What is orca crypto? Orca is a decentralized exchange built on the Solana blockchain.

It allows users to trade cryptocurrency with near-instant token swaps using an automated market maker (AMM). Orca offers a user-friendly platform with low trading fees, making it the easiest place to trade cryptocurrency on Solana.

The Orca ecosystem includes features like liquidity pools, yield farming, and governance tokens, enhancing the overall trading experience.

As a liquidity provider, you can earn a share of trading fees. Learn about the Orca team, the total supply of Orca tokens, and the future of this innovative platform within the Solana ecosystem.

Understanding Orca and Its Ecosystem

Introduction to Orca on the Solana Blockchain

Orca is a decentralized exchange (DEX) built on the Solana blockchain, designed to offer users a simple and efficient platform for trading cryptocurrencies.

Solana’s high-speed and low-cost infrastructure makes Orca a standout option compared to other exchanges.

Orca is the easiest place to trade cryptocurrency on Solana, providing fast transactions and low fees, which are essential for a smooth trading experience.

Key Features of Orca

Orca boasts several unique features that enhance its usability and appeal:

- User-Friendly Interface: Orca is designed to be easy to use, even for beginners in the crypto space. The platform includes a “Magic Bar,” which simplifies the process of swapping tokens.

- Fair Price Indicator: This tool helps users avoid slippage by showing when a swap price is close to the market rate, ensuring they get a fair deal.

- Whirlpools: These are specialized liquidity pools that optimize yields for liquidity providers by concentrating liquidity around the current trading price.

- Integration with Solana: Leveraging Solana’s capabilities, Orca ensures low transaction costs and high speed, making it more efficient than many other DEXs on different blockchains.

How Orca Functions as a Decentralized Exchange (DEX)

Orca operates as a DEX by allowing users to trade directly from their wallets, bypassing the need for a centralized authority.

This enhances security and privacy, as users maintain full control over their funds. Transactions are executed through smart contracts, which automate the trading process and reduce the risk of errors or fraud.

Recommended for you:

What is Sol Wormhole? Understanding the Cross-Chain Bridge

What is Bytecoin (BCN): The Pioneer of Privacy Cryptocurrency

Automated Market Maker (AMM) Explained

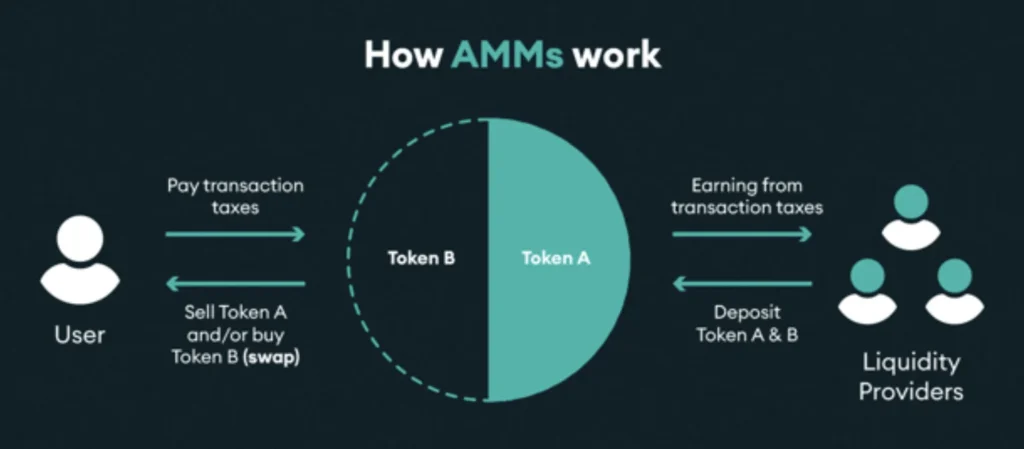

Orca uses an Automated Market Maker (AMM) model to facilitate trading. Unlike traditional order book exchanges, an AMM relies on liquidity pools where users can deposit their tokens.

