NFTs and SFTs are digital assets that have transformed the crypto world, offering unique and diverse functionalities. NFTs (Non-Fungible Tokens) stand out in the NFT market due to their uniqueness and indivisibility, making them perfect for digital art, in-game assets, and virtual real estate.

Each NFT contains data that proves ownership and authenticity, often facilitated by smart contracts on the Ethereum network. Conversely, SFTs (Semi-Fungible Tokens) provide a balance between fungibility and non-fungibility, allowing for seamless transactions and diverse use cases in the gaming industry.

This article explores “What is the difference between NFT vs SFT”, highlighting their unique features and real-world applications, providing a comprehensive understanding of NFTs and SFTs in the digital asset landscape.

Introduction to NFT vs SFT

NFTs and SFTs are types of tokens in the crypto space, each offering unique features and uses. Understanding their differences is crucial for anyone interested in digital assets.

Definition of NFTs (Non-Fungible Tokens)

NFTs (Non-Fungible Tokens) are unique digital assets that cannot be exchanged on a one-to-one basis like fungible tokens. Each NFT has its own distinct data, proving ownership and authenticity.

They are indivisible and often used in digital collectibles, digital art, and in-game assets.

The key feature of NFTs is their uniqueness and authenticity of digital items, often managed on the Ethereum network using a single smart contract.

Definition of SFTs (Semi-Fungible Tokens)

SFTs (Semi-Fungible Tokens) offer a mix of fungibility and non-fungibility. They can be exchanged like fungible tokens up to a point, then become non-fungible.

SFTs provide flexibility, allowing for transactions of the same type of tokens and then transforming into unique digital assets.

This is particularly useful in the gaming industry and other applications where initial fungibility is needed, followed by unique ownership.

SFTs are often managed using the ERC-1155 token standard, which allows for sending multiple tokens in one transaction.

Overview of Blockchain Technology and Token Standards

Blockchain technology underpins both NFTs and SFTs, providing a decentralized ledger for tracking ownership and transactions. NFTs and SFTs are part of this evolving technology, leveraging various token standards to facilitate their unique functions.

The ERC-721 token standard is commonly used for NFTs, ensuring each token is unique and cannot be exchanged one-to-one. Conversely, the ERC-1155 token standard supports SFTs, allowing for flexible transactions and the transformation of tokens from fungible to non-fungible.

This versatility supports diverse applications across the crypto industry, from digital art and collectibles to gaming and beyond.

Detailed Explanation of NFTs

NFTs are a unique type of digital asset in the world of cryptocurrencies. They are distinct from fungible tokens in several ways, offering specific features that make them valuable for certain applications.

Characteristics and Features of NFTs

NFTs (Non-Fungible Tokens) are unique and cannot be exchanged one-to-one like fungible tokens. Each NFT stands out due to its indivisibility and distinct ownership history.

This uniqueness makes NFTs ideal for digital art, collectibles, and other digital assets where authenticity is crucial. NFTs operate on the Ethereum network, typically using the ERC-721 token standard.

This allows for sending one NFT per transaction, ensuring each token’s authenticity and ownership are verifiable. Unlike SFTs, NFTs are non-fungible and cannot be exchanged for another NFT of the same type.

