Staking Ethereum is a smart move for those looking to earn rewards while supporting the Ethereum network. With Ethereum 2.0, staking has become more accessible, offering a decentralized way to secure the network.

Platforms like Binance, ByBit, and Lido stand out as the best place to stake Ethereum for their user-friendly interfaces, attractive rewards, and innovative staking solutions.

Whether you’re a seasoned staker or new to the game, these platforms provide a range of options to suit your needs, making it easier than ever to stake your ETH and reap the benefits.

Understanding Ethereum Staking: A Beginner’s Guide

Ethereum staking is an exciting way to earn rewards and contribute to the Ethereum network’s security and efficiency. Staking involves locking up a certain amount of ETH to validate transactions and maintain the network.

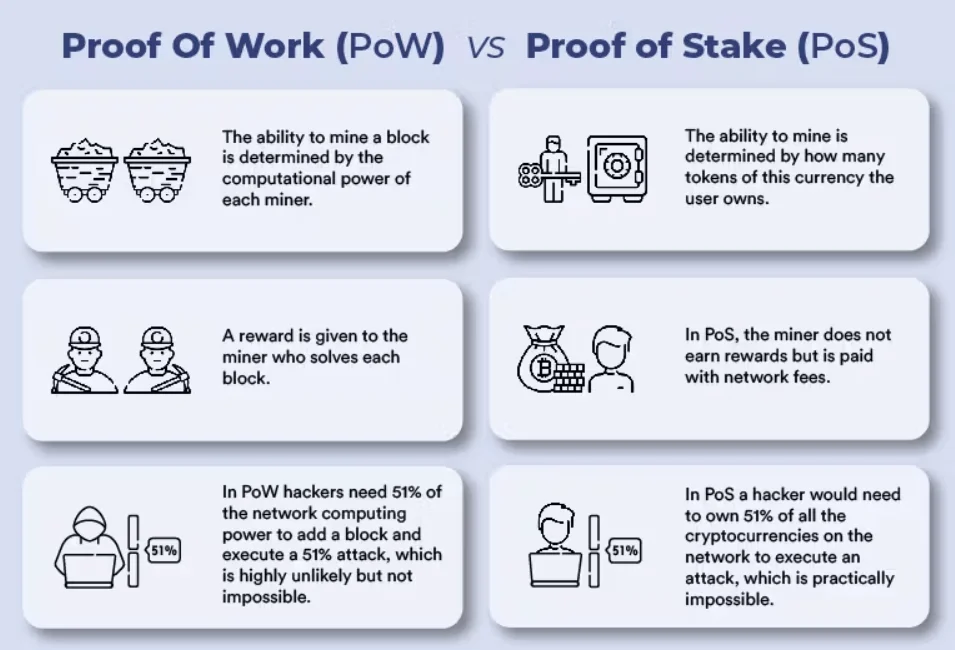

With Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS), staking has become a key component of the network’s operation, offering a more energy-efficient and scalable solution.

What is Ethereum 2.0 and Its Impact on Staking?

Ethereum 2.0, also known as the consensus layer, is a significant upgrade to the Ethereum network. It aims to enhance the network’s scalability, efficiency, and speed, allowing it to process up to 100,000 transactions per second.

This upgrade shifts Ethereum from a PoW to a PoS consensus mechanism, where validators are chosen to create new blocks and validate transactions based on the amount of ETH they stake, rather than the computational power they contribute.

The Transition from Proof-of-Work to Proof-of-Stake

The transition from PoW to PoS marks a fundamental change in how Ethereum operates.

In PoW, miners use computational power to solve complex mathematical problems and validate transactions, which consumes a significant amount of energy. PoS, on the other hand, requires validators to stake ETH as collateral to participate in the network.

This approach is more energy-efficient and reduces the risk of centralization, as it doesn’t favor participants with more powerful hardware.

The Advantages of Staking Your Ethereum

- Earn Passive Income: Staking ETH allows you to earn rewards, which are distributed periodically based on the amount staked and the network’s overall staking rate.

- Contribute to Network Security: By staking your ETH, you help secure the Ethereum network, ensuring its stability and reliability.

