What Time Does the Crypto Market Reset?

The cryptocurrency market operates 24/7, meaning it never truly “closes” like traditional stock markets. However, for practical purposes, many platforms and traders recognize 00:00 UTC (Coordinated Universal Time) as the daily reset time.

This reset point is significant because it marks the start of a new trading day, synchronizing with the opening of Asian markets and the end of the previous trading day in the US. This time is often used for daily snapshots and can influence market trends and volatility.

Why 00:00 UTC is Important

Continuous Trading Environment

Unlike traditional stock exchanges that have set trading hours and close daily, cryptocurrency markets operate continuously, allowing trading at any time of day.

This continuous operation is facilitated by the decentralized nature of blockchain technology, which underpins all cryptocurrencies.

However, to provide a structure similar to traditional markets, many traders and exchanges use 00:00 UTC as a reference point for the start and end of a trading day.

Also read:

What is a God Candle? Understanding This Crypto Phenomenon

What Is a Transaction Hash? Understanding Its Role in Cryptocurrency Transactions

Impact on Market Activity

The 00:00 UTC reset time is pivotal because it aligns with the opening of major Asian markets, such as those in Japan, South Korea, and China. This period often sees increased trading volumes and volatility, setting the tone for the rest of the global trading day.

Additionally, this reset point allows for daily performance metrics to be calculated, offering traders a clear view of market trends and movements from the previous 24 hours.

Best Times to Trade Crypto

Peak Trading Hours

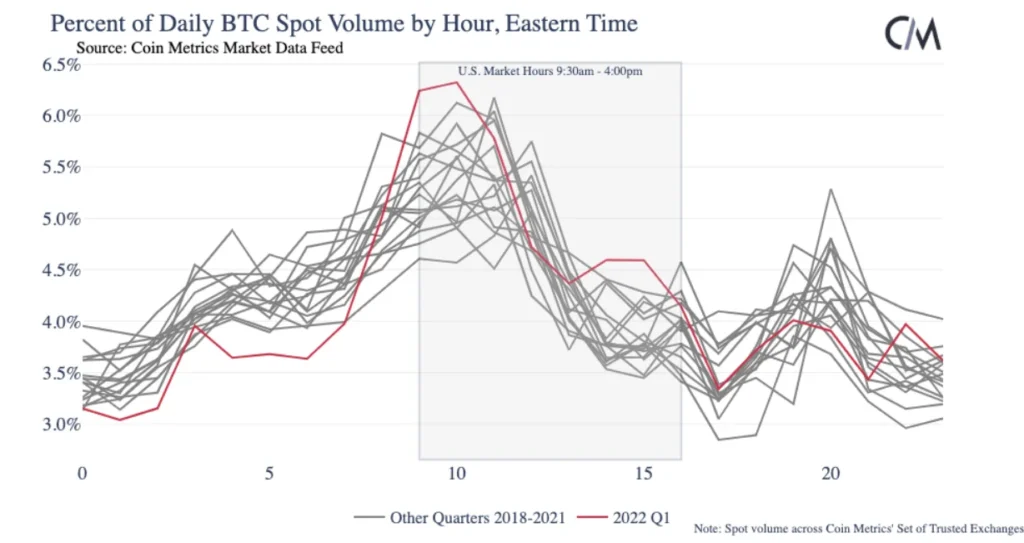

While the crypto market is open 24/7, certain times of day experience higher trading volumes and activity. Typically, the most active trading periods are:

- 10 AM to 11 AM EST (3 PM to 4 PM UTC): This time coincides with the opening hours of the US stock market and is a peak period for trading on major exchanges like Coinbase and Binance.

- 3 PM to 4 PM UTC: This is another high-activity period, often driven by institutional investors and high trading volumes in Europe and the US.

Weekend Trading

Despite being open continuously, the crypto market can see different trading dynamics on weekends. Weekend trading often involves lower volumes, which can lead to higher volatility.

Significant price movements during weekends can be driven by fewer trades, making it easier for large orders to impact the market. This period is also popular among retail traders who may have more time to engage in trading activities outside regular work hours.

Reset Times and Market Trends

Market Volatility and Reset Points

The 00:00 UTC reset time can act as an inflection point for market volatility. Historical data shows that this time often sees significant price movements, as it marks the transition between trading sessions in different regions.

Traders often observe patterns such as “gap-ups” or “gap-downs” at this time, which can indicate new trends for the following day.

Influence of Global Events

Global news and events also play a crucial role in cryptocurrency market activity. Announcements such as regulatory changes, major technological updates, or significant partnerships can cause spikes in trading volumes and volatility around the reset time. Traders need to stay informed about such events to make well-timed trading decisions.

In conclusion, while the cryptocurrency market operates around the clock, the 00:00 UTC reset time serves as an unofficial marker for the start and end of a trading day.

This time is crucial for traders to monitor, as it often brings increased activity and sets the tone for market trends. Understanding these dynamics can help traders optimize their strategies and better navigate the continuously operating crypto market.