Related: What is an NFT Airdrop? Your Easy Guide to Free Digital Treasures

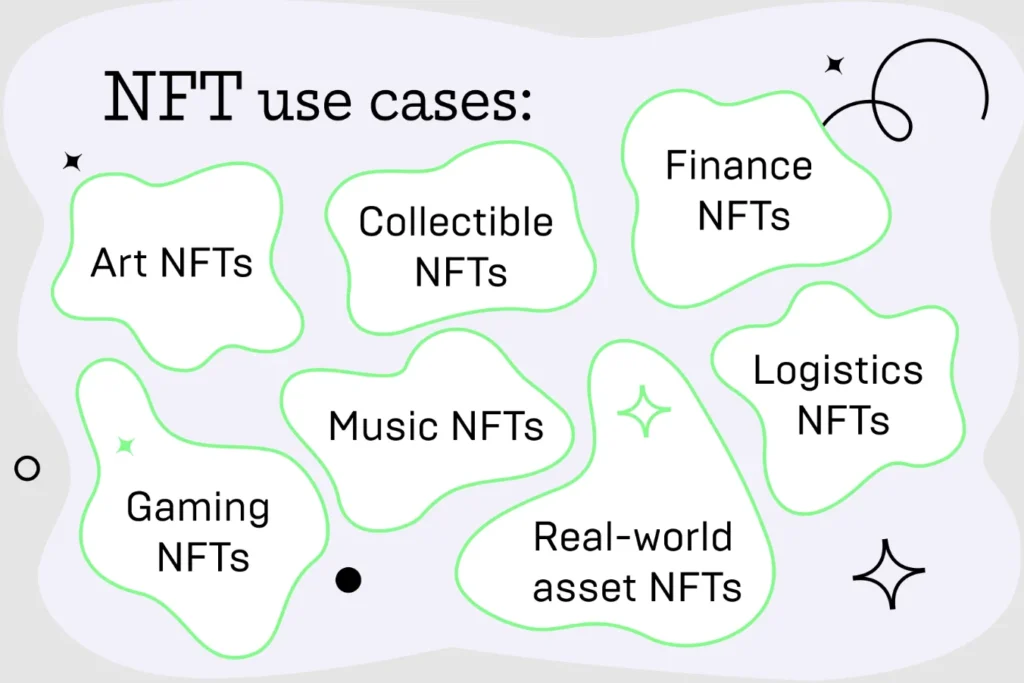

Common Use Cases for NFTs

- Digital Art: NFTs allow artists to sell unique digital artworks, ensuring authenticity and ownership history are verifiable on the blockchain.

- Collectibles: NFTs are used for digital collectibles, giving each item a unique identity that cannot be replicated or exchanged one-to-one.

- In-Game Assets: NFTs enable players to own and trade unique in-game items, providing real ownership and value to digital assets within games.

- Virtual Real Estate: NFTs represent ownership of virtual land and properties in online worlds, allowing users to buy, sell, and develop these assets.

- Domain Names: NFTs can be used to register and trade domain names, ensuring unique ownership and easier transferability.

- Music and Media Rights: NFTs allow creators to sell music and media rights directly to consumers, providing proof of ownership and authenticity, and creating new revenue streams.

NFTs provide creators with a way to prove ownership and authenticity of digital items, making them an essential part of the digital asset landscape.

Detailed Explanation of SFTs

SFTs, or Semi-Fungible Tokens, blend the characteristics of fungible and non-fungible tokens. They offer flexibility and diverse use cases in the digital asset world.

Characteristics and Features of SFTs

SFTs (Semi-Fungible Tokens) are unique in that they start as fungible tokens but can become non-fungible. This dual nature allows SFTs to be used flexibly within various applications.

SFTs are often used with the ERC-1155 token standard, enabling multiple token types to be sent in a single transaction. Unlike NFTs, which are unique and cannot be exchanged one-to-one, SFTs provide more versatility.

For instance, an SFT can represent a batch of identical items that, once used or transferred, become unique digital assets with distinct ownership histories. SFTs offer the ability to burn or convert tokens, adding another layer of functionality.

Common Use Cases for SFTs

- Gaming Industry: SFTs are used in crypto games for items that start as identical but gain uniqueness as players use them.

- Ticketing: SFTs can represent tickets that are identical initially but become unique once used.

- Loyalty Programs: SFTs can start as identical points or rewards, becoming unique upon redemption.

- Digital Assets: SFTs provide a way to manage batches of assets that transition from fungible to non-fungible.

SFTs offer flexibility and a range of applications in the digital world, making them a valuable addition to the ecosystem of fungible and non-fungible tokens.

Key Differences Between NFTs and SFTs

Understanding the key differences between NFTs and SFTs is crucial for navigating the world of digital assets. Here, we break down their main distinctions in terms of fungibility, technical specifications, and use cases.

Fungibility

Fungibility is a core difference between NFTs and SFTs. NFTs are unique and cannot be exchanged on a one-to-one basis with another NFT. Each NFT has a distinct value and identity, making them ideal for unique digital assets such as digital art and collectibles.

On the other hand, SFTs start as fungible tokens, meaning they can be exchanged like-for-like.

However, they can become non-fungible, allowing flexibility in their use, particularly in applications where initial uniformity is required but individual uniqueness becomes important over time.

