What is IEO?

An Initial Exchange Offering (IEO) is a fundraising method used by new cryptocurrency projects. Unlike Initial Coin Offerings (ICOs), an IEO is conducted on a cryptocurrency exchange platform.

This exchange facilitates the token sale, ensuring that investors can purchase the project’s tokens directly through their exchange accounts.

The exchange also handles the regulatory and security aspects, providing a layer of trust and credibility to the process.

IEOs are becoming popular due to their structured approach, offering better investor protection through KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

How IEOs Work and Their Benefits

IEOs are structured to leverage the credibility and user base of established cryptocurrency exchanges. Here’s a step-by-step overview of how they work:

- Project Submission and Review: The project team submits their proposal to the exchange. The exchange conducts thorough due diligence, reviewing the project’s whitepaper, team credentials, and business model.

- KYC and AML Compliance: Investors participating in the IEO must complete KYC and AML verification processes to ensure legality and reduce the risk of fraud.

- Token Sale on Exchange: Once approved, the exchange lists the project’s tokens for sale. Investors can purchase these tokens directly from their exchange wallets.

- Post-IEO Trading: After the token sale, the tokens are listed on the exchange for trading, providing liquidity to investors.

This structured approach enhances investor confidence and reduces risks compared to ICOs, which often faced regulatory scrutiny and fraud issues.

Also read:

What is Moving Average Convergence Divergence (MACD)?

What Is Relative Vigor Index (RVI)– Understanding the Momentum Oscillator

Advantages and Disadvantages of IEOs

Advantages of IEOs

1. Increased Trust and Credibility

IEOs are conducted on established exchanges, which perform rigorous checks on the projects. This adds a layer of trust and credibility, attracting more investors who might be wary of direct investments through ICOs.

2. Improved Investor Protection

With mandatory KYC and AML procedures, IEOs ensure that only legitimate investors participate. This reduces the risk of scams and fraud, making the investment environment safer for participants.

Disadvantages of IEOs

1. High Costs

Listing fees on reputable exchanges can be substantial. Startups may also need to provide a commission from the token sales to the exchange. These costs can be a barrier for some projects.

2. Risk of Market Manipulation

Despite the structured approach, IEOs are not immune to market manipulation tactics like pump-and-dump schemes. Investors must conduct thorough research to avoid falling victim to such scams.

Comparing IEOs with Other Fundraising Methods

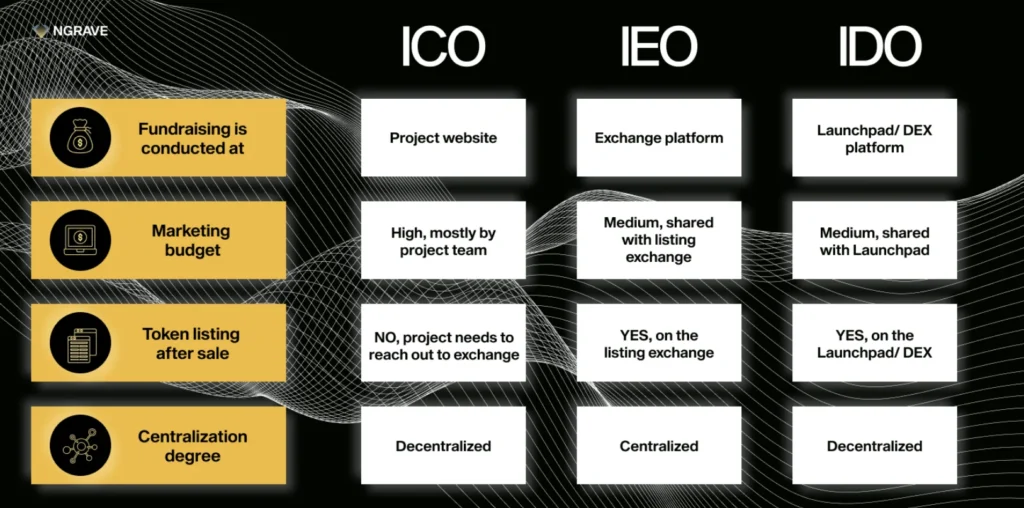

ICOs vs. IEOs

ICOs were the initial method for crypto fundraising but often lacked regulation, leading to numerous scams. IEOs, conducted through exchanges, offer a safer and more regulated environment, thus providing better investor protection and credibility.

STOs and IDOs

Security Token Offerings (STOs) involve selling regulated financial securities, providing more legal compliance and investor protection compared to ICOs and IEOs. Initial DEX Offerings (IDOs) are similar to IEOs but are conducted on decentralized exchanges, offering more decentralization but less regulatory oversight.

In conclusion, while IEOs present a promising fundraising method by leveraging the infrastructure of established exchanges, they also come with their own set of challenges. Understanding these nuances is crucial for both project teams and investors looking to navigate the complex world of cryptocurrency fundraising