Ondo Finance bridges traditional finance and blockchain technology, creating a unique space in decentralized finance (DeFi). This article explores Ondo’s mission, key products like USDY and OUSG, and the role of the ONDO token in its ecosystem.

Learn how Ondo Finance uses tokenization to integrate real-world assets, providing institutional-grade financial products and services.

We’ll also discuss market analysis, future prospects, and criticisms of Ondo Finance, highlighting its innovative approach in merging traditional and decentralized finance. This is a must-read for anyone interested in the evolving landscape of crypto and DeFi.

What is Ondo Crypto?

Ondo Crypto represents a pioneering venture in the realm of decentralized finance (DeFi), aiming to bridge the gap between traditional financial assets and the blockchain ecosystem.

Ondo Finance leverages the power of blockchain technology to offer institutional-grade financial products, making them accessible to a broader audience.

This section will delve into an overview of Ondo Finance, its mission and vision, and its unique approach to integrating traditional and decentralized finance.

Overview of Ondo Finance

Ondo Finance is a DeFi protocol that enables users to originate risk-isolated, fixed yield loans backed by yield-generating crypto assets. It operates as a permissionless protocol where users can interact directly without intermediaries, ensuring greater efficiency and lower costs.

Ondo Finance has introduced innovative products like USDY, an interest-bearing stablecoin, and OUSG, a tokenized representation of short-term US Treasuries, which offer users reliable yield options.

The protocol is part of the Ethereum ecosystem and uses smart contracts to enforce loan provisions, ensuring secure and transparent transactions.

Ondo’s Mission and Vision

Ondo Finance’s mission is to democratize access to high-quality financial products and services by leveraging blockchain technology.

The vision is to create a more inclusive financial system where both individual and institutional investors can benefit from the efficiencies and transparency of decentralized finance.

Ondo aims to merge traditional financial instruments with DeFi protocols to provide innovative products that cater to a wide range of risk preferences and investment needs.

This approach not only enhances market accessibility but also ensures compliance with regulatory standards and investor protections.

Ondo Finance’s Unique Approach

- Tokenization of Real-World Assets (RWAs): Ondo Finance tokenizes traditional financial assets like US Treasuries, providing liquid and transparent investment options that were previously inaccessible to many investors.

- Innovative Financial Products: Products like USDY and OUSG offer institutional-grade yields backed by stable, real-world assets, bridging the gap between traditional finance and the crypto ecosystem.

- Decentralized Protocols: Ondo operates a permissionless, decentralized protocol that allows peer-to-pool interactions without intermediaries, reducing costs and improving efficiency.

- Flexible Investment Options: Ondo’s Vaults system allows for customized investment strategies, offering both fixed and variable yield options to cater to different risk appetites.

By integrating these unique elements, Ondo Finance represents a significant advancement in the DeFi space, offering secure, transparent, and accessible financial products that merge the best aspects of traditional and decentralized finance.

Key Features and Products of Ondo Finance

Ondo Finance is a pioneering venture in the realm of decentralized finance, offering innovative solutions that bridge traditional finance and blockchain technology.

This section delves into the key features and products of Ondo Finance, providing a comprehensive overview.

USDY and OUSG Explained

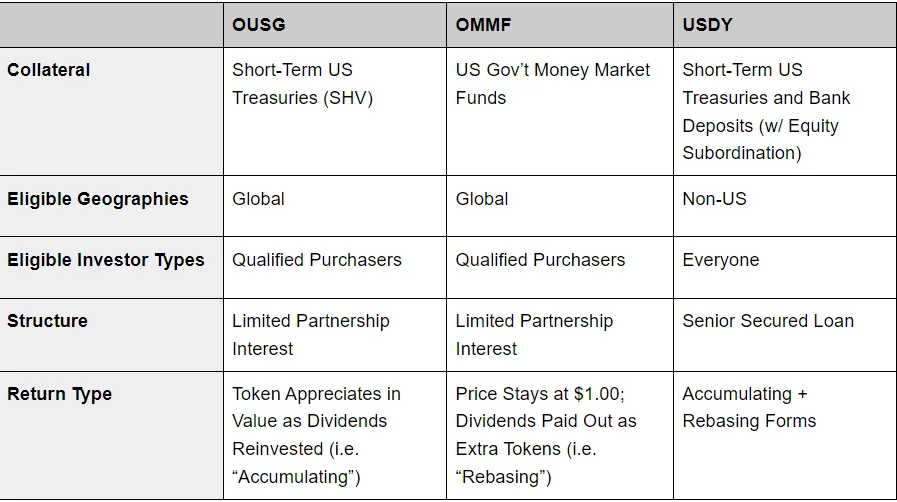

USDY and OUSG are two flagship products of Ondo Finance designed to provide stable returns and high liquidity.