- Participate in Network Governance: Stakers can have a say in the future development of the Ethereum network, as they are often involved in governance decisions.

- Environmentally Friendly: PoS is a more energy-efficient consensus mechanism compared to PoW, making your investment more sustainable.

- Diverse Staking Options: Ethereum offers various staking methods, including solo staking, staking pools, and liquid staking, catering to different levels of investment and expertise.

Staking Ethereum is a process that involves locking up ETH to support the network’s operation and security. With the advent of Ethereum 2.0, staking has become more crucial, offering a greener and more efficient way to maintain the blockchain. By staking, you not only earn rewards but also contribute to the network’s governance and security.

1. Binance: A One-Stop Solution for Staking Ethereum

Binance has emerged as a leading platform for Ethereum staking, offering a user-friendly and efficient way to stake ETH and earn rewards. With its innovative approach to staking, Binance simplifies the process, making it accessible for both beginners and experienced stakers.

The platform’s integration of Ethereum 2.0 staking and its unique features provide a comprehensive staking solution.

Key Features and Benefits

- Low Entry Barrier: Stake as little as 0.0001 ETH, making it accessible to a wide range of investors.

- Tokenized Staking: Receive Wrapped Beacon ETH (WBETH) as a tokenized representation of staked ETH and rewards.

- Flexibility: WBETH provides the ability to sell, transfer, or use staked ETH positions while still earning rewards.

- Daily Rewards: Earn yield by holding WBETH or using it for various use cases, including trading and DeFi protocols.

- Secure and Transparent: Binance ensures a secure staking environment with clear and transparent processes.

Fees and Staking Rewards

- Dynamic APR: The ETH staking Annual Percentage Rate (APR) on Binance is dynamic, following on-chain Ethereum staking rewards, which fluctuate due to various factors.

- Commission Fee: Binance charges a 10% commission fee on staking rewards to ensure the sustainability of the product.

- Reward Distribution: Rewards are distributed to Binance ETH Staking users on a T+2 day basis after the rewards are generated on-chain.

- WBETH: ETH Conversion Ratio: The value of WBETH progressively exceeds that of ETH due to the accumulation of staking rewards, with the ratio updated daily to reflect earned rewards.

Binance’s Ethereum staking offers a blend of accessibility, flexibility, and security, making it an attractive option for those looking to stake ETH. With its low entry barrier and innovative WBETH system, Binance stands out as a top choice for Ethereum staking.

2. ByBit: Tailored for Active Ethereum Stakers

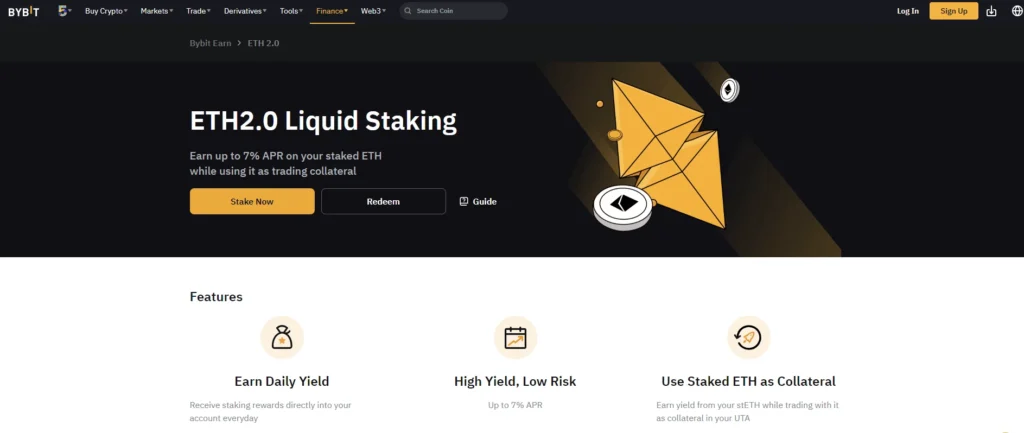

ByBit offers a dynamic and efficient platform for Ethereum staking, particularly suited for active stakers.

