In the fast-paced world of cryptocurrency, a recent event has left traders buzzing with excitement and confusion.

The $700 million airdrop by Solana-based decentralized exchange aggregator, Jupiter airdrop, turned into a rollercoaster ride, not just for those directly involved but also for unsuspecting participants in a mix-up that reads like a plot twist in a tech thriller.

The Mix-Up of the Century

Imagine two tokens, both named JUP, but one is like a ghost from the past, and the other is the star of the show.

The ghost, an Ethereum-based token from a defunct protocol designed for decentralized applications (DApps), suddenly found itself in the spotlight.

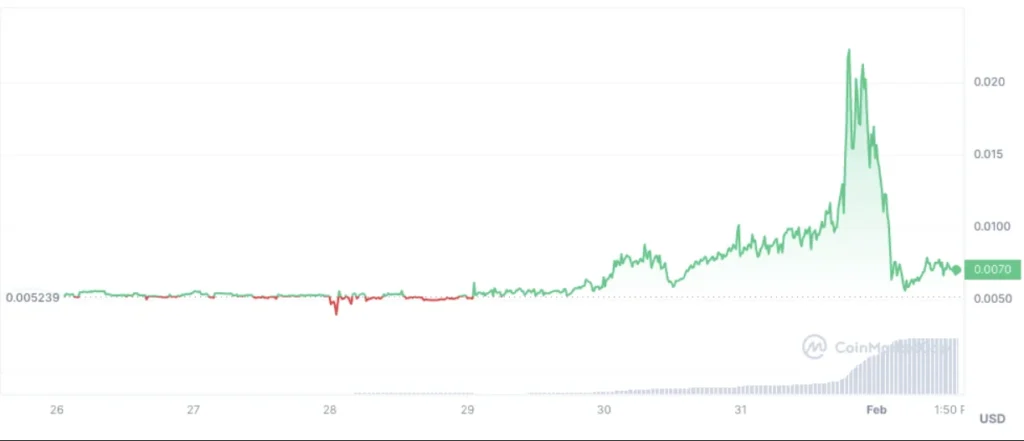

Its price skyrocketed over 430% from $0.005 to $0.026 in a matter of hours, only to crash back down to $0.007. This happened right before the much-anticipated airdrop of its namesake, the Solana-based Jupiter, was about to take place.

“A seven-year-old defunct Ethereum-based protocol may have briefly benefitted from the $700 million airdrop for Solana-based exchange aggregator Jupiter due to its similar price ticker.”

This incident highlights the importance of doing your homework in the crypto world. The mix-up caused by the identical ticker symbols led to a frenzy of speculative trading, with some traders betting on the wrong horse.

Related: Solana’s Roller Coaster Ride: Can SOL Soar to $90 Amid Market Turbulence?

The Real Deal: Jupiter’s Airdrop

State Of Jupiter: Jupuary 2024

1. Most used trading platform in defi

2. Direct 80% of organic volume

3. Most used program in Solana

4. Top 2 by vol on Coingecko

5. Most integrated platform on Solana

6. One of the top perp platforms ($1.4B volume last week)Deets:… pic.twitter.com/UEnwgyc2eu

— Jupiter 🪐 (@JupiterExchange) January 30, 2024

On the other side of the confusion was the real Jupiter, a platform that allows users to swap, place limit orders, and deploy dollar-cost averaging strategies for tokens on the Solana network.

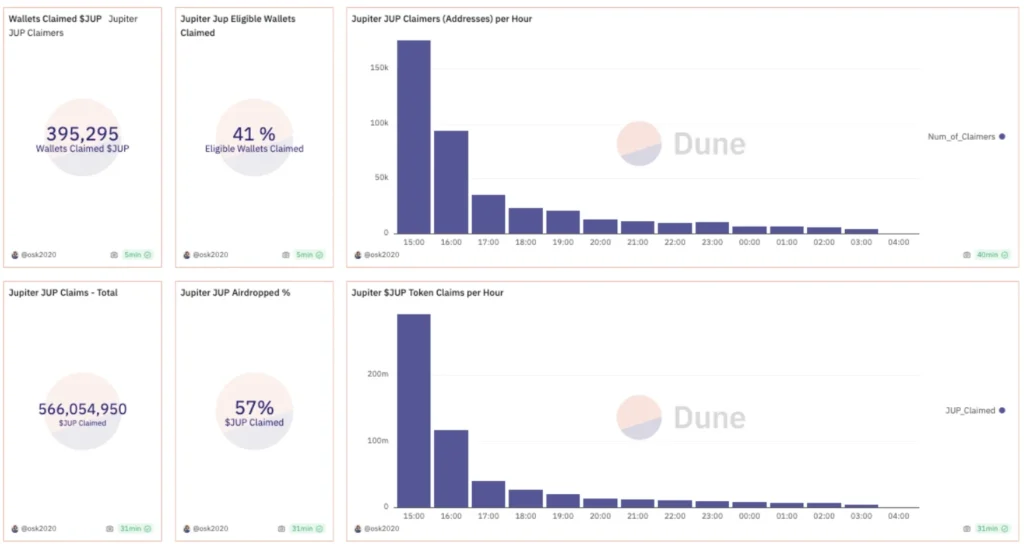

Its airdrop, one of the largest ever on Solana, went off without a hitch, according to a Solana Foundation executive. Despite some initial complaints from users of third-party apps, the network handled the event admirably, processing millions of transactions in just a few hours.

The airdrop was not just a technical success; it was also a financial windfall for some. A 17-year-old trader claimed to have made over $1 million from the event.

By the time the dust settled, 41% of all eligible wallets had claimed their JUP tokens, totaling 566 million JUP or 57% of the total airdrop allocation.

Key Takeaways from the Jupiter Airdrop Event:

- Market Sensitivity: The crypto market’s reaction to the airdrop and the mix-up underscores its volatility and the need for careful research.

- Naming Confusion: The identical ticker symbols of the two JUP tokens highlight the potential for confusion in the crypto space.

- Network Performance: Solana’s ability to handle the airdrop efficiently showcases the network’s capacity for managing large-scale events.

Lessons Learned

This event serves as a cautionary tale for traders and investors in the cryptocurrency market. The mix-up between the two JUP tokens is a stark reminder of the importance of diligence and the potential for confusion in a market flooded with thousands of tokens.

As the dust settles on this event, the crypto community is left with valuable lessons about the importance of research, the volatility of the market, and the capabilities of blockchain technology to handle significant events like the Jupiter airdrop.