Introduction to Decentralized Exchanges (DEXs)

Decentralized exchanges (DEXs) are cryptocurrency trading platforms that operate without a central authority.

Unlike traditional centralized exchanges like Coinbase, DEXs allow users to trade directly from their wallets using smart contracts. This peer-to-peer trading method ensures that users maintain control over their funds at all times.

Best Decentralized Crypto Exchanges, such as Uniswap and PancakeSwap, are built on blockchain protocols like Ethereum, enabling the trading of ERC-20 tokens and other digital assets without the need for intermediaries.

How Do Decentralized Exchanges Work?

DEXs function by using smart contracts to facilitate trades directly between users. When you connect your wallet to a DEX, you can start trading various tokens. These exchanges offer liquidity pools, where users can provide liquidity in exchange for earning fees.

Popular DEXs like Uniswap use automated market makers (AMMs) to determine prices based on supply and demand within these liquidity pools.

By eliminating the need for a central authority, DEXs offer a more transparent and secure trading experience compared to their centralized counterparts.

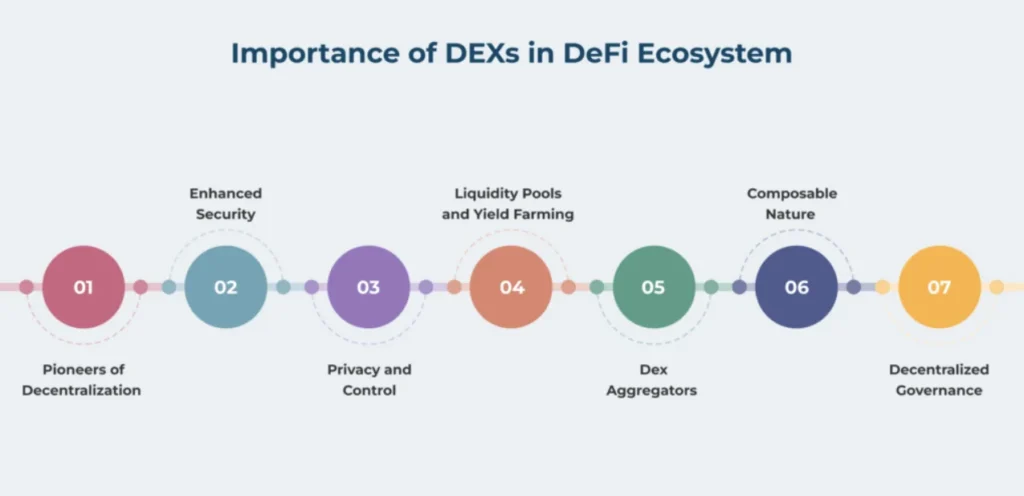

Importance of DEXs in the Crypto Ecosystem

Decentralized exchanges play a crucial role in the cryptocurrency and decentralized finance (DeFi) ecosystems. They provide users with a secure platform for trading, reducing the risks associated with centralized exchanges, such as hacking and mismanagement of funds.

DEXs also promote financial inclusivity by allowing anyone with an internet connection to participate in digital asset trading without needing permission or facing censorship.

Furthermore, they enable the creation and trading of new tokens, fostering innovation within the crypto space.

As decentralized exchanges continue to evolve, they are expected to offer even more advanced trading tools and options, further enhancing their importance in the crypto ecosystem.

Ethereum-Based DEXs

Ethereum-based decentralized exchanges (DEXs) are among the most popular in the crypto space.

These platforms enable efficient trading and provide users with various token swaps, liquidity pools, and trading pairs. Below are detailed descriptions of three leading Ethereum-based DEXs: Uniswap, SushiSwap, and 1inch.

