Overview of the Token/Coin

Token History and Background

Neon EVM, developed by Neon Labs, launched in 2021 to bridge Ethereum and Solana ecosystems. The founding team includes CEO Marina Guryeva, CTO Andrey Falaleyev, CPO Yuriy Yurchenko, Product Manager Arkadii Irincheev, and Head of Development Semen Medvedev.

In 2023, Neon EVM achieved significant milestones:

- Mainnet Launch: Neon EVM’s mainnet went live, enabling Ethereum-compatible dApps to operate on Solana without code modifications.

- Performance Benchmark: It became the world’s first parallel processing EVM, achieving 730 transactions per second (TPS) on the mainnet.

- Strategic Partnerships: Collaborations with deBridge, TrustWallet, and Ledger enhanced cross-chain interoperability and user accessibility.

These developments position Neon EVM as a pivotal player in blockchain interoperability, combining Ethereum’s versatility with Solana’s scalability.

Tokenomics and Supply Details

Total and Circulating Supply Analysis

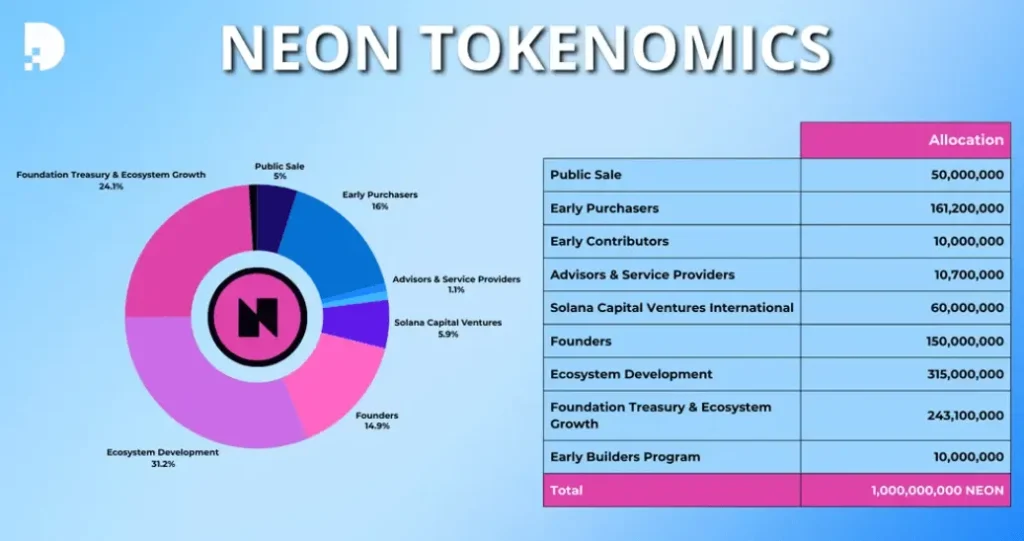

Neon EVM’s native token, NEON, has a fixed total supply of 1 billion tokens. Its circulating supply currently stands at approximately 57.65 million tokens, with the remaining tokens allocated for ecosystem development, partnerships, and long-term growth strategies. The token supply is carefully structured to ensure controlled distribution, supporting network stability and future scalability.

Market Capitalization Trends and Liquidity Data

The current market capitalization of Neon EVM is around $21.45 million. Liquidity is supported through active listings on major cryptocurrency exchanges, enabling seamless trading and price discovery.

Trading volume reflects investor interest and ensures sufficient liquidity to facilitate transactions without significant price fluctuations. This balance supports growth while reducing the risk of market manipulation.

Distribution Model (Staking, Pre-Mine, or Mining)

The distribution model for NEON tokens is designed to promote sustainable growth and ecosystem expansion. About 31.5% of the tokens are allocated for ecosystem development, funding innovation, and enhancing platform features.

Another 24.31% is reserved by the Neon DAO to support governance, community activities, and future upgrades.

Early purchasers received 16.12% of the tokens, subject to vesting schedules and lock-up periods to maintain price stability. Founders and team members hold 15% of the supply, also subject to vesting, ensuring long-term involvement and commitment.