When a trade occurs, the AMM algorithm adjusts the prices based on the pool’s liquidity and the size of the trade, ensuring continuous liquidity. This method allows for near-instantaneous trades and helps maintain a balanced market.

Liquidity Pools and Yield Farming on Orca

Liquidity pools are a core component of Orca’s ecosystem. Users can provide liquidity by depositing their tokens into these pools. In return, they earn a share of the trading fees generated by the pool, as well as additional rewards in ORCA tokens.

This process, known as yield farming, incentivizes users to contribute liquidity, which is essential for the exchange’s operation.

Orca offers concentrated liquidity pools called Whirlpools, which allow liquidity providers to focus their assets around specific price ranges. This strategy maximizes the efficiency of their liquidity and enhances potential returns.

Additionally, Orca implements features like the Fair Price Indicator to ensure that users receive accurate pricing for their trades, further enhancing the overall trading experience.

Utilizing the Orca Token

How to Buy Orca Crypto

To buy Orca crypto, you can use a centralized exchange (CEX) like Binance or Coinbase. Here’s a step-by-step guide using Coinbase:

- Sign Up for a Coinbase Account: Visit the Coinbase website and create an account by providing your email and setting a password. Verify your email address.

- Verify Your Identity: Complete the identity verification process by providing a government-issued ID and any other required information.

- Add a Payment Method: Link a payment method such as a bank account, debit card, or PayPal to fund your account.

- Buy USDT or BTC: Use your linked payment method to purchase USDT or BTC, which can be traded for Orca.

- Trade for Orca: Navigate to the trading section and select the trading pair (e.g., ORCA/USDT). Enter the amount of Orca you wish to buy and confirm the transaction.

- Store Orca in Your Wallet: After purchasing, transfer Orca to a secure wallet for safekeeping.

Storing Orca Tokens Securely

After purchasing Orca, it’s crucial to store it securely. Here are the storage options:

- Hot Wallets: These are online wallets connected to the internet, such as Trust Wallet or MetaMask. They are convenient but more vulnerable to hacking.

- Cold Wallets: These are offline wallets like Ledger Nano S or Trezor. Cold wallets are more secure because they are not connected to the internet, reducing the risk of cyber attacks.

- Exchange Wallets: Some users keep their Orca in the wallet provided by the exchange. While this is convenient, it’s less secure compared to personal wallets due to the risk of exchange hacks.

Use Cases for the ORCA Token

The ORCA token serves multiple purposes within the Orca ecosystem. It is primarily used to pay for trading fees on the Orca decentralized exchange (DEX). This makes transactions cost-effective for users. Additionally, ORCA tokens are vital for liquidity mining, where users provide liquidity to trading pools and earn ORCA tokens as rewards. This incentivizes participation and ensures the platform’s liquidity.

Another significant use case is governance. ORCA token holders can vote on proposals that affect the platform’s future, such as protocol changes and new features. This democratic approach gives users a direct say in the development and evolution of the Orca ecosystem.

Governance and Community Involvement

Governance in the Orca ecosystem is community-driven. ORCA token holders can submit proposals for changes or new features on the platform. Each ORCA token represents one vote, so holders with more tokens have a larger influence on decisions. This process ensures that the platform evolves according to the community’s wishes.

Active participation in governance not only helps shape the platform’s future but also fosters a strong community spirit among ORCA holders. The Orca team actively encourages community involvement and regularly engages with users through various channels, ensuring that their voices are heard and their suggestions are considered.

Staking Rewards and Incentives

Staking ORCA tokens is a way to earn additional rewards while supporting the network’s security and operations.

When users stake their ORCA tokens in designated staking pools, they lock up their tokens for a specific period, supporting network activities. In return, they earn rewards in the form of ORCA tokens. These rewards come from a portion of the trading fees and other emissions generated by the platform.