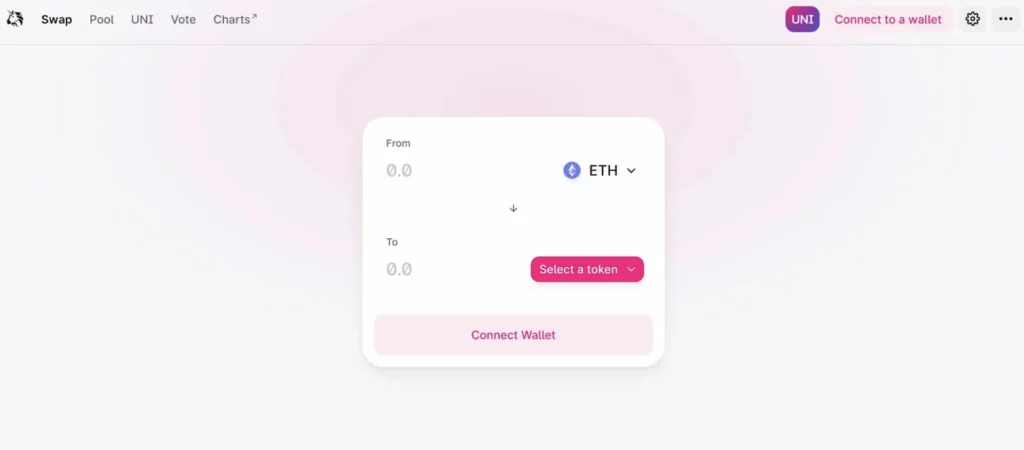

1. Uniswap

Uniswap is one of the most well-known decentralized exchanges built on the Ethereum blockchain. It pioneered the automated market maker (AMM) model, which allows users to trade ERC-20 tokens directly from their wallets.

- Founded Year: 2018

- Founded by: Hayden Adams

- Fees: Typically 0.3% per trade

- Key Features:

- Uses liquidity pools instead of traditional order books

- Supports a wide range of ERC-20 tokens

- Open-source platform

- Provides governance through the UNI token

- Liquidity: Users can provide liquidity to earn fees

- Usage: Highly popular for decentralized finance (DeFi) activities.

2. SushiSwap

SushiSwap started as a fork of Uniswap but has since grown to become a major player in the DEX space, offering additional features and a community-driven approach.

- Founded Year: 2020

- Founded by: Anonymous developer known as Chef Nomi

- Fees: 0.3% per trade (0.25% to liquidity providers, 0.05% to the Sushi treasury)

- Key Features:

- SushiBar for staking SUSHI tokens to earn rewards

- BentoBox for lending and margin trading

- Supports token swaps across multiple blockchains

- Governance through the SUSHI token

- Liquidity Mining: Users can stake liquidity provider tokens to earn SUSHI rewards

- Additional Services: SushiSwap offers more comprehensive DeFi services compared to traditional DEXs.

3. 1inch

1inch is a DEX aggregator that sources liquidity from various exchanges to provide users with the best possible trading rates. It enhances trading efficiency by splitting orders among multiple DEXs.

- Founded Year: 2019

- Founded by: Sergej Kunz and Anton Bukov

- Fees: Vary depending on the liquidity source, but typically lower due to aggregation

- Key Features:

- Aggregates liquidity from multiple DEXs to offer optimal prices

- Supports a wide range of tokens and trading pairs

- Uses the 1INCH token for governance and staking

- Liquidity Pools: Provides options to stake in various liquidity pools

- Security: Known for implementing advanced security measures to protect users

- Cross-Chain Swaps: Allows token swaps across different blockchains.

These Ethereum-based DEXs provide users with efficient trading options and diverse features, making them some of the top decentralized exchanges in 2024. They stand out for their innovative approaches, user control over funds, and ability to connect seamlessly with multiple blockchains, enhancing the overall crypto trading experience.

Related: Best DeFi Wallets: Top 10 List for 2024

Binance Smart Chain DEXs

Binance Smart Chain (BSC) hosts several prominent decentralized exchanges (DEXs) that offer efficient trading options and a wide array of trading pairs.

