Creating a MEV bot is a journey into the dynamic world of blockchain and Ethereum arbitrage. This guide dives into the essentials of MEV (Maximal Extractable Value) and how to harness it through a trading bot.

You’ll learn about leveraging mempool data, constructing smart contracts, and deploying strategies for profitable MEV opportunities.

Whether you’re a seasoned trader or new to the MEV space, this guide offers valuable insights into building MEV bots, making it a must-read for anyone looking to profit from MEV extraction in the ever-evolving blockchain landscape.

Introduction to MEV Bots

MEV bots, a revolutionary concept in the crypto world, are transforming how traders interact with blockchain technology. MEV, or Maximal Extractable Value, represents the maximum value that can be extracted from blockchain transactions, particularly on Ethereum.

These bots are designed to identify and capitalize on profitable opportunities within the blockchain, making them a powerful tool for traders and investors.

Demystifying MEV and Its Significance in Crypto

MEV is a critical aspect of blockchain ecosystems, especially in decentralized finance (DeFi). It involves the potential profit that miners, validators, or other participants can earn by influencing the order of transactions in a block.

MEV arises from various activities like arbitrage, sandwich attacks, and liquidations. The concept is particularly prevalent in Ethereum due to its complex transaction structure and smart contract interactions.

MEV bots often scan the network to identify these lucrative opportunities, aiming to maximize returns by exploiting price differences and transaction orders.

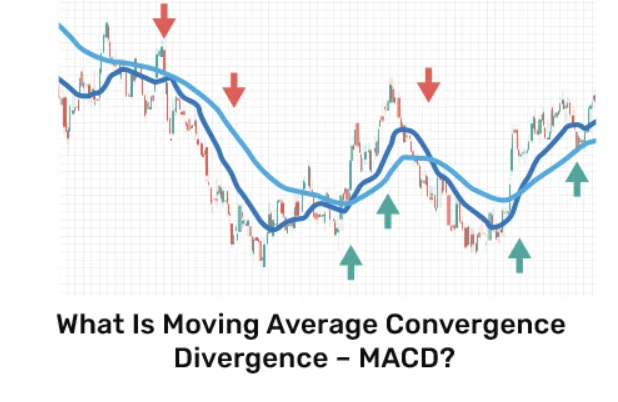

Arbitrage: The Heartbeat of MEV Strategies

Arbitrage is at the core of many MEV strategies. It involves taking advantage of price differences for the same asset across different markets or decentralized exchanges (DEXs) like Uniswap and Sushiswap.

MEV bots use sophisticated algorithms to detect these price discrepancies in real time, often by analyzing pending transactions in the Ethereum mempool.

They then execute trades that capitalize on these differences before they are resolved, thereby securing profits. This process requires a deep understanding of blockchain mechanics, smart contract functionality, and the ability to quickly analyze and respond to changing market conditions.

Laying the Groundwork for Your MEV Bot

Before diving into the creation of a MEV bot, it’s crucial to understand the foundation required for successful development. This involves acquiring the right tools and knowledge, as well as setting up an effective development environment.

These initial steps are essential for anyone looking to build an MEV bot, as they lay the groundwork for the more complex aspects of MEV bot creation and operation.

Essential Tools and Knowledge for MEV Bot Creation

Creating an MEV bot requires a solid understanding of blockchain technology, particularly Ethereum, and proficiency in programming languages like Solidity. Familiarity with Ethereum’s blockchain mechanics, smart contracts, and the Ethereum Virtual Machine (EVM) is crucial. Additionally, knowledge of decentralized exchanges (DEXs) and liquidity pools is important, as MEV bots often operate within these environments.

Tools such as Blocknative’s MEV bundle RPC endpoint and simulation platforms are vital. These tools provide real-time data feeds of the mempool, enabling the bot to analyze pending transactions and identify profitable opportunities.

Understanding gas fees, transaction routing, and the intricacies of on-chain and mempool transactions is also essential. This knowledge, combined with the right tools, allows bot operators to effectively navigate the MEV landscape.

Setting the Stage: Development Environment Essentials

Setting up a development environment for MEV bot creation involves configuring software and platforms that support Ethereum blockchain interaction and smart contract development. This includes installing and configuring a Solidity compiler, Ethereum client, and other blockchain development tools.

A well-structured development environment should also include testing frameworks and simulation tools to test and refine MEV strategies before deploying them on the mainnet.

It’s important to have a secure and efficient setup that allows for rapid development and testing of MEV strategies.

This includes having access to real-time blockchain data, a robust coding environment, and the ability to simulate various scenarios to optimize the bot’s performance. A comprehensive development environment is key to building effective and profitable MEV bots.