Staking provides financial incentives and grants stakers a voice in governance. This dual benefit encourages long-term commitment to the platform and active participation in its evolution.

By understanding and utilizing the various aspects of the ORCA token, users can maximize their involvement and potential returns within the Orca ecosystem.

Related Articles:

What is Ondo Crypto: Bridging Traditional Finance and Blockchain Technology

What is Injective (INJ)? Understanding the Innovative DeFi Protocol

Advantages, Risks, and Future Prospects

Strengths of the Orca Platform

Orca stands out as a decentralized exchange (DEX) on the Solana blockchain, designed for simplicity and efficiency. One of its primary strengths is its user-friendly interface, making it accessible even to beginners. This ease of use is enhanced by features such as the “Magic Bar,” which simplifies the process of swapping tokens.

Additionally, Orca boasts competitive trading fees of just 0.05%, which is significantly lower than many other DEXs and even some centralized exchanges like Binance and KuCoin.

This low fee structure, combined with Solana’s high-speed and low-cost transactions, makes Orca an attractive option for traders looking to minimize costs and maximize efficiency.

The platform supports a variety of liquidity pools, referred to as Aquafarms, which offer attractive yields, sometimes exceeding triple digits. This robust liquidity provision is essential for maintaining healthy trading activity and market depth on the platform.

Environmental Focus and Sustainability Efforts

Orca is built on the Solana blockchain, which is known for its energy-efficient design. Solana’s proof-of-stake (PoS) consensus mechanism consumes significantly less energy compared to proof-of-work (PoW) blockchains like Bitcoin and Ethereum.

This makes Orca an environmentally friendly choice for users concerned about the carbon footprint of their cryptocurrency transactions.

By leveraging Solana’s sustainable infrastructure, Orca not only reduces its environmental impact but also benefits from faster and cheaper transactions, aligning with global sustainability goals.

Security Measures and Audits

Security is a paramount concern for any cryptocurrency platform, and Orca takes several measures to ensure the safety of its users’ funds. The platform undergoes regular security audits conducted by reputable third-party firms to identify and mitigate vulnerabilities.

These audits cover various aspects of the platform, including smart contract security and overall system integrity.

In addition to audits, Orca employs best practices in cybersecurity, such as multi-signature wallets and stringent access controls. Users are encouraged to enable two-factor authentication (2FA) to add an extra layer of security to their accounts.

These measures help protect against hacking and unauthorized access, ensuring that user funds remain secure.

Potential Risks and Considerations

Despite its many strengths, there are risks associated with using Orca. One significant concern is the dependency on the Solana blockchain. Any issues or vulnerabilities within Solana could directly impact Orca. For instance, network congestion or technical failures on Solana could affect the performance of the Orca platform, leading to delays or increased transaction costs.

Another risk is the inherent volatility of the cryptocurrency market. The value of the ORCA token, like other cryptocurrencies, can be highly volatile, which poses risks for investors.

Users should conduct thorough research and consider their risk tolerance before making any investment decisions.

Additionally, while Orca’s liquidity pools offer attractive yields, they come with risks such as impermanent loss, where the value of assets in a liquidity pool can decrease relative to holding the assets separately.

Future Developments and Roadmap

Orca has a promising future with several developments on the horizon aimed at enhancing its platform and expanding its ecosystem. The team behind Orca is focused on integrating more features that improve user experience and increase platform utility. Future updates may include the introduction of advanced trading tools, enhanced liquidity management options, and new staking mechanisms.

One of the key areas of focus for Orca is expanding its governance model. By allowing ORCA token holders to have a more significant say in the platform’s development, Orca aims to foster a more engaged and empowered community. This decentralized approach to governance ensures that the platform evolves in a way that aligns with the interests of its users.

Additionally, Orca plans to explore partnerships with other projects within the Solana ecosystem. These collaborations could bring new functionalities and integrations, further solidifying Orca’s position as a leading DEX on Solana. The platform’s commitment to continuous improvement and innovation suggests a bright future, with potential to capture a larger share of the DeFi market.