These exchanges are known for their low fees and fast transaction speeds.

Below are detailed descriptions of three leading BSC DEXs: PancakeSwap, BakerySwap, and Venus.

1. PancakeSwap

PancakeSwap is one of the most popular decentralized exchanges on Binance Smart Chain. It uses an automated market maker (AMM) model similar to Uniswap but offers several unique features and lower fees.

- Founded Year: 2020

- Founded by: Anonymous developers

- Fees: 0.25% per trade

- Key Features:

- Uses liquidity pools for token swaps

- Supports yield farming and staking for additional income

- Lottery system and NFT market integration

- Governance through the CAKE token

- Liquidity Mining: Users can earn CAKE by providing liquidity to various pools

- Community: Strong community support and frequent updates.

2. BakerySwap

BakerySwap is another leading DEX on Binance Smart Chain, known for its unique approach to combining decentralized finance (DeFi) and non-fungible tokens (NFTs).

- Founded Year: 2020

- Founded by: Anonymous developers

- Fees: 0.30% per trade

- Key Features:

- Combines AMM with NFT marketplace

- Supports staking and yield farming with BAKE rewards

- Low fees compared to Ethereum-based DEXs

- NFT launchpad and bakery-themed NFTs

- Liquidity Pools: Provides incentives for liquidity providers through BAKE rewards

- Innovation: Continues to introduce new DeFi and NFT products.

3. Venus

Venus is a decentralized money market and stablecoin platform built on Binance Smart Chain. It allows users to borrow against their crypto assets and earn interest.

- Founded Year: 2020

- Founded by: Swipe (later acquired by Binance)

- Fees: Variable interest rates for borrowing and lending

- Key Features:

- Supports a wide range of cryptocurrencies for collateral

- Generates VAI, a synthetic stablecoin pegged to USD

- Governance through the XVS token

- Integration with other DeFi platforms for enhanced liquidity

- Borrowing and Lending: Users can earn interest by supplying assets to the protocol and use those assets as collateral for loans

- Stability: Focuses on providing stable, decentralized financial services.

These Binance Smart Chain DEXs provide a robust and user-friendly platform for both beginners and experienced traders.

They offer lower trading fees and faster transactions compared to Ethereum-based exchanges, making them an attractive option in the world of decentralized cryptocurrency exchanges.

Related: 8 Best Crypto Staking Platforms in 2024

Solana-Based DEXs

Solana-based decentralized exchanges (DEXs) are renowned for their high transaction throughput and low fees, making them popular choices among traders.

Here are details on three leading Solana-based DEXs: Serum, Raydium, and Orca.

1. Serum

Serum is one of the leading decentralized exchanges on the Solana network, designed to offer a trading experience similar to centralized exchanges but with the benefits of decentralization.

- Founded Year: 2020

- Founded by: Sam Bankman-Fried and the Serum Foundation

- Fees: Varies, typically very low due to Solana’s low gas fees

- Key Features:

- Fully limit order-based trading interface

- Deep liquidity and tight spreads

- Near-instant finality of transactions

- Governance through the SRM token

- Integration with other Solana DeFi projects

- Technology: Leverages Solana’s high-speed blockchain for efficient trading

- Liquidity: Access to a large liquidity pool, reducing slippage.

2. Raydium

Raydium is a Solana-based automated market maker (AMM) and liquidity provider that powers the Solana DeFi ecosystem.

- Founded Year: 2021

- Founded by: AlphaRay and XRay

- Fees: 0.25% per trade

- Key Features:

- Shares liquidity with Serum

- Central order book mechanism

- Fast, low-fee transactions

- Supports yield farming and staking

- Governance through the RAY token

- Integration: Connects with Serum for deep liquidity and order book trades

- User Experience: Combines AMM efficiency with the reliability of an order book system.

3. Orca

Orca is a user-friendly decentralized exchange on Solana known for its simplicity and ease of use.

