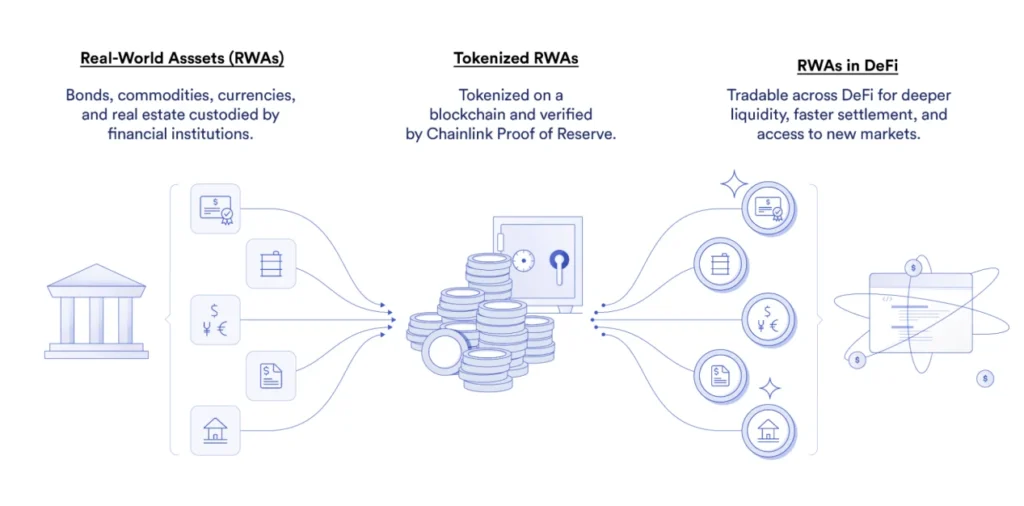

RWA tokens are digital representations of tangible assets such as real estate, commodities, or bonds, brought onto the blockchain.

These tokens enable the integration of traditional financial assets into the decentralized finance (DeFi) ecosystem.

RWA crypto projects are driving the tokenization of high-value assets, providing more accessible investment opportunities and enhancing liquidity for assets that were traditionally illiquid.

How RWA Tokens Work

RWA tokens work by representing real-world assets on the blockchain. Each token corresponds to a specific underlying asset, allowing for fractional ownership and easier transfer of these assets.

For instance, projects like Ondo Finance have tokenized US Treasury bills, offering these tokenized assets to crypto investors seeking stable, yield-bearing instruments.

By using blockchain technology, these projects bridge the gap between traditional finance and the crypto market, providing transparency and security in transactions.

Advantages of RWA Tokenization

The tokenization of real-world assets offers several benefits:

- Increased Liquidity: Tokenizing traditionally illiquid assets like real estate or precious metals allows for easier buying, selling, and trading, thereby enhancing market liquidity.

- Fractional Ownership: Investors can own fractions of high-value assets, making investment in assets like real estate more accessible.

- Transparency and Security: Blockchain technology ensures transparent tracking of asset ownership and transactions, reducing the risk of fraud.

- Access to Global Markets: RWA tokens enable investors from anywhere in the world to invest in assets they might not otherwise have access to.

- Efficiency in Transactions: Blockchain streamlines the process of transferring ownership, making transactions faster and more cost-effective.

Understanding the mechanisms and benefits of RWA crypto projects is crucial for investors looking to diversify their portfolios with tokenized real-world assets.

These projects are poised to play a significant role in the future of both traditional finance and the crypto ecosystem.

Related: What is Layer 3 Crypto and Top 5 Layer 3 Cryptos

Market Analysis of RWA Tokens

Real-World Asset (RWA) tokens have gained traction in the crypto market, with several projects emerging as top players by market capitalization. Notable examples include Hifi Finance, LTO Network, and Boson Protocol.

These tokens represent a range of assets, from real estate to commodities, and have market caps ranging from tens to hundreds of millions of dollars.

Their inclusion in the top rankings highlights the growing importance of RWA tokens in the financial market.

Price Performance of RWA Tokens

The price performance of RWA tokens has seen significant variability. For instance, the market cap of tokenized US treasuries surged dramatically in 2023, reflecting a growing interest in stable, yield-bearing assets.

The market cap increased from $104 million in January 2023 to over $931 million by early 2024.

This trend indicates that investors are seeking safer, more stable investment opportunities amid broader market volatility.

Supply and Value Statistics

RWA tokens often have a capped supply, ensuring scarcity and potential value appreciation. For example, the fully diluted valuation (FDV) of RWA tokens like those tracked by CoinGecko considers the maximum number of tokens in circulation, providing insights into their potential market cap.