Strategic partners and advisors were allocated 7.02% to reward their contributions to the project. Additionally, 5% of the tokens were sold through public offerings to encourage decentralized participation, while 1% was set aside for early contributors who played key roles in the initial phases of development.

Utility and Use Cases

Primary Use Cases in Decentralized Applications (dApps)

Neon EVM allows Ethereum-based decentralized applications (dApps) to operate on the Solana blockchain. It enables developers to deploy Ethereum-compatible smart contracts without modifying their code, making it easier to migrate projects while benefiting from Solana’s speed and low fees.

The platform supports DeFi applications such as decentralized exchanges (DEXs), lending platforms, and automated market makers. Neon EVM improves scalability, reduces costs, and simplifies cross-chain interactions, making it ideal for developers and users seeking faster and more efficient blockchain solutions.

Partnerships and Collaborations within the Ecosystem

Neon EVM has formed strategic partnerships to strengthen its ecosystem and promote cross-chain functionality. Collaborations with infrastructure providers support integration with wallets, cross-chain bridges, and multi-chain DeFi platforms.

These partnerships focus on improving interoperability, liquidity management, and decentralized trading. Through alliances with developers and financial platforms, Neon EVM is expanding its utility and ensuring compatibility with Ethereum tools, enhancing its adoption in the blockchain space.

Real-World Applications, Including DeFi, Payments, and NFTs

Neon EVM is widely used in decentralized finance (DeFi) applications, offering solutions for lending, staking, and liquidity provisioning. It supports seamless transactions, reduces fees, and enhances trading efficiency for DeFi users. Payments and settlements using Neon EVM leverage Solana’s low-cost infrastructure, making it suitable for microtransactions and remittances.

In addition, Neon EVM integrates with NFT platforms, enabling the creation, trading, and management of non-fungible tokens. This versatility makes Neon EVM a key player in bridging DeFi, NFTs, and payment systems across multiple blockchains.

Price History and Key Performance Trends

Neon EVM launched with an initial price of approximately $0.50. Early trading patterns showed steady growth as the project gained traction in the crypto market, driven by its integration of Ethereum dApps with Solana’s high-speed infrastructure.

Shortly after launch, Neon EVM experienced increased trading volume due to investor interest in its cross-chain compatibility and scalability solutions.

The all-time high for Neon EVM reached approximately $3.96, reflecting strong early adoption and market optimism. However, like most cryptocurrencies, it also faced corrections, with its lowest recorded price near $0.03 during periods of market uncertainty. Historical price movements indicate volatility influenced by broader crypto trends and investor sentiment.

Major updates, such as the mainnet launch, partnerships with DeFi platforms, and wallet integrations, contributed to price spikes. Listings on major exchanges increased liquidity and visibility, further impacting its performance.

Events like collaborations with cross-chain bridges and NFT platforms also played a key role in maintaining investor confidence and improving price stability.

Related: Catizen Coin Price Prediction: Will CATI Reach New Heights in 2025, 2030, and Beyond?

Price Predictions and Forecasts

Neon EVM (NEON) has garnered attention in the cryptocurrency market, prompting analyses of its future price trajectory.

Short-Term Predictions (2025–2026)

Analysts offer varying forecasts for NEON’s short-term performance. One projection suggests that by the end of 2025, NEON could reach a price between $1.04 and $1.24, with an average around $1.17.

Another analysis anticipates a price of approximately $0.7860 by the end of 2025, indicating a cumulative return on investment (ROI) of about 95.28%.

These predictions are influenced by factors such as market sentiment, technological advancements, and overall cryptocurrency market trends.

Long-Term Predictions (2030 and Beyond)

Long-term forecasts for NEON suggest potential growth, though estimates vary. One source predicts that by 2030, NEON’s price could reach approximately $1.29, representing a cumulative ROI of about 220.31%.

Another analysis indicates that NEON might achieve a price of $1.24 by the end of 2025, with the possibility of reaching higher values in subsequent years.

