Injective (INJ) is a groundbreaking crypto project redefining decentralized finance (DeFi). Built on blockchain technology, it supports cross-chain compatibility and operates seamlessly with platforms like Ethereum and Cosmos.

Injective’s unique exchange module allows for efficient trading, including spot and derivatives markets. With a circulating supply of 100 million INJ tokens, it offers robust financial infrastructure and governance.

Key investors include Pantera Capital and Mark Cuban. This article covers Injective’s features, market performance, and future prospects, providing insights into its innovative ecosystem and why it’s a significant player in the cryptocurrency market.

Overview of Injective Protocol

Introduction to Injective Protocol

Injective Protocol (INJ) is a cutting-edge blockchain platform designed to support decentralized finance (DeFi) applications. It is built on the Cosmos network and integrates Ethereum, making it highly interoperable.

Injective allows developers to create and operate various DeFi applications with low fees and high security.

Key features include a decentralized exchange (DEX), smart contract capabilities through CosmWasm, and robust interoperability across different blockchains like Solana and Polygon. This combination of features makes Injective a versatile and powerful tool for the DeFi ecosystem.

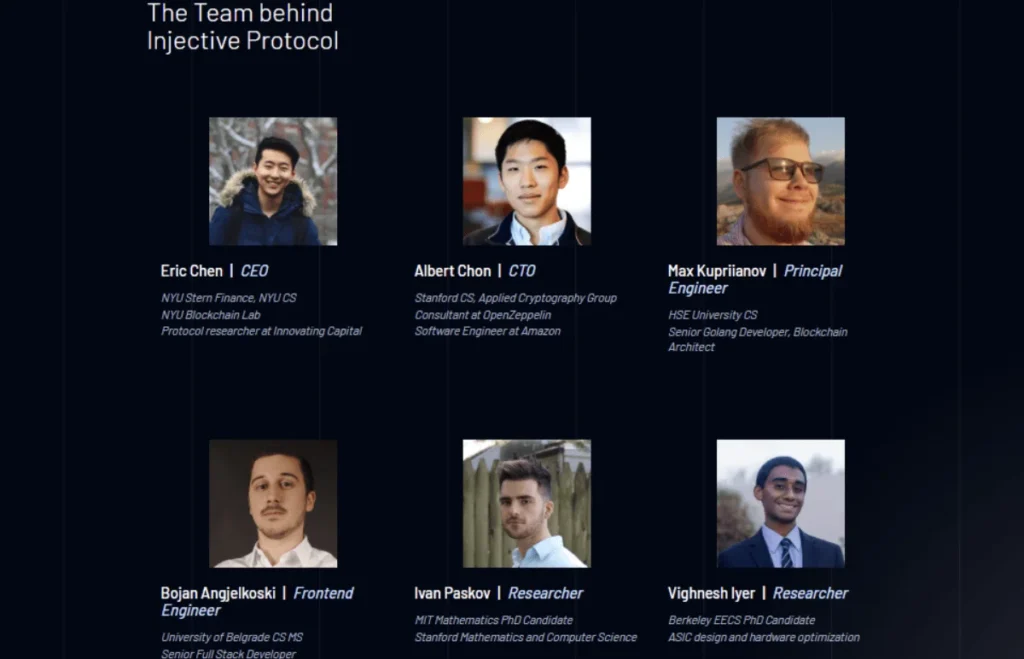

Founders and Development Team

Injective was created by Injective Labs, a research and development firm specializing in blockchain technology. Key figures include co-founder and CEO Eric Chen, and CTO Albert Chon, both of whom have extensive backgrounds in blockchain and finance.

The development team consists of experienced engineers and researchers who have worked at major tech companies and financial institutions.

Significant milestones in their development include the launch of the mainnet, integration with Cosmos IBC, and partnerships with major blockchain projects.