- Founded Year: 2021

- Founded by: Yutaro Shintaku and Grace Kwan

- Fees: 0.30% per trade

- Key Features:

- Simple, intuitive interface

- Supports SPL token trading

- Incentivized token pools for liquidity providers

- Governance through the ORCA token

- Low transaction fees due to Solana’s efficient blockchain

- User-Friendly: Designed to be beginner-friendly with a focus on simplicity

- Liquidity Pools: Users can earn rewards by providing liquidity.

These Solana-based DEXs offer efficient trading options, leveraging Solana’s fast and cost-effective blockchain.

They stand out among decentralized exchanges for their unique features, making them some of the best decentralized crypto exchanges in 2024.

Related: The Best Cold Wallets for Crypto in 2024: Unlock the Ultimate Security

Polygon-Based DEXs

Polygon-based decentralized exchanges (DEXs) are highly efficient, providing low transaction fees and fast transaction speeds.

Here are detailed descriptions of three leading Polygon-based DEXs: QuickSwap, DFYN, and SushiSwap.

1. QuickSwap

QuickSwap is the largest decentralized exchange on the Polygon network. It provides a range of features that cater to both new and experienced traders.

- Founded Year: 2020

- Founded by: Nick Mudge and Sameep Singhania

- Fees: 0.3% per trade

- Key Features:

- Utilizes on-chain liquidity pools for token swaps

- Supports a wide range of ERC-20 tokens deployed on Polygon

- Offers lending and prediction markets, single token staking, and GameFi

- High trade volume, providing ample liquidity for users

- Governance through the QUICK token

- Liquidity Pools: Enables liquidity providers to earn rewards from trading pools

- User Base: One of the most active DEXs on Polygon, ideal for traders looking for a robust trading platform.

2. DFYN

DFYN is a multi-chain DEX that operates on the Polygon network, offering a wide range of trading pairs and liquidity options.

- Founded Year: 2021

- Founded by: DFYN Network team

- Fees: 0.2% per trade

- Key Features:

- Multi-chain capabilities, allowing token swaps across different blockchains

- Integration with the Router Protocol for seamless cross-chain swaps

- Supports liquidity mining and yield farming

- Governance through the DFYN token

- High-speed transactions and low fees due to Polygon’s efficient infrastructure

- Liquidity Pools: Incentivizes liquidity providers with DFYN rewards

- User Experience: Focuses on providing a seamless and efficient trading experience across multiple chains.

3. SushiSwap

SushiSwap is a well-known decentralized exchange that operates across multiple blockchains, including Polygon. It has expanded its offerings to include various DeFi services.

- Founded Year: 2020

- Founded by: Chef Nomi

- Fees: 0.3% per trade

- Key Features:

- Automated market maker (AMM) model for token swaps

- Supports trading across multiple EVM-compatible networks and Layer-2 solutions

- Governance through the SUSHI token

- Offers staking, yield farming, and SushiBar for earning rewards

- Expansive DeFi ecosystem with additional features like lending and NFT marketplace

- Liquidity Pools: Provides incentives for liquidity providers through SUSHI rewards

- Community: Strong community support and continuous development, making it a versatile choice among DEXs.

These Polygon-based DEXs offer diverse and efficient trading options, leveraging Polygon’s low fees and high transaction speeds. They are key players among decentralized exchanges, providing users with a range of trading pairs and innovative DeFi features.

Avalanche-Based DEXs

Avalanche-based decentralized exchanges (DEXs) offer low fees and high-speed transactions, making them attractive options in the DeFi ecosystem.

Here are details on three prominent Avalanche-based DEXs: Trader Joe, Pangolin, and Yield Yak.

1. Trader Joe

Trader Joe is a versatile decentralized exchange and DeFi platform on the Avalanche network. It combines trading, lending, and yield farming in one place.