Detailed statistics such as circulating supply, market cap, and trading volumes are crucial for investors.

Ondo Finance, for example, has a total value locked (TVL) of $185.7 million in its tokenized US Treasury bills, illustrating the substantial investment these tokens attract within the DeFi ecosystem.

Top 10 RWA Crypto Projects

1. Polytrade (TRADE)

Polytrade is a decentralized finance (DeFi) platform that leverages blockchain technology to facilitate trade finance.

It connects businesses needing liquidity with investors, allowing real-world assets like invoices to be tokenized and traded.

This platform helps businesses access immediate funds while offering investors a new asset class within the DeFi ecosystem.

Key Features:

- Invoice financing: Allows businesses to obtain liquidity by selling their invoices to investors.

- Integration with liquidity providers: Connects businesses with a wide range of liquidity providers in the DeFi space, enhancing funding opportunities.

- Real-world asset tokenization: Converts real-world assets into digital tokens, making them easier to trade and increasing their liquidity.

2. Realio Network (RIO)

Realio Network is a decentralized platform that bridges traditional assets like real estate with blockchain technology.

This platform allows users to tokenize physical assets, making them more accessible and easier to trade within the digital asset ecosystem.

Realio focuses on providing a compliant and secure environment for investment and asset management.

Key Features:

- Real estate tokenization: Converts physical real estate assets into digital tokens, allowing fractional ownership and easier trading.

- Decentralized trading platform: Facilitates the trading of tokenized assets on a secure blockchain network.

- Compliance with regulatory standards: Ensures all transactions meet regulatory requirements, enhancing trust and security for users.

3. Boson Protocol (BOSON)

Boson Protocol is an innovative platform that facilitates decentralized commerce by enabling the exchange of digital value for real-world assets.

This project aims to create a decentralized network where physical assets can be tokenized and traded, making it easier for users to engage in commerce without intermediaries.

Key Features:

- Decentralized commerce: Facilitates peer-to-peer transactions, reducing the need for intermediaries and lowering transaction costs.

- Smart contracts: Utilizes blockchain-based contracts to automate and secure transactions between buyers and sellers.

- Integration with e-commerce platforms: Easily integrates with existing online marketplaces, enhancing the functionality and reach of these platforms.

Also read: What is the Most Profitable Crypto to Mine in 2024

4. Propchain (PROPC)

Propchain is a pioneering platform focused on the tokenization of real estate. It aims to revolutionize the real estate market by allowing fractional ownership and seamless trading of property assets on the blockchain.

By tokenizing real-world assets like real estate, Propchain enhances liquidity and accessibility, enabling a broader range of investors to participate in the real estate market.

This project is designed to integrate real-world assets into the digital ecosystem, providing new opportunities for token holders and increasing the overall efficiency of real estate transactions.

Key Features:

- Real estate fractional ownership: Allows investors to buy fractions of properties, reducing entry barriers and increasing accessibility.

- Blockchain-based property trading: Provides a secure and transparent platform for trading real estate tokens, ensuring seamless transactions.

- Enhanced liquidity for real estate assets: Increases the liquidity of real estate investments by enabling easy trading of tokenized assets.

5. AllianceBlock Nexera Token (NXRA)

AllianceBlock Nexera Token (NXRA) is designed to bridge the gap between decentralized finance (DeFi) and traditional finance.

It provides a comprehensive ecosystem that allows users to tokenize real-world assets and seamlessly integrate them into the blockchain.

This platform focuses on regulatory compliance and aims to create a secure environment for financial transactions involving tokenized assets.

Key Features:

- Integration with traditional finance: Facilitates the bridging of traditional financial systems with decentralized finance, enhancing liquidity and accessibility.

- Regulatory compliance: Ensures that all transactions meet regulatory standards, providing a secure and compliant platform for users.

- Tokenization of real-world assets: Converts physical assets into digital tokens, enabling fractional ownership and easy trading.

6. Polymath Network (POLY)

Polymath Network is a platform that facilitates the creation, issuance, and management of security tokens on the blockchain.

It aims to bring real-world assets, like stocks and bonds, onto the blockchain, enabling a compliant and regulated environment for tokenized assets.

Polymath simplifies the complex technical and legal challenges of launching security tokens.

Key Features:

- Security Token Standard: Polymath has developed the ERC-1400 standard, specifically designed for security tokens, ensuring compliance and regulatory adherence.

- Token Studio: Provides a suite of tools for the creation, issuance, and management of security tokens, simplifying the tokenization process.

- Compliance and Governance: Ensures that all tokenized assets meet regulatory standards, providing a secure environment for issuers and investors.

7. ELYSIA (EL)

ELYSIA is a blockchain-based platform focused on the tokenization of real estate assets.