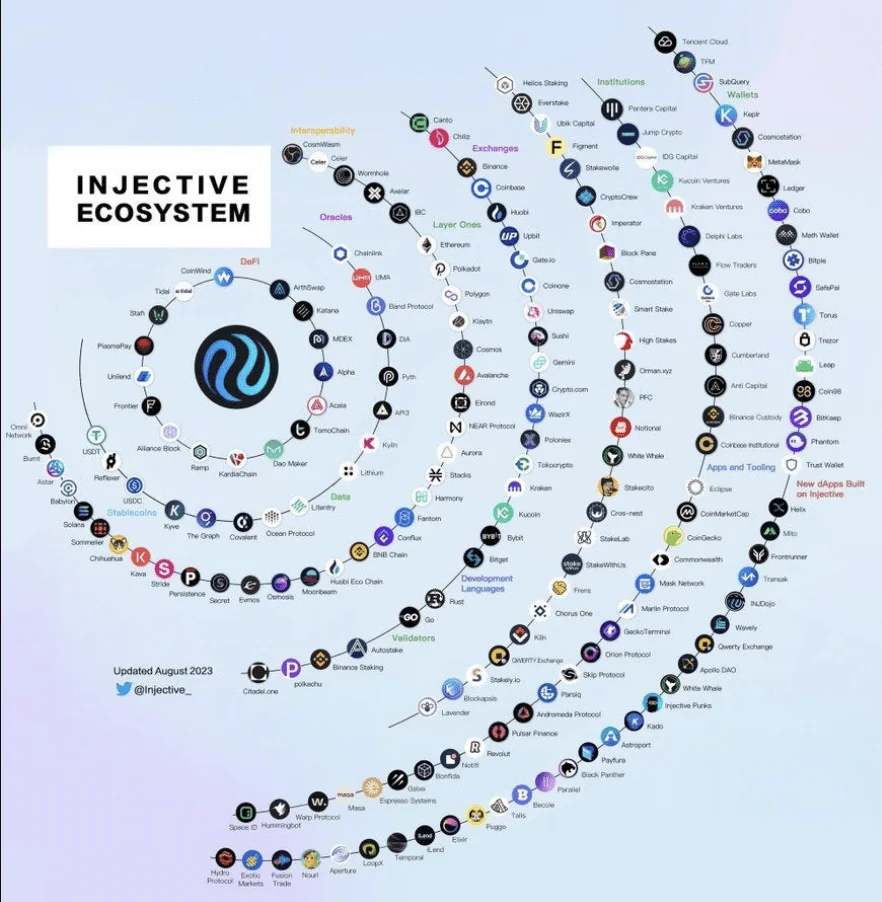

Injective Ecosystem and Investors

The Injective ecosystem includes a wide range of DeFi applications and services. Key components are the decentralized exchange, prediction markets, and various financial primitives that enhance its functionality.

Major investors in Injective include prominent names like Pantera Capital, Mark Cuban, and Binance. These partnerships have been crucial in providing financial support and strategic guidance, enabling Injective to expand its ecosystem and user base.

The platform’s ecosystem initiative, with a fund of $150 million, aims to support developers building on Injective, further fostering innovation and growth within the network.

Technical Features and Innovations

1. Core Exchange Module

The Core Exchange Module of Injective Protocol is a decentralized trading platform designed for speed and efficiency. Unlike traditional exchanges, which are centralized and can be prone to censorship and manipulation, Injective offers a fully decentralized, trustless environment.

This module supports a range of trading activities including perpetual swaps, futures, margin, and spot trading. It leverages a decentralized order book model, enabling users to trade without relying on intermediaries, thus reducing fees and increasing transaction speeds.

2. Smart Contracts and CosmWasm

Injective utilizes smart contracts to automate and secure transactions on its platform. These contracts are built using CosmWasm, a technology that allows for the creation of interoperable smart contracts across multiple blockchains.

CosmWasm enhances the flexibility and functionality of Injective by enabling developers to implement complex financial instruments and DeFi applications directly on the platform.

Also read:

What is Bytecoin (BCN): The Pioneer of Privacy Cryptocurrency

What is Codius Crypto? Revolutionizing Smart Contracts and Decentralization

3. Proof-of-Stake and Security Mechanisms

Injective employs a Proof-of-Stake (PoS) consensus mechanism to secure its network. Validators are required to lock up their INJ tokens as collateral to participate in the network’s operations, earning rewards in return.