With its ETH 2.0 Liquid Staking, ByBit provides a seamless way to earn rewards while contributing to the Ethereum network’s security. The platform’s approach to staking is designed to maximize user benefits and flexibility.

Key Features and Benefits

- ETH 2.0 Liquid Staking: Allows users to stake ETH and earn rewards while participating in network validation.

- Low Minimum Stake: Participate in ETH 2.0 Liquid Staking with as little as 0.1 ETH.

- Flexible Redemption: Redeem staked ETH for ETH at a 1:1 ratio, with a processing time of 5-7 days.

- Daily Yield: Earn daily rewards based on the amount of stETH in your ByBit account.

- Trading with stETH: Use stETH as collateral in ByBit’s Unified Trading Account and Spot market.

- Secure Staking Process: ByBit handles the minting process, ensuring security and eliminating the need for on-chain activities or gas fees.

Fees and Staking Rewards

- APR Fluctuations: The Annual Percentage Rate (APR) for staking ETH on ByBit fluctuates daily based on network activities.

- Maximum APR: The highest APR can reach around 7%, offering competitive returns for stakers.

- Yield Distribution: Yields are distributed to the Funding Account at 6:00 UTC daily, based on each user’s share of the stETH staked in ByBit’s overall pool.

- No Withdrawal Limit: There is no limit on the number of redemption orders per day, with a minimum redemption amount of 0.01 stETH and a maximum of 1,000 stETH per order.

ByBit’s Ethereum staking platform is designed for active stakers who seek flexibility and competitive returns. With its user-friendly interface and innovative staking solutions, ByBit stands out as a top choice for Ethereum staking.

Also Read: How to Stake AVAX: A Simple Guide to Earning Rewards on the Avalanche Network

3. Kraken: Ideal for Ethereum Stakers with No Minimum Requirements

Kraken stands out as a versatile platform for Ethereum staking, especially appealing to those who prefer no minimum staking requirements. It offers a straightforward and secure way to stake ETH, contributing to the Ethereum network’s security while earning rewards.

Kraken’s integration with the Ethereum blockchain and user-friendly features make it a top choice for both novice and experienced stakers.

Key Features and Benefits

- No Minimum Staking: Stake any amount of ETH, making it accessible to all types of investors.

- Integrated Exchange Platform: Seamlessly stake, buy, sell, and trade ETH all within one platform.

- World-Class Security: Ensures the safety of your staked ETH with robust security measures.

- Easy and Fast Setup: Quickly stake ETH in just a few clicks, without any technical complexities.

- Liquid Staking Options: Offers the flexibility to trade against staked ETH through liquid staking protocols.

Fees and Staking Rewards

- Variable Staking Rewards: Earn rewards of approximately 5% to 17% yearly, based on the network rate.

- Administrative Fee: Kraken retains a 15% fee on all rewards received from Ethereum staking.

- Automatic Reward Distribution: Rewards are automatically distributed and added to your staking balance.

- Flexible Unstaking: Unstake your ETH at any time, with no lock-up periods, allowing for immediate trading.

Kraken’s Ethereum staking service is designed for ease of use and flexibility, catering to a wide range of staking preferences. With its no minimum requirement and competitive rewards, Kraken is an excellent platform for those looking to stake ETH and earn passive income.