It aims to simplify real estate investment by allowing users to invest in fractions of properties through digital tokens.

This approach provides enhanced liquidity and accessibility to real estate investments, traditionally known for being illiquid and difficult to access for smaller investors.

Key Features:

- Real estate tokenization: Converts real estate assets into digital tokens, enabling fractional ownership and easier investment.

- Enhanced liquidity: By tokenizing properties, ELYSIA increases the liquidity of real estate investments, making it easier to trade and invest.

- User-friendly platform: Offers a straightforward interface for users to invest in tokenized real estate, reducing complexity.

8. Opulous (OPUL)

Opulous is an innovative platform focused on the music industry, providing artists with the opportunity to tokenize their music royalties.

By leveraging blockchain technology, Opulous allows for the creation of a new asset class within the music industry, enabling artists to secure funding and investors to gain exposure to music royalties.

This approach not only democratizes the music industry but also brings real-world assets into the crypto ecosystem.

Key Features:

- Music royalty tokenization: Converts music royalties into digital tokens, allowing artists to raise funds and investors to participate in the music industry.

- DeFi integration: Utilizes decentralized finance to enhance liquidity and provide financial products for music royalties.

- Artist and investor platform: Offers a user-friendly platform that connects artists with investors, facilitating secure and transparent transactions.

9. Brickken (BKN)

Brickken is a versatile platform that facilitates the tokenization of real-world assets (RWA) such as real estate, startups, franchises, and entertainment assets.

It provides a comprehensive suite for digital asset creation, management, and distribution, aiming to simplify the tokenization process and enhance liquidity for traditionally illiquid assets.

This platform is particularly noted for its ease of use, regulatory compliance, and robust support for various asset classes.

Key Features:

- Comprehensive Token Suite: Enables the creation, sale, and management of tokenized digital assets, providing tools for capital acquisition and investor management.

- Enhanced Liquidity: Transforms illiquid assets into tradeable digital tokens, accessible 24/7 in global markets, facilitating easier market entry and exit.

- Regulatory Compliance: Ensures all tokenization processes adhere to global regulatory standards, embedding compliance into the tokenization process.

10. Bytom (BTM)

Bytom is a blockchain protocol designed to bridge the gap between digital and physical assets. Bytom’s platform facilitates the tokenization of real-world assets, enabling seamless asset transfers and interactions on the blockchain.

It aims to support a variety of assets, including securities, bonds, and other financial instruments, making it a versatile solution in the RWA market.

Key Features:

- Digital and physical asset interaction: Bytom allows the integration and management of both digital and physical assets, ensuring smooth interactions on its blockchain platform.

- Blockchain-based asset transfer: Provides a secure and transparent method for transferring assets, enhancing trust and security in transactions.

- Versatile asset support: Bytom supports a wide range of assets, including securities, bonds, and other financial instruments, making it adaptable to various use cases.

Future of RWA Tokenization

Emerging RWA Projects to Watch

The realm of Real-World Asset (RWA) tokenization continues to grow, with several emerging projects set to make a significant impact in 2024. One such project is XDC Network, which is at the forefront of integrating blockchain technology with traditional assets.

XDC Network facilitates trade finance through platforms like TradeFinex, which connects trade finance originators with banks and financial institutions using blockchain for secure, transparent transactions.

Another notable project is the Fathom Dollar (FXD), a stablecoin pegged to the U.S. dollar and over-collateralized with XDC tokens, offering new opportunities for small and medium enterprises (SMEs) to access capital efficiently.

Impact on Traditional Finance

The tokenization of real-world assets (RWA) is set to revolutionize traditional finance by providing greater liquidity, transparency, and accessibility. Projects like Ondo Finance have demonstrated the potential by issuing tokenized U.S. Treasuries, offering a new way for investors to access stable, yield-bearing assets.

The integration of blockchain technology into traditional finance not only enhances the efficiency of transactions but also reduces the barriers for retail investors to participate in markets that were previously inaccessible.

This shift is expected to create a more inclusive financial ecosystem, bridging the gap between conventional and digital economies.

Regulatory Considerations

As RWA tokenization gains traction, regulatory frameworks will play a crucial role in its development. Ensuring compliance with financial regulations is paramount to maintaining investor trust and protecting market integrity.

Platforms like Polymath Network have focused on developing regulatory-compliant token standards, such as the ERC-1400 for security tokens, to meet these needs.

The challenge lies in balancing innovation with regulation, ensuring that new financial products are secure and transparent while also adhering to global regulatory standards.

As the RWA market grows, collaboration between regulators and blockchain innovators will be essential to foster a safe and efficient environment for tokenized assets.