- Founded Year: 2021

- Founded by: Anonymous developers

- Fees: 0.3% per trade

- Key Features:

- Liquidity Book: A novel AMM providing efficient liquidity management

- Comprehensive DeFi Platform: Supports token swaps, yield farming, lending, and borrowing

- NFT Marketplace: Allows users to buy, sell, and trade NFTs

- Governance: Utilizes the JOE token for governance and staking rewards

- High Liquidity: Offers deep liquidity for various trading pairs

- User Experience: Known for its user-friendly interface and comprehensive DeFi tools.

2. Pangolin

Pangolin is a community-driven DEX on Avalanche that offers fast transactions and low fees, with a focus on community involvement and governance.

- Founded Year: 2021

- Founded by: Ava Labs

- Fees: 0.3% per trade

- Key Features:

- Community Governance: Users can vote on proposals using PNG tokens

- Token Swaps: Supports a wide range of token pairs, including AVAX and ERC-20 tokens

- Liquidity Mining: Incentivizes liquidity providers with PNG rewards

- Low Fees: Benefits from Avalanche’s low transaction costs

- High Throughput: Can handle thousands of transactions per second

- Decentralization: Fully decentralized and community-governed.

3. Yield Yak

Yield Yak is a DeFi yield farming platform and DEX aggregator on Avalanche, known for auto-compounding rewards and providing efficient yield strategies.

- Founded Year: 2021

- Founded by: Anonymous developers

- Fees: Varies, typically lower due to auto-compounding efficiency

- Key Features:

- Auto-Compounding: Automatically reinvests farming rewards to maximize returns

- DEX Aggregator: Aggregates liquidity from multiple DEXs to offer the best prices

- Liquidity Pools: Offers various pools with competitive yields

- Yak Swap: Facilitates seamless token swaps across different pools

- Governance: Uses the YAK token for community proposals and decisions

- User Benefits: Simplifies yield farming by automating the compounding process.

These Avalanche-based DEXs provide efficient trading and yield farming options, leveraging Avalanche’s fast and low-cost infrastructure.

They are among the best decentralized exchanges in 2024, offering unique features and benefits tailored to different trading and investment needs.

Features and Benefits of Using DEXs

Decentralized exchanges (DEXs) offer several advantages over traditional centralized exchanges, making them popular choices for cryptocurrency trading. Below are key features and benefits of using DEXs.

Non-Custodial Trading

Non-custodial trading is a fundamental feature of DEXs. Unlike centralized exchanges, DEXs do not hold users’ funds. Instead, users maintain control of their assets through their wallets.

This setup reduces the risk of hacks and thefts commonly associated with centralized exchanges, as users’ funds are not stored in a central location.

DEXs like Uniswap and SushiSwap exemplify non-custodial trading, providing users with a secure platform to trade directly from their wallets.

Privacy and Permissionless Access

DEXs prioritize user privacy and operate without requiring extensive personal information or identity verification. This permissionless access allows anyone with an internet connection and a compatible wallet to trade.

It contrasts sharply with centralized exchanges, which often require users to undergo KYC (Know Your Customer) processes.

DEXs offer a more inclusive and accessible trading environment, making them a preferred choice for users valuing privacy and autonomy.

Early Access to New Tokens

DEXs often list new tokens earlier than centralized exchanges. This early access can be advantageous for traders looking to invest in emerging projects before they gain wider recognition and potentially increase in value.

The decentralized nature of DEXs facilitates the listing of a broader range of tokens, providing users with opportunities to discover and trade new assets.

This feature is particularly beneficial for those looking to diversify their cryptocurrency portfolio and capitalize on early-stage investments.

Enhanced Composability in DeFi

Decentralized exchanges are integral to the decentralized finance (DeFi) ecosystem, enhancing composability. Composability refers to the ability of DeFi protocols to interact seamlessly with one another, creating a more interconnected financial system.

DEXs enable various DeFi applications, such as lending platforms, yield farming, and synthetic assets, to integrate and work together.

This synergy allows users to leverage multiple DeFi services to optimize their trading strategies and maximize returns.