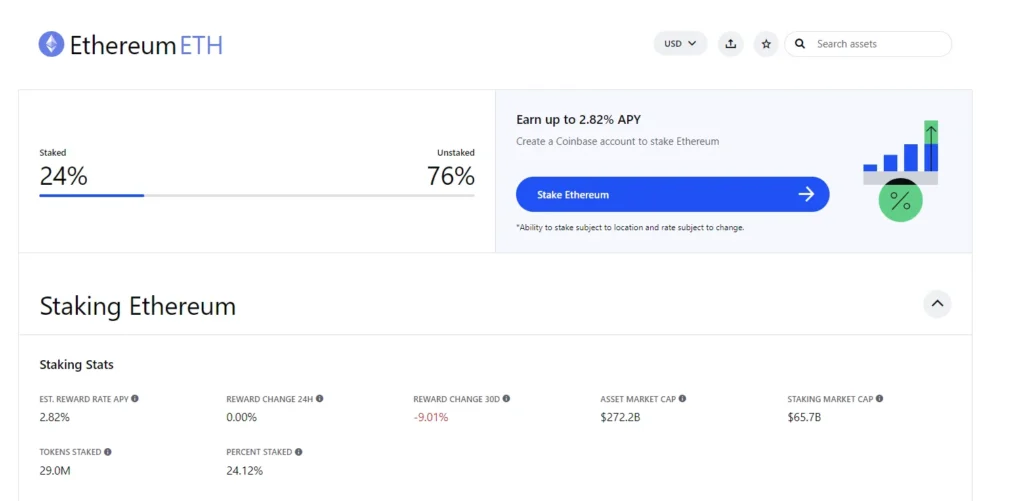

4. Coinbase: The Go-To Platform for U.S. Ethereum Stakers

Coinbase has become a top choice for U.S. Ethereum stakers, offering a straightforward and secure way to earn staking rewards. As a well-known crypto exchange, Coinbase provides an easy-to-use platform for both beginners and experienced users to stake their ETH. With its focus on user experience and security, Coinbase stands out as a leading option for Ethereum staking.

Key Features and Benefits

- Easy Enrollment: Start staking Ethereum with just a few clicks, making it simple for anyone to participate.

- Security Measures: Coinbase takes steps to ensure the safety of your staked ETH, allowing you to stake with confidence.

- Passive Income: By staking Ethereum, you can earn rewards over time, turning your ETH into a source of passive income.

- No Minimum Staking Requirement: Stake any amount of Ethereum, making it accessible for all levels of investors.

- Integrated Platform: Easily buy, sell, trade, and stake Ethereum all within the Coinbase ecosystem.

Fees and Staking Rewards

- Reward Rate: The current estimated Annual Percentage Yield (APY) for staking Ethereum on Coinbase is 2.87%.

- Reward Fluctuations: The reward rate can change based on network conditions and the total amount of ETH staked.

- Staking Market Cap: Ethereum’s staking market cap on Coinbase is around $64.0 billion.

- Percentage Staked: Approximately 24.14% of the total Ethereum supply is currently staked on Coinbase.

- No Additional Lockup Periods: Coinbase does not impose any extra lockup periods, offering flexibility for stakers.

Coinbase’s Ethereum staking service combines ease of use with security, making it a popular choice for those looking to earn rewards by staking their ETH. With its competitive APY and user-friendly platform, Coinbase is a go-to option for U.S. Ethereum stakers.

Also Read: How to Stake AVAX: A Simple Guide to Earning Rewards on the Avalanche Network

