TL;DR

Michael J Burry, known for his unique investment strategies and ability to predict market trends, has built a significant net worth throughout his career. Born in San Jose, California, Burry founded Scion Capital and made a name for himself with his bet against the subprime mortgage market. Despite controversies, his savvy investments have led to substantial returns. As of 2023, Michael Burry’s net worth is estimated to be $300 million. His story inspires investors, demonstrating the potential rewards of understanding and navigating the financial markets.

Introduction to Michael Burry

In the world of finance, few names resonate as strongly as Michael Burry, Known for his uncanny ability to predict market trends, Michael Burry net worth is a testament to his investment prowess.

Who is Michael Burry and His Role in Investment

Born on June 19, 1971, in San Jose, California, Michael J Burry showed an early interest in finance. He studied economics at the University of California, Los Angeles, and later earned his M.D. from the Vanderbilt University School of Medicine. However, Burry’s true passion lay in the financial markets.

In 2001, Burry founded Scion Capital LLC, a hedge fund that would soon make him a household name in the investment world. With initial capital from loans from his family and his inheritance, Burry grew the fund’s assets under management to over $600 million.

Burry’s investment strategy was unique. He focused on short positions, betting against market trends. This strategy was risky, but Burry was able to make it work. His most infamous bet came in 2005 when he predicted the subprime mortgage crisis. He persuaded investment firms to sell him credit default swaps against vulnerable subprime deals. This bet was initially a loser, but Burry held on. When the housing market crashed in 2008, he made a personal profit of $100 million and $700 million for his investors.

In 2013, Burry reopened his hedge fund called Scion Asset Management. His story serves as a reminder that it’s possible to make money in both uptrends and downtrends, a testament to the power of smart investing.

Michael Burry’s Early Life and Education

The journey of Michael Burry, the founder of Scion Capital LLC and a prominent figure in the financial crisis of 2008, is a fascinating one. His early life and education laid the foundation for his success as an investor and hedge fund manager.

The Rise of Michael Burry as an American Investor

Michael J Burry showed an early interest in finance and investing. Burry started his journey in the financial world by studying economics at the University of California, Los Angeles.

After completing his studies, Burry worked in Stanford Hospital’s neurology department. However, his passion for investing led him to leave his medical career. He went on to found Scion Capital LLC in 2001. The hedge fund started with a small investment from his family and quickly grew to manage over $600 million in assets.

Burry’s unique investment strategies, particularly his focus on shorting, set him apart in the financial world.

Michael Burry’s Life and Education: Building the Foundation of His Net Worth

Burry’s early life and education played a crucial role in building the foundation of his net worth. His study of economics provided him with the knowledge to understand market trends and make informed investment decisions.

Burry’s time at Stanford also shaped his approach to investing. He argued that anyone capable of making money to the downside could make billions by shorting, a strategy he used effectively at his hedge fund, Scion Capital.

In 2021, Elon Musk responded to Michael Burry’s bet against Tesla, inferring that Michael Burry is a one-trick pony. However, Burry’s biography shows a man who has consistently made successful investments, proving he is more than capable of making money in the financial markets. His net worth is estimated to be $300 million as of 2023, a testament to his investment prowess.

Michael Burry Net Worth in 2023

As we delve into the financial standing of Michael Burry, it’s essential to understand the factors that have contributed to his net worth.

Michael Burry Net Worth: The Known and Unknown

Michael Burry net worth is estimated to be $300 million as of 2023. This figure is a testament to his investment prowess and his ability to make strategic decisions in the financial market. However, the exact figure could be higher or lower, as the value of personal investments can fluctuate with market conditions.

Factors Contributing to Michael Burry’s Net Worth

Several factors have contributed to Michael Burry’s net worth:

- Scion Capital: Burry was the founder of the hedge fund called Scion Capital. He started the fund after receiving loans from his family, and it quickly grew to manage over $600 million in assets.

- Subprime Mortgage Bet: Burry became famous for his bet against the subprime mortgage market in 2005. He was able to earn a personal profit of $100 million and $700 million for his investors during the financial crisis of 2008.

- Investment Strategy: Burry’s unique investment strategy has played a significant role in building his net worth. He often takes short positions, betting against market trends. This strategy is risky but can lead to high returns if the predictions are correct.

- Personal Investments: Besides his work with Scion Capital, Burry has also made significant personal investments. These investments contribute to his net worth, although the exact value can fluctuate with market conditions.