Step-by-Step: How to create a MEV Bot

Creating an MEV bot requires a systematic approach, starting from researching arbitrage opportunities to launching and refining the bot.

This step-by-step blueprint guides you through the process of building a basic arbitrage bot on the Ethereum blockchain, as detailed in Blocknative’s blog on MEV bots.

Step 1: Researching Arbitrage Opportunities

The first step in creating a MEV bot is to identify arbitrage opportunities within the Ethereum blockchain. This involves understanding the dynamics of decentralized exchanges (DEXs) like Uniswap and Sushiswap and how price differences between the same assets can be exploited.

By monitoring the mempool for pending transactions, you can detect potential arbitrage opportunities that arise when a transaction impacts the price of an asset on one DEX but not on another.

const Web3 = require('web3');

const web3 = new Web3(new Web3.providers.WebsocketProvider('wss://mainnet.infura.io/ws/v3/YOUR_INFURA_KEY'));

web3.eth.subscribe('pendingTransactions', (error, txHash) => {

if (!error) {

web3.eth.getTransaction(txHash, (err, tx) => {

if (tx && tx.to) {

// Analyze transaction for potential arbitrage opportunities

}

});

}

});

Step 2: Crafting Your First Arbitrage Bot on Ethereum

Once you’ve identified potential arbitrage opportunities, the next step is to write a script for your MEV bot. This script should be capable of detecting these opportunities and executing trades to take advantage of them.

A basic understanding of Solidity, the programming language used for Ethereum smart contracts, is essential for this step.

You can start by modifying a pre-built smart contract to fit your needs, incorporating real-time mempool data to calculate the profit potential of arbitrage opportunities.

npm install -g truffle

truffle init

npm install @openzeppelin/contracts

Step 3: Navigating the Mempool for MEV Gold

The mempool is where all pending transactions wait to be confirmed and included in the next block. Your MEV bot needs to analyze these transactions in real time to find profitable arbitrage opportunities.

This requires a reliable data feed of the mempool, which can be obtained through APIs like Blocknative’s MEV bundle RPC endpoint.

pragma solidity ^0.8.0;

contract ArbitrageDetector {

function detectArbitrage(address tokenA, address tokenB) external view returns (bool) {

// Logic to detect arbitrage opportunities

}

}

Step 4: Assembling Your Flashbots Bundle

Flashbots are a way to privately send your transactions to miners, bypassing the public mempool. Once you’ve identified a profitable arbitrage opportunity, you need to construct a Flashbots bundle, which includes your arbitrage transactions. This bundle is then sent to the Flashbots relay for inclusion in the next block.

// Assuming the use of the earlier JavaScript snippet for mempool monitoring

web3.eth.getTransaction(txHash, (err, tx) => {

if (tx && tx.to) {

// Call your smart contract's detectArbitrage function

// with relevant parameters based on the transaction data

}

});

Step 5: Launching Your MEV Bot into Action

After constructing your Flashbots bundle, it’s time to launch your MEV bot. This involves submitting your bundle to the Flashbots relay and monitoring its inclusion in the blockchain.

Your bot should be able to handle different types of transactions and adjust its strategy based on real-time market conditions.

pragma solidity ^0.8.0;

contract ArbitrageExecutor {

function executeArbitrage(address tokenA, address tokenB, uint256 amount) external {

// Logic to execute arbitrage trades

}

}

Step 6: Testing the Waters: Simulating MEV Transactions

Before fully deploying your MEV bot, it’s crucial to test its performance. This can be done through simulation platforms that allow you to test your bot’s transactions against the current block state. These simulations help identify any potential issues and optimize the bot’s strategy.

const ArbitrageExecutor = artifacts.require("ArbitrageExecutor");

contract("ArbitrageExecutor", accounts => {

it("should execute arbitrage correctly", async () => {

const instance = await ArbitrageExecutor.deployed();

// Add your test logic here

});

});

Step 7: Refining Your Bot for Peak Efficiency

After testing, refine your bot to ensure it operates at peak efficiency. This involves optimizing the bot’s code for gas efficiency, improving its transaction execution strategy, and continuously monitoring its performance to make necessary adjustments.

truffle migrate --network mainnet

Step 8: Maximizing Profits in the World of MEV

The final step is to maximize your bot’s profits in the competitive world of MEV. This requires staying updated with the latest trends and strategies in MEV, continuously improving your bot’s algorithms, and exploring new opportunities in the ever-evolving blockchain landscape.

// Example logging function

function logPerformance(metrics) {

console.log("Performance metrics:", metrics);

}

// Call logPerformance with relevant data periodically

By following these steps, you can create a basic MEV arbitrage bot on the Ethereum blockchain. Remember, this is a highly competitive field, and success requires a deep understanding of blockchain technology, smart contract development, and real-time data analysis.