Technical Distinctions ( ERC-721 vs. ERC-1155)

The technical standards governing NFTs and SFTs highlight their differences. NFTs typically use the ERC-721 token standard on the Ethereum network.

This standard ensures that each token is unique and cannot be exchanged on a one-to-one basis. ERC-721 tokens are often used for digital collectibles, in-game assets, and virtual real estate, where authenticity and ownership history are critical.

In contrast, SFTs use the ERC-1155 token standard, which allows for both fungible and non-fungible tokens within a single smart contract.

This standard provides more flexibility, enabling the transfer of multiple tokens in one transaction. ERC-1155 tokens are used in scenarios where items start as identical but later need to become unique, such as in gaming and loyalty programs.

Use Case Variations

| Feature | NFTs | SFTs |

|---|---|---|

| Fungibility | Non-Fungible | Starts as Fungible, can become Non-Fungible |

| Token Standard | ERC-721 | ERC-1155 |

| Common Use Cases | Digital Art, Collectibles, In-Game Assets, Virtual Real Estate, Domain Names, Music and Media Rights | Gaming Items, Tickets, Loyalty Points, Digital Assets |

| Transaction Method | One NFT per transaction | Multiple tokens in one transaction |

| Flexibility | Unique and indivisible | Can be fungible initially, then become unique |

| Platform | Ethereum Network | Ethereum Network |

| Advantages | Uniqueness, Authenticity, Ownership Verification | Flexibility, Batch Transfers, Versatility |

These distinctions make NFTs and SFTs suitable for different applications, catering to various needs in the digital asset ecosystem.

NFTs are unique digital items ideal for verifying ownership and authenticity, whereas SFTs offer flexibility for items that transition from fungible to non-fungible.

Applications and Benefits of NFTs

NFTs (Non-Fungible Tokens) are transforming various industries by providing unique digital assets with verifiable ownership. Let’s explore their practical applications, advantages, and potential for growth in the digital economy.

Practical Applications in Various Industries

NFTs are used in several industries due to their ability to authenticate and verify ownership of digital assets. Some practical applications include:

- Digital Art: Artists can sell unique digital artworks, ensuring authenticity and ownership history.

- Collectibles: NFTs create a new market for digital collectibles, offering unique items that cannot be replicated.

- In-Game Assets: Gamers can own and trade unique in-game items, enhancing the gaming experience.

- Virtual Real Estate: Users can buy, sell, and develop virtual properties in online worlds.

- Domain Names: NFTs can represent ownership of domain names, simplifying the transfer process.

- Music and Media Rights: Creators can sell music and media rights directly to consumers, ensuring authenticity and ownership.

Advantages of Using NFTs

NFTs offer several advantages, making them valuable in the digital world. These benefits include:

- Authenticity and Ownership: NFTs provide verifiable proof of ownership and authenticity, protecting creators and buyers.

- Uniqueness: Each NFT is unique and cannot be exchanged on a one-to-one basis with another NFT, ensuring exclusivity.

- Transparency: Transactions are recorded on the blockchain, offering transparency and security.

- Liquidity: NFTs can be traded on various platforms, increasing liquidity for digital assets.

- Flexibility: NFTs can represent various types of assets, from art and collectibles to real estate and domain names.

Related: The Big Reveal: Netflix Dives Deep into the NFT Craze with “NFT:WTF?”

Potential for Growth in the Digital Economy

NFTs have significant potential for growth in the digital economy. As more industries adopt NFTs, their impact will likely expand, driven by several factors:

- Innovation: Continued innovation in blockchain technology will enhance NFT functionality and applications.

- Adoption: Increasing adoption by artists, gamers, and other creators will drive demand for NFTs.

- Integration: Integration with other technologies, such as virtual reality and augmented reality, will create new use cases for NFTs.

- Market Expansion: As the NFT market grows, more platforms and exchanges will support NFT transactions, boosting their liquidity and accessibility.

- Community Engagement: NFTs foster community engagement by allowing creators to connect directly with their audience, enhancing loyalty and support.

NFTs and SFTs share the potential to revolutionize how we view and interact with digital assets. By understanding their key differences and use cases, users can leverage these technologies to unlock new opportunities in the digital landscape.

Applications and Benefits of SFTs

SFTs (Semi-Fungible Tokens) blend the characteristics of fungible and non-fungible tokens, offering flexibility and utility in various applications.