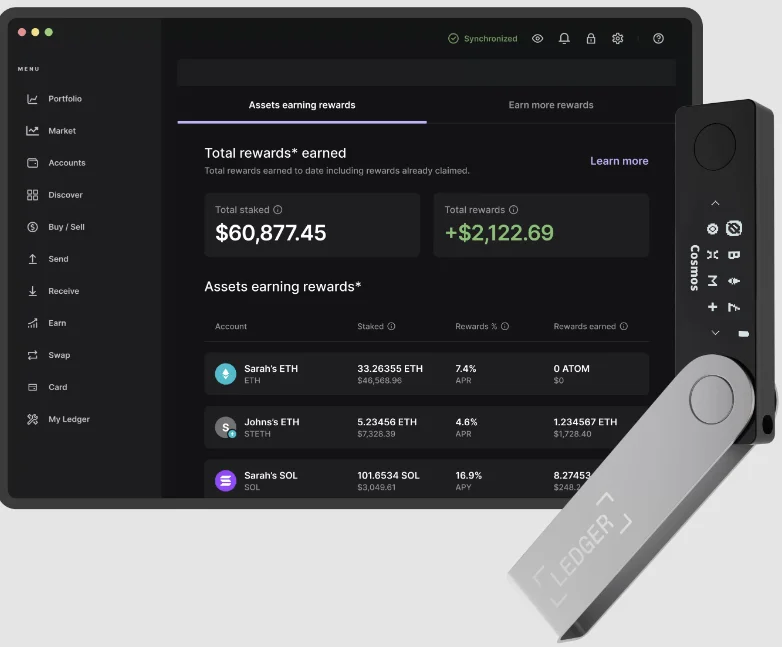

5. Ledger Wallet: Secure and Reliable Hardware Wallet for Staking Ethereum

Ledger Wallet has established itself as a secure and reliable hardware wallet for staking Ethereum. It offers a unique combination of hardware security and software convenience, making it an ideal choice for those looking to stake ETH safely. With Ledger Wallet, users can easily delegate their ETH to a validator and start earning rewards through the Ledger Live app.

Key Features and Benefits

- Enhanced Security: Ledger Wallet provides top-notch security for your staked ETH, ensuring your assets are safe from online threats.

- Easy Delegation: Stake your ETH effortlessly by delegating to a validator directly through the Ledger Live app.

- Flexible Staking Options: Choose between running your own validator with Kiln or liquid staking with Lido, catering to different staking preferences.

- All-in-One Solution: Manage, buy, swap, and stake your ETH through Ledger Live, offering a comprehensive crypto management experience.

- Passive Income: Earn rewards by staking ETH, contributing to the security of the Ethereum network while growing your assets.

Fees and Staking Rewards

- Average Return: Staking Ethereum with Kiln offers an average return of 7%, while Lido offers around 4%. These rates may vary.

- Reward Distribution: With Kiln, rewards are earned at each block proposed by the validator. Lido distributes staking rewards within 24 hours of deposit.

- Staking Fees: Lido applies a 10% fee on staking rewards, shared among node operators, the DAO, and an insurance fund.

- Minimum Staking Amount: Kiln currently requires a minimum of 32 ETH for staking, while Lido allows staking with any amount of ETH.

- ETH Lockup Period: Rewards earned through Kiln will be unlocked in a future Ethereum upgrade. Lido allows swapping stETH back for regular ETH, effectively unstaking your assets.

Ledger Wallet’s Ethereum staking service combines the security of a hardware wallet with the convenience of an integrated app, making it a top choice for secure and reliable Ethereum staking. Whether you’re a seasoned staker or new to the world of Ethereum staking, Ledger Wallet provides a user-friendly and secure way to stake your ETH and earn rewards.

Selecting the best place to stake ethereum

Choosing the right Ethereum staking platform is crucial for anyone looking to earn rewards by staking ETH. With the transition to Ethereum 2.0, staking has become a popular way to earn passive income while contributing to the network’s security.

However, with so many options available, it can be challenging to determine which platform best suits your needs. Here, we’ll explore key considerations, compare rewards and fees, and discuss the importance of security and user-friendliness in Ethereum staking.

Key Considerations When Choosing a Staking Platform

When selecting an Ethereum staking platform, consider factors like security, annual percentage yield (APY), lock-up period, payout frequency, and ease of use.

A platform’s reputation and regulatory compliance are also important, as they can impact the safety of your staked ETH. Additionally, consider whether the platform offers liquid staking options, which allow you to access your staked ETH without having to unstake it.

Platforms like Coinbase, Nexo, Lido, and Rocketpool are among the top choices, each offering unique features and benefits.

Comparing Staking Rewards and Fees Across Platforms

Staking rewards and fees vary across different platforms. For instance, Coinbase offers a 3.25% APY on staked Ethereum, while Nexo provides around 4% APY with customizable yields. Lido offers a 3.8% APY, and Rocketpool has a 3.27% APY.

It’s important to compare these rates, as well as any associated fees, to maximize your staking returns. Some platforms may also offer synthetic tokens in exchange for staked ETH, providing additional yield opportunities.

Also Read: How to Stake AVAX: A Simple Guide to Earning Rewards on the Avalanche Network

Security and User-Friendliness: Essential for Ethereum Staking

Security is a top priority when staking Ethereum, as it involves locking up your assets on the platform.

Look for platforms with robust security measures, such as cold storage for the majority of assets and insurance against losses. User-friendliness is equally important, especially for beginners.