Lessons from the Trenches: MEV Bot Best Practices

Navigating the Competitive Landscape of MEV

The world of MEV (Maximal Extractable Value) is highly competitive, with numerous participants vying for profitable opportunities on the blockchain.

Success in this arena requires a deep understanding of the Ethereum ecosystem, including the dynamics of transactions in the mempool, smart contract interactions, and the behavior of miners.

MEV bots often need to adapt to changing market conditions and network states, making flexibility and quick response crucial. Solid quant skills and a thorough grasp of trading strategies are essential for navigating this landscape effectively.

Insider Tips for a Successful MEV Bot Operation

To operate a successful MEV bot, it’s important to focus on several key areas:

- Strategy Development: Develop robust MEV bot strategies that can adapt to various market conditions. This involves analyzing pending transactions in the mempool, understanding price impacts, and identifying arbitrage opportunities across multiple DEXs.

- Efficiency and Speed: Your bot should be efficient in terms of gas usage and quick in executing transactions. This is crucial in a space where miners could participate in MEV extraction, and the order of transactions can significantly affect profitability.

- Security and Testing: Ensure the security of your bot, especially when dealing with smart contracts on blockchains like Ethereum and Polygon. Regular testing and simulation of different scenarios help in identifying potential issues.

- Monitoring and Adaptation: Continuously monitor your bot’s performance using a dashboard and adjust your strategies based on real-time data. This includes staying updated with the latest developments in DeFi and crypto trading.

- Understanding the Ecosystem: Familiarize yourself with tools like Flashbots and other protocols that prioritize transactions. Understanding how validators benefit from increased fees and how to use these mechanisms can give your bot an edge.

By following these best practices and staying informed about the latest trends and technologies in the MEV space, you can increase the chances of success for your MEV bot operation.

Key Takeaways: How to create a MEV bot

As we conclude our journey through the intricate world of MEV bots, here are the essential bullet points to remember:

- Understand MEV: Maximal Extractable Value (MEV) involves extracting value from blockchain transactions, primarily through methods like front-running and back-running.

- Identify Arbitrage Opportunities: Use your MEV bot to capitalize on price differences across decentralized exchanges (DEXs).

- Solidify Your Development Skills: Proficiency in Solidity and understanding the Ethereum blockchain are crucial for MEV bot building.

- Monitor the Mempool: Analyzing pending transactions in the mempool is key to identifying profitable opportunities.

- Efficient Strategy Implementation: Develop and implement various types of MEV bot strategies to adapt to different market conditions.

- Security and Testing: Prioritize the security of your bot, especially when dealing with smart contracts. Regular testing is essential.

- Stay Informed: Keep up with the latest trends in DeFi and crypto trading to refine your strategies.

- Leverage Tools and Platforms: Utilize platforms like Flashbots to prioritize transactions and increase the efficiency of your bot.

- Optimize for Gas and Speed: Ensure your bot is gas-efficient and can execute transactions swiftly to stay competitive.

- Continuous Learning: The world of MEV is complex and ever-evolving. Stay committed to learning and adapting.

Remember, creating a successful MEV bot involves a blend of technical skills, strategic thinking, and a deep understanding of the blockchain ecosystem. With these key points in mind, you’re well on your way to mastering the art of MEV bot creation.

Frequently Asked Questions

Are MEV bots profitable?

Yes, MEV bots can be profitable. They exploit opportunities like arbitrage and front-running on the blockchain, extracting value from transaction order differences. However, profitability depends on the bot’s strategy and market conditions.

What language are MEV bots written in?

MEV bots are primarily written in Solidity, the programming language for Ethereum smart contracts. Solidity is essential for creating and deploying MEV strategies on the Ethereum blockchain.

What is a MEV bot?

A MEV bot is a software program designed to identify and exploit Maximal Extractable Value (MEV) opportunities on blockchain networks. These bots analyze pending transactions and execute strategies to extract value.

Are there MEV bots on Solana?

Yes, MEV bots exist on Solana and other blockchains besides Ethereum. These bots exploit similar opportunities in different blockchain ecosystems, adapting their strategies to each network’s unique characteristics.

Which crypto bot is most profitable?

The profitability of a crypto bot depends on its strategy, efficiency, and the market environment. MEV bots, arbitrage bots, and trading bots can be profitable, but there’s no one-size-fits-all answer.

How big is the MEV market?

The MEV market is significant and growing, with millions of dollars in value extracted from blockchain transactions. Its size fluctuates with market conditions and the evolving blockchain landscape.