These projections consider factors such as increased adoption, technological innovations, and the expansion of decentralized finance (DeFi) and interoperability within the blockchain ecosystem.

Related: Hoppy Coin Price Prediction 2025: HOPPY Price & Market Cap Insights

Price Prediction Table

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2025 | $0.39 | $0.46 | $4.23 |

| 2026 | $0.42 | $0.55 | $4.50 |

| 2030 | $0.38 | $2.50 | $2.86 |

Risks and Opportunities

Investing in Neon EVM involves various risks and opportunities that potential investors should consider.

Risks and Challenges

- Market Volatility and Liquidity Concerns: The cryptocurrency market is known for its volatility, with prices subject to rapid and unpredictable changes. Neon EVM’s value may experience significant fluctuations, impacting investment stability.

- Security Risks Related to Smart Contracts and Network Vulnerabilities: As a platform that facilitates decentralized applications (dApps), Neon EVM relies on the security of its smart contracts and underlying network. Vulnerabilities or exploits could lead to financial losses and damage to its reputation.

- Regulatory Uncertainty and Compliance Challenges Impacting Adoption: The evolving regulatory landscape for cryptocurrencies poses challenges. Unclear or changing regulations can affect Neon EVM’s operations and its acceptance in various jurisdictions.

- Dependence on Developer Support and Future Technological Upgrades: The success of Neon EVM depends on continuous development and technological advancements. A lack of developer engagement or delays in upgrades could hinder its growth and competitiveness.

Growth Opportunities

- Expanding Use Cases in DeFi, Web3 Applications, and Payments: Neon EVM’s compatibility with Ethereum and Solana positions it to support a wide range of decentralized finance (DeFi) applications, Web3 projects, and payment solutions, broadening its market reach.

- Institutional Adoption and Strategic Partnerships: Collaborations with established financial institutions and strategic partners can enhance Neon EVM’s credibility and facilitate its integration into mainstream financial systems.

- Scalability Improvements and Integrations with Ethereum and Solana: By leveraging the strengths of both Ethereum and Solana, Neon EVM can offer scalable solutions that attract developers seeking efficient and cost-effective platforms for their applications.

- Innovations in Decentralized Finance Driving Wider Adoption: Continuous innovation in DeFi services, such as lending, staking, and liquidity provisioning, can drive user adoption and increase the utility of Neon EVM within the crypto ecosystem.

Frequently Asked Questions

What is the price target for Neon?

Price predictions for Neon EVM vary. Some forecasts suggest it could reach around $0.5738 by the end of 2029.

What is the max supply of Neon EVM?

Neon EVM has a maximum supply of 1 billion NEON tokens.

How much does Neon sell for?

As of January 3, 2025, Neon EVM is priced at approximately $0.375 per token.

What is Neon crypto used for?

Neon EVM is a platform that allows Ethereum smart contracts to run on the Solana blockchain, combining Solana’s speed and low fees with Ethereum’s versatility.

H2: Conclusion

Neon EVM offers a scalable and cost-effective environment for Ethereum-compatible decentralized applications (dApps), leveraging Solana’s high-speed infrastructure to enhance performance and reduce transaction costs.

In the short term, Neon EVM’s growth is influenced by adoption trends and strategic partnerships. Collaborations with platforms like Aave, which voted to deploy Aave V3 onto Neon EVM mainnet, signify increasing integration within the decentralized finance (DeFi) ecosystem.

Long-term success depends on technological advancements and network expansions. Developments such as achieving parallel processing capabilities with a throughput of 730 transactions per second demonstrate Neon EVM’s commitment to innovation and scalability.

Price predictions indicate potential gains; for instance, forecasts suggest that Neon EVM could reach approximately $0.7860 by the end of 2025, reflecting a cumulative return on investment of about 95.28%.

However, the cryptocurrency market’s inherent volatility necessitates careful consideration.

Investors should conduct thorough research, stay informed about market trends, and diversify their portfolios to manage risks effectively. Consulting financial advisors and utilizing reliable sources can aid in making informed investment decisions.