Let’s explore the practical applications, advantages, and growth potential of SFTs in the digital economy.

Practical Applications in Various Industries

SFTs have diverse applications across multiple industries, thanks to their hybrid nature. Here are some key areas where SFTs are used:

- Gaming Industry: SFTs are commonly used for in-game assets that start as identical items and become unique as they are used or leveled up.

- Ticketing: SFTs can represent tickets that are identical upon issuance but become unique after being scanned or redeemed.

- Loyalty Programs: SFTs manage loyalty points or rewards that begin as fungible and later become unique upon redemption.

- Digital Collectibles: Similar to NFTs, SFTs can be used for digital collectibles where initial batches are fungible but individual items gain uniqueness over time.

Advantages of Using SFTs

SFTs offer several advantages, making them useful in various contexts. These benefits include:

- Flexibility: SFTs can transition from fungible to non-fungible, providing versatility in their applications.

- Efficiency: The ERC-1155 standard allows multiple tokens to be sent in a single transaction, reducing transaction costs and increasing efficiency.

- Utility: SFTs can handle both fungible and non-fungible assets, catering to a wide range of needs within a single framework.

- Interoperability: SFTs can be used across different platforms and applications, enhancing their usability.

Potential for Growth in the Digital Economy

SFTs hold significant growth potential in the digital economy. Their hybrid nature and versatile applications position them for expanding influence:

- Innovation: Ongoing innovations in blockchain technology will continue to enhance SFT functionalities and applications.

- Adoption: Growing adoption in gaming, ticketing, and loyalty programs will drive demand for SFTs.

- Integration: SFTs’ ability to integrate with various technologies and platforms will open up new use cases.

- Market Expansion: As the market for digital assets grows, more platforms and exchanges will support SFT transactions, increasing liquidity and accessibility.

- Community Engagement: SFTs can foster closer connections between creators and users, enhancing engagement and loyalty.

SFTs and NFTs coexist within the crypto industry, each offering unique benefits and use cases. Understanding their key differences and applications helps in leveraging these technologies to unlock new opportunities in the digital asset landscape.

Challenges and Considerations

As with any emerging technology, NFTs and SFTs face several challenges and considerations that must be addressed for broader adoption and long-term success. Here we explore the current hurdles and important factors for adoption.

Current Challenges Faced by NFTs

NFTs (Non-Fungible Tokens) have gained immense popularity, but they also encounter several challenges:

- High Transaction Fees: The cost of minting and transferring NFTs on the Ethereum network can be prohibitively expensive, limiting accessibility for many users.

- Environmental Concerns: The energy consumption associated with blockchain transactions, particularly on Ethereum, raises significant environmental concerns.

- Market Volatility: The value of NFTs can be highly volatile, influenced by trends and speculation, which can deter long-term investment.

- Intellectual Property Issues: Ensuring the authenticity of digital art and other assets and preventing unauthorized copying or selling is a major challenge.

Current Challenges Faced by SFTs

SFTs (Semi-Fungible Tokens) also face distinct challenges as they gain traction in the digital asset space:

- Complexity in Use: The hybrid nature of SFTs, transitioning from fungible to non-fungible, can complicate their use and understanding among users and developers.

- Adoption Barriers: While SFTs offer versatility, their adoption is slower due to the need for more widespread understanding and integration into existing systems.

- Regulatory Uncertainty: Like all digital assets, SFTs are subject to evolving regulatory landscapes, which can create uncertainty and hinder their adoption.

Considerations for Adoption

For NFTs and SFTs to achieve widespread adoption, several key considerations must be addressed:

- User Education: Educating users about the benefits, uses, and risks of NFTs and SFTs is crucial for fostering trust and adoption.

- Scalability Solutions: Developing more efficient and scalable blockchain technologies can help reduce transaction costs and environmental impact.

- Enhanced Security Measures: Implementing robust security measures to protect against fraud, hacking, and intellectual property theft is essential.

- Interoperability Standards: Ensuring NFTs and SFTs can operate across different platforms and ecosystems will enhance their utility and adoption.

- Regulatory Clarity: Clear and supportive regulatory frameworks will provide the necessary stability and confidence for users and investors.