- USDY: This is an interest-bearing note collateralized by short-term US Treasuries and bank demand deposits. It is designed for non-US investors looking for a yield-bearing alternative to conventional stablecoins. USDY offers daily redemptions and can be freely transferred after a 40-50 day restriction period.

- OUSG: This product offers tokenized exposure to BlackRock’s iShares Short Treasury Bond ETF. It provides liquid, on-chain access to short-term US Treasuries, making it an ultra-low-risk investment option. OUSG is structured as a limited partnership interest and is available to qualified purchasers globally.

The Role of the ONDO Token

The ONDO token serves as the governance token for Ondo Finance, enabling token holders to participate in decision-making processes.

This includes voting on protocol upgrades and other key operational changes within the Ondo DAO, which oversees the Flux Finance protocol.

The token also plays a crucial role in incentivizing ecosystem growth, with a significant portion allocated to rewards and governance participation.

Tokenization of Real-World Assets

Ondo Finance leverages tokenization to bring real-world assets (RWAs) onto the blockchain, enhancing liquidity and accessibility. By tokenizing assets like US Treasuries, Ondo Finance enables seamless, 24/7 trading and investment.

This approach democratizes access to traditionally illiquid markets, allowing a broader range of investors to participate in high-quality financial products.

The tokenization process involves creating digital representations of physical assets, which can then be traded and managed on the blockchain.

Ondo’s DeFi Solutions and Offerings

Ondo Finance provides a variety of DeFi solutions through its innovative product offerings:

- Ondo Vaults: These are risk-isolated vaults that allow investors to choose between fixed and variable yield positions. This flexibility caters to different risk appetites and investment strategies, enhancing the appeal of Ondo’s products to a diverse investor base.

- Flux Finance Protocol: This protocol is a core part of the Ondo ecosystem, enabling the efficient management and exchange of tokenized assets. It supports a range of financial products and ensures compliance with regulatory standards.

- Ondo Bridge: The Ondo Bridge facilitates the transfer of assets between different blockchains, ensuring seamless integration and interoperability within the DeFi ecosystem. This tool is essential for maintaining liquidity and enabling the efficient movement of digital assets.

By combining these features, Ondo Finance sets itself apart as a leader in the integration of traditional finance and DeFi, providing innovative and accessible financial solutions to a global audience.

Ondo Token (ONDO) Utility and Market Analysis

Ondo Finance’s ONDO token plays a critical role in the platform’s ecosystem, serving as a governance tool and contributing to the overall DeFi integration.

This section will delve into the governance and utility of the ONDO token, its market cap and circulation, how it enhances DeFi integration, and the criticisms and challenges faced by Ondo Finance.

Governance and Utility of ONDO Token

The ONDO token is primarily used as a governance token within the Ondo DAO. This allows token holders to vote on key decisions affecting the platform, such as updates to the Flux Finance protocol and other strategic changes.

This democratic approach ensures that the community has a say in the development and direction of Ondo Finance.

Additionally, the ONDO token incentivizes participation in the ecosystem through various rewards and airdrops, aimed at promoting active engagement and growth.

Also Read:

What is Injective (INJ)? Understanding the Innovative DeFi Protocol

What is Bytecoin (BCN): The Pioneer of Privacy Cryptocurrency

Market Cap and Circulation of ONDO

As of now, the ONDO token has a market cap of approximately $1.54 billion, with around 1.4 billion tokens in circulation out of a total supply of 10 billion.

The token has seen significant growth since its launch, with its value appreciating by 2,500% shortly after being unlocked. This rapid increase in value reflects the high interest and confidence in Ondo Finance’s offerings.

However, it is essential to note that the market cap and circulation figures are subject to change based on market conditions and trading volumes.

How ONDO Token Enhances DeFi Integration

The ONDO token enhances DeFi integration by facilitating seamless interactions within the Ondo Finance ecosystem. It supports the tokenization of real-world assets (RWAs), such as U.S. Treasuries, making these traditionally illiquid assets accessible to a broader audience through blockchain technology.

This integration provides liquidity and security, enabling investors to benefit from stable returns and diversified portfolios.

The Ondo Bridge further supports this integration by allowing the transfer of assets between different blockchains, enhancing the platform’s interoperability and functionality.

Criticisms and Challenges Faced by Ondo

Despite its innovative approach, Ondo Finance faces several criticisms and challenges. One major concern is the potential dilution of the ONDO token’s value due to its high total supply and structured token release schedule.

Critics argue that this could lead to inflationary pressures, potentially affecting the token’s long-term value.

