-chain to the P-chain for staking purposes.

How long should I stake AVAX for?

The staking period for AVAX can range from a minimum of two weeks to a maximum of one year. Longer staking periods typically offer higher rewards.

Is staking Avalanche worth it?

Staking Avalanche can be worth it if you’re looking for a way to earn passive income while contributing to network security. However, consider the risks and your investment goals before staking.

Is there a minimum to stake AVAX?

Yes, the minimum amount to stake AVAX is 25 AVAX. This minimum is set to prevent network spam and ensure healthy network participation.

ARTICLE SOURCES

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- AvaxNetwork: How do I stake AVAX on Avalanche?

- MilkRoad: AVAX Staking: What To Know And How To Get Started

- Avax: Validator

- BankLessTime: How To Stake Avalanche in 2023

- Avax: Staking FAQ