Addressing these challenges and considerations is vital for NFTs and SFTs to realize their full potential in the digital economy. Understanding the differences between these tokens, their key use cases, and the hurdles they face can help stakeholders navigate the evolving landscape of digital assets.

The Future of Tokenization

The future of tokenization looks promising, with NFTs and SFTs poised to play significant roles in the evolving digital asset landscape. Let’s explore the predictions and expectations for these token types and their broader impact on digital assets and blockchain technology.

Predictions and Expectations for NFTs

NFTs are expected to continue their growth and influence in various sectors. Key predictions include:

- Increased Adoption in Art and Entertainment: NFTs will likely see greater adoption in the art, music, and entertainment industries, providing new revenue streams for creators and ensuring authenticity of digital works.

- Expansion into Real-World Assets: NFTs may expand beyond digital assets to represent ownership of physical items, such as real estate, collectibles, and luxury goods.

- Integration with Virtual Worlds: NFTs will become integral to virtual worlds and metaverses, where users can own, trade, and display unique digital assets.

- Enhanced Interoperability: Improved interoperability standards will allow NFTs to be used across multiple platforms and blockchain networks, increasing their utility and accessibility.

- Regulatory Developments: As the market matures, clearer regulatory frameworks will emerge, providing greater security and stability for NFT transactions.

Predictions and Expectations for SFTs

SFTs are also set to grow, offering unique benefits that complement those of NFTs. Key expectations include:

- Wider Use in Gaming: SFTs will become more prevalent in gaming, where their hybrid nature allows for the creation of items that start as fungible and become unique as they are used.

- Adoption in Ticketing and Events: SFTs will be increasingly used for event tickets, which need to be fungible initially but become unique once issued and used.

- Enhanced Flexibility in Loyalty Programs: SFTs will offer greater flexibility for managing loyalty points and rewards, making them more attractive to businesses and consumers.

- Technical Innovations: Advances in blockchain technology will enhance the functionality and efficiency of SFTs, making them more accessible and easier to use.

Impact on the Future of Digital Assets and Blockchain

The integration of NFTs and SFTs will have a profound impact on the future of digital assets and blockchain technology:

- Broader Acceptance: As NFTs and SFTs become more widely accepted, they will drive broader adoption of blockchain technology across various industries.

- Innovation and New Use Cases: The unique properties of NFTs and SFTs will spur innovation, leading to new use cases and applications in the digital economy.

- Increased Security and Transparency: Blockchain’s inherent security and transparency will enhance trust in digital transactions, benefiting all stakeholders.

- Economic Opportunities: The growth of NFTs and SFTs will create new economic opportunities for creators, developers, and investors, contributing to the overall growth of the digital asset market.

- Integration with Existing Systems: As NFTs and SFTs integrate with existing financial and technological systems, they will bridge the gap between traditional and digital economies.

NFTs and SFTs are set to reshape the digital landscape, offering unique solutions and opportunities in the tokenization of assets. By understanding their potential and addressing current challenges, stakeholders can leverage these technologies to unlock new value and drive innovation in the digital economy.

Conclusion

- NFTs vs SFTs: NFTs are unique and indivisible, while SFTs start as fungible but can become non-fungible.

- Use Cases: NFTs excel in digital art, collectibles, and virtual real estate. SFTs shine in gaming, ticketing, and loyalty programs.

- Technical Differences: NFTs use ERC-721 on the Ethereum network, ensuring unique ownership. SFTs use ERC-1155, allowing flexibility in transactions.

- Advantages: NFTs provide verifiable ownership and authenticity. SFTs offer flexibility and efficiency.

- Challenges: High transaction fees and environmental impact for NFTs; complexity and regulatory uncertainty for SFTs.

- Future Potential: Both have significant growth prospects, driving innovation and new use cases in the digital economy.

- Integration: NFTs and SFTs coexist within the crypto industry, enhancing the overall ecosystem for digital assets.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- NFT vs. SFT: Understanding the Differences and Applications – Medium

- NFT vs. SFT: Key Differences and Use Cases – Crossmint Blog

- Non-Fungible Tokens vs. Semi-Fungible Tokens – DailyCoin

- NFT vs. SFT: What Are the Key Differences Between These Tokens? – Medium Coinmonks

- Non-Fungible Token (NFT) vs. Semi-Fungible Token (SFT): A Comprehensive Guide – KuCoin