What is a Bull Run in Crypto?

A bull run in crypto refers to a prolonged period during which the prices of cryptocurrencies increase significantly. Widespread optimism, increased trading volumes, and heightened investor confidence characterize this phase.

During a bull run, the demand for cryptocurrencies exceeds supply, leading to a continuous upward trend in prices.

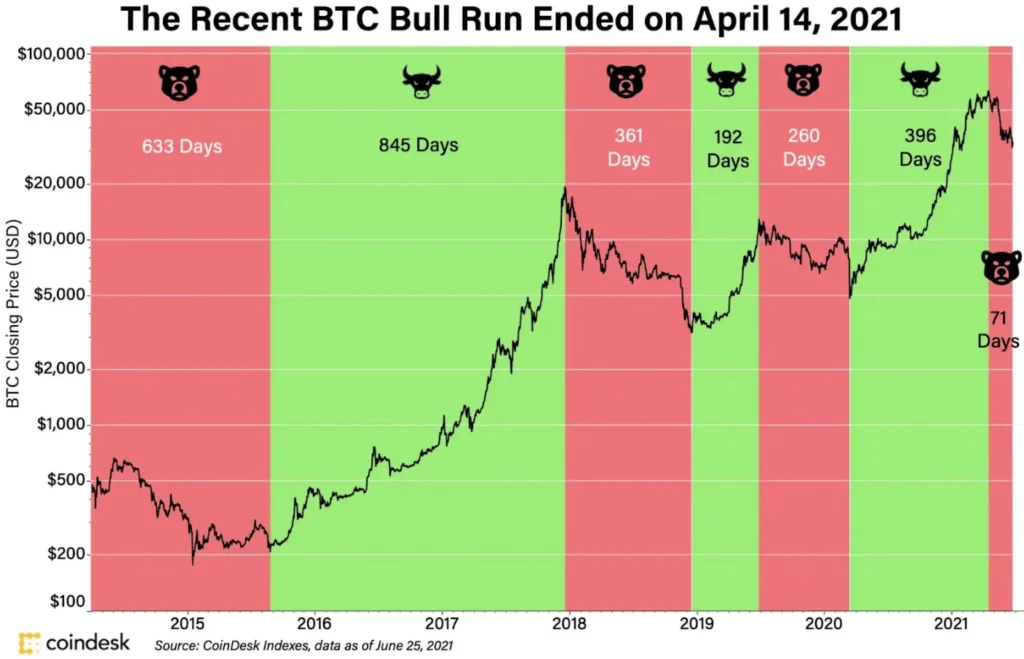

Investors, driven by the fear of missing out (FOMO), contribute to the rising market by buying more assets and anticipating further price increases. Notable examples include the 2017 and 2021 bull runs, where Bitcoin and other cryptocurrencies reached new all-time highs.

Key Characteristics and Causes of a Bull Run

Key Characteristics of a Bull Run

- Price Surge: The most obvious feature of a bull run is the sharp increase in cryptocurrency prices. For example, during the 2017 bull run, Bitcoin’s price skyrocketed from around $1,000 in January to nearly $20,000 in December.

- Increased Trading Volume: Bull runs are marked by a surge in trading activity as more investors enter the market, leading to higher volumes of buy and sell orders.

- Positive Market Sentiment: There is general optimism among investors about the prospects of cryptocurrencies, which fuels further buying.

- Media Attention: As prices soar, cryptocurrencies gain mainstream recognition, attracting significant media coverage and drawing more investors into the market.

- Volatility: While prices generally rise during a bull run, the market also experiences considerable volatility, with sharp price fluctuations being common.

Also Read:

What is a God Candle? Understanding This Crypto Phenomenon

Causes of Bull Runs

- Market Sentiment: Positive news, such as favorable regulatory developments or institutional adoption, can boost investor confidence and spark a bull run.

- FOMO: Fear of Missing Out drives investors to buy cryptocurrencies as they anticipate further price increases, adding to the upward momentum.

- Speculation and Trading Activity: Increased trading activity and speculation can amplify price movements, pushing prices higher.

- Market Manipulation: In some cases, large investors or groups may manipulate the market by inflating prices to attract more buyers.

- Technological Advancements: Innovations and technological improvements in the blockchain and cryptocurrency space can also trigger bull runs.

Differences Between Bull and Bear Markets

Bull Market

Rising prices and high investor confidence characterize a bull market. Investors are optimistic about the market’s future, leading to increased buying activity. This phase can last for months or even years, driven by sustained economic growth, low interest rates, and strong corporate earnings.

In the context of cryptocurrencies, a bull market can be triggered by positive developments such as Bitcoin halving events, regulatory approvals, or major technological breakthroughs.

Bear Market

Conversely, a bear market is marked by falling prices and low investor confidence. Investors are pessimistic, leading to increased selling activity as they seek to minimize losses. Economic downturns, high interest rates, or negative regulatory news can trigger bear markets.

For example, the cryptocurrency market experienced a bear phase following the 2017 bull run, with Bitcoin’s price dropping from nearly $20,000 to around $3,000 over the next year.

Also read:

What Is Relative Vigor Index (RVI)– Understanding the Momentum Oscillator

What is Moving Average Convergence Divergence (MACD)?

Strategies for Navigating a Bull Run

Buy and Hold

The buy-and-hold strategy involves purchasing cryptocurrencies and holding them for the long term, anticipating that prices will continue to rise over time. This strategy requires patience and a belief in the long-term potential of the market.

Buy the Dips

This strategy involves buying cryptocurrencies during temporary price pullbacks within a bull market. By identifying support levels or using technical analysis, investors can purchase assets at lower prices, aiming to benefit from the subsequent rebound.

Dollar-cost averaging (DCA)

DCA involves investing a fixed amount of money at regular intervals, regardless of market conditions. This approach mitigates the impact of short-term volatility and allows investors to accumulate assets over time.

Swing Trading

Swing trading involves taking advantage of short-term price movements within a bull market. Traders use technical analysis to identify entry and exit points, aiming to profit from short-term trends.

Risk Management

Proper risk management is crucial during a bull run. This includes setting stop-loss orders, managing position sizes, and avoiding over-leveraging. Staying informed about market news and trends and adhering to a trading plan can help mitigate risks.

In conclusion, a bull run in the crypto market is a period of sustained price increases fueled by positive market sentiment, increased investor confidence, and heightened trading activity.

Understanding the characteristics and causes of bull runs, as well as implementing effective strategies, can help investors navigate these exciting but volatile periods.