In conclusion, Michael Burry’s net worth is a reflection of his investment skills, strategic decisions, and the success of his hedge fund, Scion Capital. His story serves as an inspiration for investors and a testament to the potential rewards of understanding and navigating the financial markets.

Influence of the Investment Market on Michael Burry’s Net Worth

The investment market has played a significant role in shaping Michael Burry’s net worth. His ability to understand and predict market trends has been a key factor in his financial success.

How Investments and Bets Impact Michael Burry’s Net Worth

Michael Burry net worth has been significantly impacted by his investments and bets. His ability to predict market trends has been instrumental in his financial success. For instance, Burry initiated a bet against the subprime mortgage market in 2005, a move that was seen as risky at the time. However, Burry was able to earn a personal profit of $100 million and $700 million for his investors when the housing market crashed in 2008. This bet alone significantly increased his net worth.

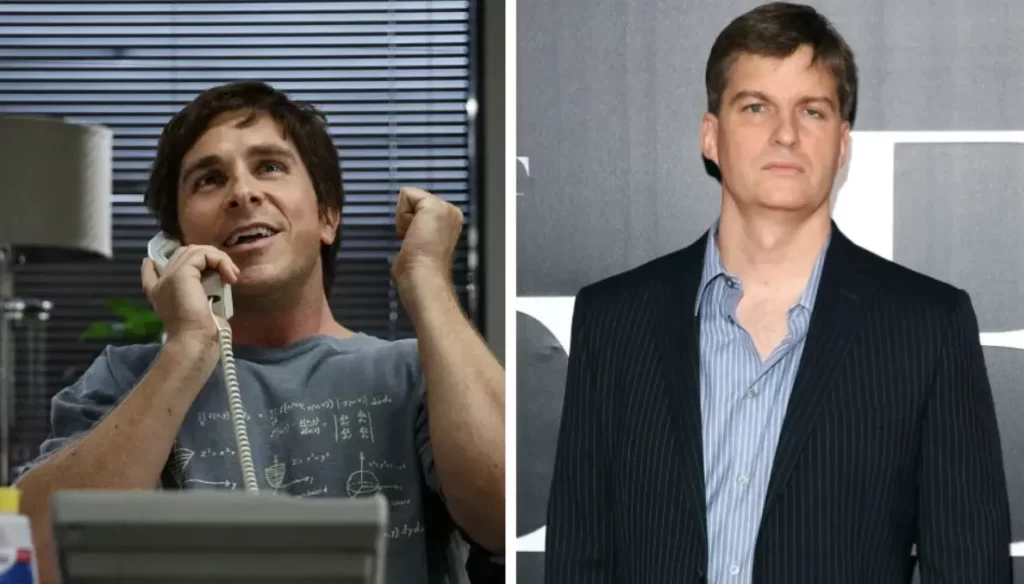

Burry’s investment strategy often involves betting against market trends, a strategy known as shorting. This was notably depicted in the movie “The Big Short,” based on the book by Michael Lewis, which tells the story of how Burry was able to predict the financial crisis of 2008. While this strategy carries a high level of risk, it can lead to high returns if the predictions are correct, as was the case with Burry’s bet against the subprime mortgage market.

Michael Burry: A Net Worth Shaped by Investment Market Volatility

Investment market volatility has also played a significant role in shaping Michael Burry’s net worth. The value of investments can fluctuate with market conditions, leading to potential gains or losses. Burry’s ability to understand and navigate this volatility has been a key factor in his financial success.

For instance, Burry was able to make billions by shorting the subprime mortgage market ahead of the 2008 financial crisis. This move was seen as risky at the time, but Burry’s understanding of the market allowed him to make a significant profit when the housing market crashed.

Michael Burry in 2023: Current Ventures

As of 2023, Michael Burry is focusing on his personal investments and new ventures in the investment market.

Michael Burry: New Ventures in Investment

After closing Scion Capital, Burry turned his attention to his personal investments. He has made significant investments in various sectors, including gold, water, and farmland. These investments represent a shift in focus from his previous strategy of shorting the market.

Burry’s new ventures in investment also include large investments in companies like Facebook and Google’s parent company, Alphabet Inc. These investments represent a belief in the potential of these companies and their ability to generate significant returns.