Additionally, there are concerns about the concentration of token allocations, with a significant portion reserved for core contributors and investors, which might lead to market manipulation or large sell-offs.

Addressing these challenges is crucial for maintaining investor confidence and ensuring the platform’s sustainable growth.

Future Prospects and Analyst Views on Ondo Crypto

The future of Ondo Crypto is shaped by its strategic plans, bullish analyst predictions, potential growth areas, and the challenges it may face. This section explores these aspects in detail.

Future Plans for Ondo Finance

Ondo Finance aims to solidify its position as a leader in the tokenization of real-world assets (RWAs). The company is expanding its product offerings, focusing on bridging traditional finance with decentralized finance (DeFi).

Future plans include enhancing the Ondo Global Markets platform, which facilitates the tokenization of conventional securities and broadening its presence across multiple blockchain platforms like Aptos, Sui, and Solana.

These expansions are designed to attract institutional investors by offering compliant, institutional-grade financial products.

Analyst Views and Predictions

Analysts are generally optimistic about the future of Ondo Crypto. Prominent figures in the crypto world, such as Ben Armstrong (BitBoy Crypto), predict that Ondo could achieve a market capitalization of $100 billion, potentially placing it among the top 10 cryptocurrencies.

Technical analysts have highlighted positive chart patterns and trendlines, suggesting a potential uptrend for the ONDO token. These bullish sentiments are driven by Ondo’s innovative approach to RWA tokenization and growing investor interest.

Also Read:

What is Codius Crypto? Revolutionizing Smart Contracts and Decentralization

What is XDC Crypto? Explore XDC Network & Its Impact in Crypto

Potential Growth Areas for Ondo Crypto

Ondo Finance’s focus on RWA tokenization presents significant growth opportunities. The platform’s ability to offer tokenized U.S. Treasuries and money market funds is attracting both retail and institutional investors.

The demand for stable, high-quality financial products on the blockchain is expected to grow, providing Ondo with a robust market base.

Additionally, Ondo’s partnerships with major financial institutions like BlackRock and its expansion into new blockchain ecosystems are likely to drive further growth.

Addressing Future Challenges and Opportunities

Ondo Finance faces several challenges, including regulatory scrutiny and market competition. Ensuring compliance with regulatory standards while maintaining the flexibility of DeFi is crucial.

Another challenge is the potential dilution of the ONDO token’s value due to its high total supply. However, these challenges also present opportunities for Ondo to differentiate itself by focusing on regulatory compliance and transparency.

By continuing to innovate and expand its product offerings, Ondo Finance can address these challenges and capitalize on the growing interest in tokenized assets.

Ondo Finance represents a pioneering venture in the integration of traditional finance and DeFi, and its future prospects are supported by strategic expansions, analyst optimism, and significant growth potential in the RWA sector.

Conclusion: Key Points to Remember

- Ondo Finance bridges traditional finance and blockchain technology, pioneering the integration of real-world assets (RWA) with DeFi.

- Ondo products include USDY, an interest-bearing note, and OUSG, a tokenized representation of short-term U.S. Treasuries.

- The ONDO token is the governance token for Ondo DAO, enabling community-driven decisions.

- Analysts are optimistic about investing in ONDO, predicting significant growth due to its innovative approach and strategic partnerships.

- Ondo Finance aims to democratize access to institutional-grade finance, offering high-quality financial products to a broader audience.

- Future growth is expected in the RWA sector, with Ondo leading the way in tokenized securities.

- Always do your own research and consider the market conditions before making financial decisions.

FAQ

Is Ondo a good investment?

Ondo is considered a promising investment due to its innovative approach to tokenizing real-world assets and strong partnerships. However, always do your own research.

What does Ondo do?

Ondo Finance bridges traditional finance and blockchain by offering tokenized financial products like USDY and OUSG, providing stable returns and high liquidity.

How does Ondo work?

Ondo uses blockchain technology to tokenize real-world assets. Investors can buy these tokens, which represent assets like U.S. Treasuries, and earn returns.

Who created Ondo Crypto?

Ondo Crypto was co-founded by Nathan Allman and Pinku Surana in 2021. They aimed to merge traditional finance with decentralized finance.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- MarketBeat: Ondo Price Prediction, News, and Analysis (ONDO)

- CoinGecko: What is Ondo Finance: Narratives, Products, and Potential Future

- Crypto News Flash: Ondo Finance (ONDO) Price Surges 40%: RWA Tokenization and Whale Activity Drive Growth

- CaptainAltcoin: Ondo Price Trajectory: Can the Altcoin Surge to New Levels Amid Bullish Signals? Key Metrics to Watch