Platforms like Balancer and dYdX illustrate this enhanced composability by providing users with sophisticated tools and options within the DeFi landscape.

Challenges and Risks of Decentralized Exchanges

Decentralized exchanges (DEXs) offer many benefits, but they also come with unique challenges and risks. Understanding these issues is crucial for anyone looking to get started trading on DEXs.

Increased User Responsibility

When using DEXs, users must take full responsibility for their funds and transactions. Unlike centralized exchanges where a support team can assist with issues, DEX users must manage their wallets, private keys, and backups.

If a user loses access to their wallet or makes a mistake in a transaction, there is no way to recover the funds.

This increased responsibility requires users to be vigilant and knowledgeable about secure cryptocurrency practices.

Higher Transaction Fees

DEXs, particularly those built on Ethereum, often have higher transaction fees compared to centralized exchanges.

These fees, known as gas fees, can fluctuate significantly based on network congestion. For users conducting frequent or large transactions, these costs can add up quickly.

While Layer 2 solutions and other blockchains offer lower fees, Ethereum-based DEXs like Uniswap often face this challenge.

Risk of Sandwich Attacks

A specific risk in the DEX ecosystem is the possibility of sandwich attacks. In this scenario, a malicious actor observes a pending transaction, places a higher fee transaction to front-run it, and then another transaction to sell immediately after the user’s transaction, manipulating the price for profit.

This risk is inherent in transparent blockchain transactions and requires users to be cautious and potentially use advanced tools to mitigate such risks.

No Legal Recourse

DEXs operate in a decentralized and often anonymous manner, making it difficult for users to seek legal recourse in the event of fraud or disputes.

Unlike centralized exchanges, which may offer some form of customer service or legal framework, DEXs leave users with limited options if something goes wrong.

This legal ambiguity can be a significant deterrent for users who are not comfortable with the high level of personal responsibility required.

Security Measures in DEXs

Decentralized exchanges (DEXs) employ several security measures to protect users and ensure safe trading environments. Here are some of the key security practices commonly used in DEXs.

Smart Contract Audits

Smart contract audits are critical for ensuring the security of decentralized exchanges. These audits involve thorough examinations of the smart contract code by security experts to identify and fix vulnerabilities.

Audits help prevent exploits that could lead to loss of funds. Platforms like Uniswap and dYdX often undergo multiple audits by reputable firms to ensure their contracts are secure and trustworthy.

Decentralized Governance

Decentralized governance allows the community of token holders to participate in decision-making processes.

This approach ensures that no single entity has complete control over the platform, reducing the risk of malicious actions.

Governance tokens, such as Uniswap’s UNI and Compound’s COMP, enable users to vote on proposals and changes to the protocol, enhancing transparency and security within the ecosystem.

User Security Practices

Users play a crucial role in maintaining security on DEXs. It’s essential for users to follow best practices, such as using hardware wallets, enabling two-factor authentication, and regularly updating their software.

Additionally, users should be cautious of phishing attacks and double-check the URLs of DEX platforms to avoid scams.

Educating users about these practices helps protect their assets and contributes to the overall security of the decentralized finance (DeFi) ecosystem.

Comparing DEXs with Centralized Exchanges (CEXs)

Decentralized exchanges (DEXs) and centralized exchanges (CEXs) serve the same purpose of enabling cryptocurrency trading but operate in fundamentally different ways. Here’s a comparison of key features and characteristics of DEXs and CEXs.