Key Points to Remember About Orca Crypto on Solana

- Orca is a user-friendly decentralized exchange (DEX) built on Solana.

- Offers low trading fees at 0.05%, making it cost-effective.

- Supports over 150 liquidity pools, also known as Aquafarms.

- Users can earn trading fees and token rewards through liquidity mining.

- Orca governance allows token holders to vote on platform decisions.

- Built on Solana, ensuring fast and low-cost transactions.

- Provides strong security measures with regular audits.

- Environmentally friendly due to Solana’s proof-of-stake (PoS) mechanism.

- Potential risks include Solana’s network dependency and market volatility.

- Future developments include advanced trading tools and new partnerships.

Orca exemplifies a leading platform for trading cryptocurrency on the Solana blockchain.

FAQ

Is Orca a good crypto?

Orca is considered a good cryptocurrency for users who are part of the Solana ecosystem due to its user-friendly interface, low trading fees, and strong liquidity pools.

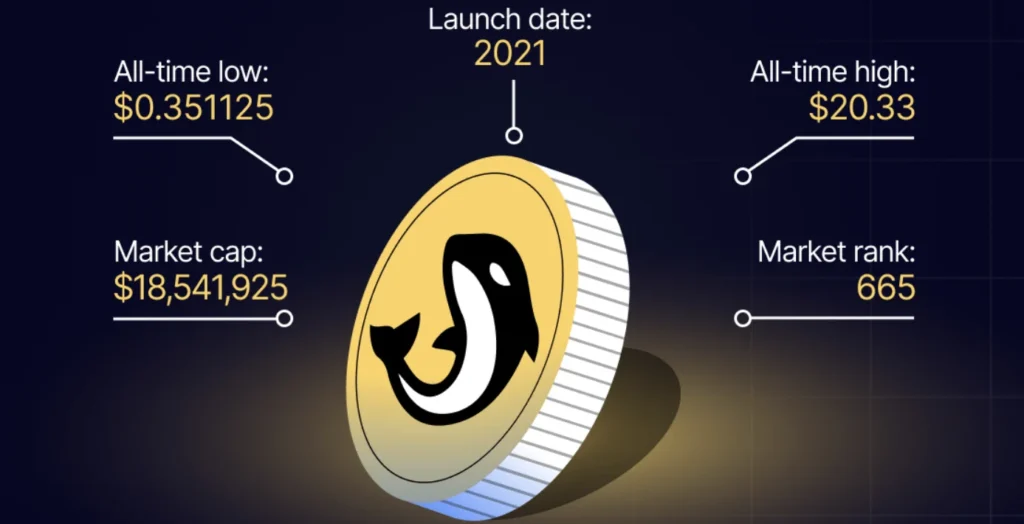

How much is the Orca token worth?

As of the latest update, the Orca token is worth approximately $1.84, but prices can vary. Check real-time updates on exchanges like Coinbase or CoinGecko.

Who is the founder of Orca coin?

Orca was co-founded by Grace Kwan and Yutaro Mori. Grace is a UX designer and software engineer, and Yutaro has extensive experience in the crypto space.

Does an orca require KYC?

Using Orca does not require KYC (Know Your Customer) verification, as it is a decentralized exchange (DEX).

What is orca cryptocurrency?

Orca is a decentralized exchange and automated market maker built on the Solana blockchain. It allows users to trade and provide liquidity with low fees.

Can I invest in crypto without KYC?

Yes, you can invest in crypto without KYC on decentralized exchanges like Orca, which do not require identity verification.

How many Orca coins are there?

The total supply of Orca tokens is capped at 100 million.

Where can I buy Orca coins?

You can buy Orca coins on several centralized exchanges such as Coinbase, Binance, and KuCoin. Additionally, you can purchase Orca on decentralized exchanges like Raydium.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.