This mechanism not only ensures the security of the network but also aligns the interests of validators with the long-term health of the ecosystem.

Additionally, Injective incorporates MEV-resistant features to protect against front-running and other types of market manipulation.

4. Interoperability and Cross-Chain Compatibility

Injective stands out for its strong interoperability and cross-chain trading capabilities. Using the Cosmos SDK and Inter-Blockchain Communication (IBC) protocol, Injective can seamlessly interact with various blockchains such as Ethereum, Solana, and Polygon.

This cross-chain compatibility allows users to trade assets across different blockchain ecosystems, enhancing liquidity and offering more trading opportunities.

5. Tokenomics and Burn Mechanism

The INJ token serves multiple purposes within the Injective ecosystem. It is used for governance, allowing holders to vote on protocol upgrades and other important decisions.

The tokenomics of INJ include a deflationary burn mechanism, where a portion of the transaction fees collected is used to buy back and burn INJ tokens, reducing the total supply over time.

This mechanism not only incentivizes token holders but also helps in maintaining the value of the token by creating scarcity.

By focusing on these innovative features, Injective Protocol aims to provide a robust, secure, and efficient platform for decentralized trading and financial applications.

This approach positions it as a key player in the evolving landscape of decentralized finance (DeFi).

Market Performance and Future Prospects

Market Stats and Historical Performance

Injective Protocol (INJ) has shown impressive market performance since its launch.

The current market cap of INJ is around $1.85 billion, with a circulating supply of approximately 93.4 million INJ tokens. INJ experienced its all-time high price of $52.56 in March 2024, driven by increased adoption and positive market sentiment.

The trading volume remains high, indicating strong market demand. Despite the volatility common in cryptocurrencies, INJ has demonstrated significant growth potential, reflecting its robust ecosystem and innovative features.

Where to Buy and Trade INJ

INJ tokens are available on major cryptocurrency exchanges such as Binance, Huobi Global, and Uniswap.

To buy INJ, create an account on one of these exchanges, complete the verification process, and deposit funds. Then, search for INJ and execute a buy order.

For trading, you can place market or limit orders depending on your strategy. Always consider security measures and store your INJ in a secure wallet after purchase.

Future Developments and Potential Use Cases

Injective Protocol continues to evolve with exciting future developments. Upcoming features include enhanced cross-chain capabilities and new DeFi applications.

The protocol aims to expand its decentralized cross-chain bridging infrastructure, enabling seamless asset transfers across multiple blockchains.

Potential use cases extend beyond DeFi, with applications in lending protocols, prediction markets, and more, offering diverse opportunities for innovation and growth.

Community and Governance

The Injective community plays a crucial role in protocol governance. INJ holders can participate in decision-making processes through a decentralized autonomous organization (DAO). They can propose and vote on protocol upgrades and new features.

Staking is another key aspect, where users stake their INJ tokens to secure the network and earn rewards. This community-driven approach ensures that Injective remains a collaborative and innovative ecosystem.

By focusing on these elements, Injective Protocol aims to maintain its position as a leading platform in the cryptocurrency market, fostering a vibrant and participatory community.

Key Points to Remember

- Injective Protocol: A powerful, interoperable blockchain for DeFi applications.

- Core Features: Includes a decentralized exchange, smart contracts with CosmWasm, and cross-chain capabilities.

- Market Performance: INJ has a market cap of $1.85 billion, with a historical all-time high of $52.56.

- Where to Buy: Available on major exchanges like Binance and Huobi.

- Future Prospects: Enhancing cross-chain capabilities and expanding DeFi applications.

- Community Governance: INJ holders can stake tokens and vote on protocol upgrades.

- INJ Token: Used for governance, transaction fees, and staking rewards.

- Development Team: Led by Eric Chen and Albert Chon.

By understanding these points, you can appreciate how Injective is shaping the future of decentralized finance. For more detailed injective price prediction 2024 and insights, stay updated with injective news and market trends.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.