What is a God Candle?

In cryptocurrency trading, a “God Candle” refers to an unusually large and rapid increase in the price of a cryptocurrency, represented by a single massive green candlestick on a trading chart.

This candlestick is significantly larger than those around it, indicating a dramatic surge in price over a short period.

Traders often use the term to describe a bullish movement that can signal a potential trend change or a significant market rally.

The Impact and Implications of a God Candle

A God Candle typically signifies a period of intense buying pressure, leading to a substantial increase in the asset’s price.

Various factors, including positive market news, significant developments within the cryptocurrency space, or large-scale purchases by institutional investors, can drive this phenomenon.

The appearance of a God Candle is often seen as a bullish indicator, suggesting that the asset may continue to rise in value.

Also read:

What is Moving Average Convergence Divergence (MACD)?

What Is Relative Vigor Index (RVI)– Understanding the Momentum Oscillator

How a God Candle Forms

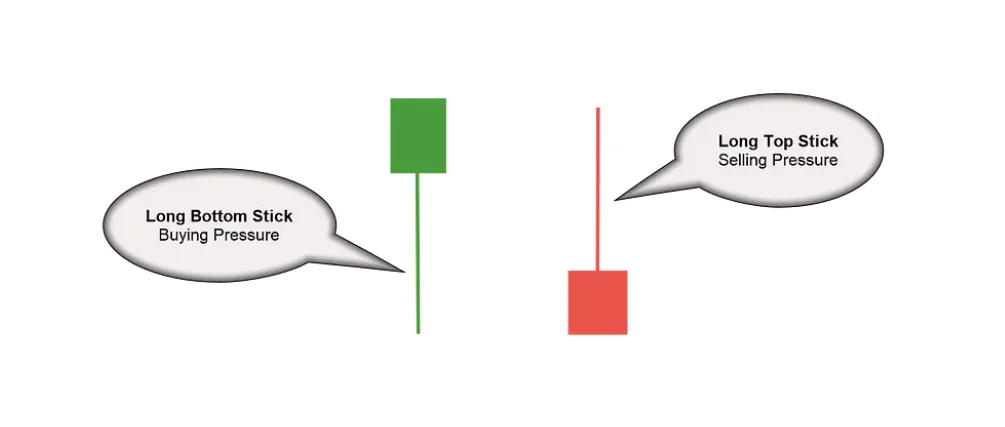

Market Momentum and Buying Pressure

A God Candle forms when there is a sudden influx of buying activity. This can be triggered by news such as the approval of a Bitcoin ETF, major investments from institutions, or significant technological advancements in cryptocurrency.

The increased demand drives the price up rapidly, creating a large green candlestick on the trading chart.

Change in Market Trends

The formation of a God Candle can also indicate a shift in market sentiment. For example, if a cryptocurrency has been in a bearish trend and a God Candle appears, it might suggest the beginning of a bullish reversal.

Traders and analysts often watch for these patterns to make informed investment decisions, as they can herald significant price movements.

Examples and Effects of God Candles

Bitcoin’s Notable Surges

Bitcoin has experienced several God Candles throughout its trading history. One notable instance occurred in February 2021, when Bitcoin’s price surged by over $20,000 in a single month.

This massive increase was fueled by growing interest from institutional investors and the approval of new financial products related to Bitcoin.

Ethereum and Other Cryptocurrencies

Ethereum and other cryptocurrencies have also seen God Candles. For instance, Ethereum’s price saw significant increases following major upgrades to its network and widespread adoption of decentralized finance (DeFi) applications.

These events drive up demand and can result in the formation of God Candles.

The Effects of God Candles on Trading

Boosting Investor Confidence

The appearance of a God Candle often boosts investor confidence, as it signals strong market interest and potential for further price increases. This can lead to a positive feedback loop where more investors buy into the asset, driving the price even higher.

Market Volatility

While God Candles can indicate bullish trends, they also contribute to market volatility. The rapid price increase can attract speculative trading, leading to sharp corrections and price fluctuations. Traders need to be cautious and consider the broader market context when interpreting God Candles.

In summary, a God Candle in cryptocurrency trading represents a significant and rapid price surge, often driven by strong market demand and positive developments. These patterns are important indicators for traders and can signal potential trend changes or continued bullish momentum.