| Feature | Decentralized Exchanges (DEXs) | Centralized Exchanges (CEXs) |

|---|---|---|

| Control of Funds | Users maintain control through their wallets | Exchange holds users’ funds in custodial accounts |

| Security | Reduced risk of hacking due to non-custodial nature | Higher risk due to centralized storage of funds |

| Privacy | High, no KYC/AML requirements | Lower, requires KYC/AML for compliance |

| Transaction Speed | Depends on blockchain network speed | Generally faster, uses internal databases |

| Fees | Can be high due to blockchain gas fees | Generally lower, but can vary widely |

| Access to Tokens | Often list new tokens quicker | More selective, slower listing process |

| User Experience | Can be complex, less user-friendly | Generally more user-friendly |

| Regulation | Mostly unregulated | Heavily regulated to ensure compliance |

| Liquidity | Lower, fragmented across multiple pools | Higher, centralized order books provide deep liquidity |

| Innovation | Rapid, due to open-source and community-driven development | Slower, due to centralized control and regulatory compliance |

Key Takeaways

- Control and Security: DEXs provide users with more control over their funds and typically offer higher security due to the non-custodial nature, whereas CEXs can be more susceptible to hacks since they hold users’ funds centrally.

- Privacy: DEXs offer higher privacy as they do not require extensive personal information, unlike CEXs, which follow strict KYC/AML regulations.

- Transaction Speed and Fees: While CEXs usually offer faster transactions and potentially lower fees, DEXs’ speed and fees depend on the underlying blockchain’s performance.

- Access to New Tokens: DEXs often list new tokens faster than CEXs, providing early access to new investment opportunities.

- User Experience: CEXs generally provide a more user-friendly experience compared to DEXs, which can be more complex and intimidating for beginners.

Both DEXs and CEXs have their unique advantages and disadvantages. Users should consider their specific needs, such as security, privacy, and ease of use, when choosing between different decentralized exchanges and centralized exchanges. This comparison can help users find the best platform for their trading needs.

Conclusion

- Decentralized exchanges offer high security, privacy, and control over funds.

- DEXs like Uniswap and SushiSwap provide early access to new tokens and are integral to the DeFi ecosystem.

- Users need to manage their own wallets and understand smart contract risks.

- DEXs often have higher transaction fees but offer innovative features and decentralized governance.

- Comparing DEXs with centralized exchanges highlights differences in control, privacy, speed, and user experience.

- When choosing between platforms, consider liquidity, user experience, and security.

- Using the 10 best Decentralized exchanges can optimize your trading strategies and protect your assets.

FAQs of Best Decentralized Crypto Exchanges

Which decentralized exchange is best?

Uniswap is often considered the best decentralized exchange due to its high liquidity, extensive token listings, and user-friendly interface. It pioneered the automated market maker (AMM) model, which many other DEXs have adopted.

Which crypto is the most decentralized?

Bitcoin is the most decentralized cryptocurrency. It has a vast and distributed network of miners and nodes, ensuring no single entity controls the network. This decentralization makes Bitcoin secure and resistant to censorship.

What is the biggest DEX in crypto?

Uniswap is the largest DEX in terms of trading volume and liquidity. It supports a wide range of tokens and has become a cornerstone of the DeFi ecosystem, facilitating billions of dollars in trades monthly.

What are decentralized crypto exchanges?

Decentralized crypto exchanges (DEXs) are platforms that enable users to trade cryptocurrencies directly from their wallets without relying on a central authority. They use smart contracts to execute trades, ensuring users maintain control over their funds.

What is the safest DEX?

dYdX is considered one of the safest DEXs due to its robust security measures, including thorough smart contract audits and a focus on user protection. It also offers advanced trading features like perpetual contracts and margin trading.

Which decentralized exchange has the lowest fees?

PancakeSwap, built on the Binance Smart Chain, is known for its low transaction fees. It offers similar functionalities to Ethereum-based DEXs but with significantly lower gas costs, making it a cost-effective option for traders.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.

- CoinGecko: Popular Decentralized Exchanges Ranked

- CoinLedger: Best Decentralized Exchanges

- Koinly: Best Decentralized Exchanges

- Binance Academy: What are Decentralized Exchanges (DEX)?

- CryptoSlate: Top Decentralized Crypto Exchanges

- CoinDesk: Understanding Decentralized Exchanges

- Decrypt: The Best Decentralized Exchanges for 2024