H3: Potential Impact of Future Projects on Michael Burry’s Net Worth

Future projects and investments could significantly impact Michael Burry’s net worth. His current investments in gold, water, and farmland, as well as his large investments in Facebook and Alphabet Inc., could lead to substantial returns if they prove successful.

However, these investments also carry a level of risk. The value of these investments can fluctuate with market conditions, and there is no guarantee of a return. Despite this, Burry’s track record and understanding of the market suggest that he is well-positioned to navigate these risks and potentially generate significant returns.

In conclusion, Michael Burry net worth is a reflection of his investment skills, strategic decisions, and the success of his hedge fund, Scion Capital. His story serves as an inspiration for investors and a testament to the potential rewards of understanding and navigating the financial markets.

- Also Read: Justin Sun Net Worth in 2023: The Journey of the Chinese Entrepreneur and Founder of TRON

Michael Burry’s Public Image and Controversies

Michael Burry’s public image and the controversies surrounding him have been as intriguing as his investment strategies. His unique approach to investing and his ability to predict market trends have earned him a reputation as a maverick in the investment world.

Public Perception of Michael Burry: The Subprime Mortgage Bet

Michael J Burry is often seen as a maverick in the investment world. His unique approach to investing and his ability to predict market trends have earned him a reputation as a savvy investor. However, his predictions and investment strategies have also been controversial and have led to criticism.

His decision to bet against the subprime mortgage market ahead of the 2008 Great Recession was highly controversial at the time. However, Burry argued that anyone who understood the market could see the impending crash. His bet against the market ultimately proved to be correct, earning him a personal profit of $100 million and $700 million for his investors.

Michael Burry, His Biography, and Controversies

Michael Burry’s biography is filled with tales of his unique investment strategies and the controversies that followed. His decision to bet against the subprime mortgage market was seen as risky and controversial at the time. However, Burry was able to earn significant profits for his investors when the market crashed in 2008.

Despite the controversies, Burry has remained steadfast in his investment strategies. He believes in his ability to understand and predict market trends, and his track record suggests that he is often correct. His unique approach to investing has allowed him to build a net worth estimated to be $300 million.

Conclusion: The Future of Michael Burry’s Net Worth

As we look to the future, it’s clear that Michael Burry net worth will continue to be influenced by his investment decisions and the performance of the market.

Recap: How Did Michael Burry Build His Net Worth?

Michael Burry built his net worth through savvy investments, most notably his prediction of the 2008 real estate market crash. His unique approach to investing and his ability to predict market trends have earned him substantial returns.

Burry started his hedge fund, Scion Capital, with loans from his family. The fund quickly grew to manage over $600 million in assets. His bet against the subprime mortgage market in 2005 led to a personal profit of $ 100 million and $ 700 million for his investors.

The Future of Michael Burry’s Net Worth: Growth and Changes Ahead

The future of Burry’s net worth will likely be influenced by his future investment decisions. His current focus on personal investments, as well as his large investments in Facebook and Alphabet Inc., could lead to substantial returns if they prove successful.

However, his net worth could also be impacted by market volatility and the risk associated with his investment strategies. Despite these risks, Burry’s track record and understanding of the market suggest that he is well-positioned to navigate these challenges and potentially generate significant returns.

In conclusion, Michael Burry’s net worth is a testament to his investment skills, strategic decisions, and the success of his hedge fund, Scion Capital. His story serves as an inspiration for investors and a testament to the potential rewards of understanding and navigating the financial markets.

Frequently Asked Questions

How much money is Dr Michael Burry worth?

As of 2023, Dr. Michael Burry, a renowned investor and founder of Scion Capital, has an estimated net worth of around $300 million. This wealth is largely attributed to his savvy investment strategies and his ability to predict market trends.

How much did Michael Burry make from the short?

Michael Burry made a personal profit of $100 million from his infamous bet against the subprime mortgage market in 2005. His investors also made $700 million from this bet.

How is Michael Burry investing in water?

Michael Burry has shown interest in water as an investment. However, the specifics of how he is investing in water are not publicly disclosed.

Who predicted 2008 crash?

Several individuals and entities predicted the 2008 crash. Among them, Michael Burry is notable for his accurate prediction of the subprime mortgage crisis, which led to the 2008 financial crash.

Who made the most money in 2008 financial crisis?

Several investors made significant profits during the 2008 financial crisis by shorting the market. Michael Burry is one of them, making a personal profit of $100 million and $700 million for his investors.