A platform with an intuitive interface and easy-to-follow staking process can make the experience more accessible and enjoyable. Platforms like Coinbase are known for their user-friendly interfaces and regulatory compliance, making them a safe choice for staking ETH.

Staking Ethereum: A Guide for Beginners and Experts Alike

Staking Ethereum involves depositing ETH into a smart contract to help secure the network and earn rewards. Validators are chosen based on the amount of ETH they stake, and they earn rewards for validating transactions.

For those with less than 32 ETH, joining a staking pool or using a liquid staking solution like Lido can be a viable option. It’s important to understand the risks associated with staking, such as slashing and smart contract vulnerabilities, and to choose a reputable platform to minimize these risks.

In conclusion, selecting the perfect Ethereum staking platform requires careful consideration of various factors, including security, rewards, fees, and user-friendliness.

By understanding these aspects and comparing different platforms, you can make an informed decision that aligns with your staking goals and risk tolerance.

Essential Takeaways for Ethereum Staking

As we navigate the world of Ethereum staking, it’s important to keep in mind key aspects that ensure a successful and secure staking experience. Here’s a summary of the most important things to remember:

- Ethereum Staking Basics: Ethereum staking is the process of locking up ETH to validate transactions and secure the network. It’s a form of passive income and contributes to the decentralization of the Ethereum network.

- Staking Requirements: To become a validator on the Ethereum network, you need at least 32 ETH. However, you can join a staking pool or use centralized exchanges to stake with less than 32 ETH.

- Staking Methods: There are several ways to stake Ethereum, including solo staking, staking as a service, pooled staking, and staking via centralized exchanges. Each method has its own benefits and risks.

- Rewards and Risks: Staking rewards vary depending on the staking method and the total amount of ETH staked. Be aware of risks such as smart contract vulnerabilities, counterparty risks, and penalties for validator misbehavior.

- Withdrawals and Earnings: After the Shanghai update in April 2023, it became possible to withdraw staked Ethereum. The amount you can earn by staking depends on the staking method and the platform’s APR.

- Security Considerations: Ensure the security of your staked ETH by understanding the risks associated with each staking method. Research and choose reputable staking platforms or services.

Remember, Ethereum staking is more than just earning rewards; it’s about actively participating in securing and strengthening the Ethereum blockchain.

Whether you choose to stake solo, join a staking pool, or stake through a centralized exchange, make informed decisions and stay updated on the latest developments in Ethereum staking.

Frequently Asked Questions

What is the best rate for staking ETH?

The best staking rates vary, but platforms like Coinbase offer around 3.25% APY, while Nexo and Lido offer around 4% and 3.8% respectively.

Is it worth it to stake Ethereum?

Staking Ethereum can be worth it for earning passive rewards and contributing to network security, but consider the risks and the price of Ethereum.

What is the largest Ethereum staking pool?

Lido is one of the largest Ethereum staking pools, with a high market share and total value locked in liquid ETH staking.

Where to stake Ethereum 2023?

In 2023, popular platforms for staking Ethereum include Coinbase, Nexo, Lido, and Rocketpool, each offering unique features and APYs.

Can I lose my ETH if I stake it?

There is a risk of losing ETH due to slashing penalties or smart contract vulnerabilities, especially if staking rules are violated.

Is staking ETH risk-free?

Staking ETH is not risk-free; it involves potential risks like slashing, smart contract vulnerabilities, and market volatility.

Where is the safest place to stake ETH?

The safest places to stake ETH are reputable platforms like Coinbase, known for regulatory compliance and robust security measures.

What are the risks of staking ETH?

Risks include slashing penalties, smart contract vulnerabilities, centralization concerns, and potential regulatory changes.

What is the minimum ETH for staking?

What is the minimum ETH for staking?

The minimum ETH for solo staking is 32 ETH, but pooled staking and staking on exchanges often have much lower minimum requirements.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- ledger: STAKING YOUR ETH SECURELY TO EARN REWARDS

- Techopedia: The 4 Best Ethereum Staking Platforms with the Highest APY for 2024

- Changelly: Ethereum Staking