Overview of the LimeWire Token (LMWR)

LimeWire Token (LMWR) powers the LimeWire platform, enabling seamless transactions and interactions. Initially known as a file-sharing service, LimeWire was relaunched in 2022 as a decentralized platform for content creators and brands.

The updated LimeWire ecosystem focuses on digital collectibles and memberships, simplifying digital content creation and distribution across devices.

Token History and Background

LimeWire’s relaunch in 2022 marked a major transformation from its file-sharing roots to a blockchain-based platform. The LimeWire Token was introduced as a utility token, enabling payments, tips, and premium content access within its ecosystem.

The project achieved significant milestones, including its integration with Coinbase’s Base network and listing on Revolut, Europe’s largest neobank with over 45 million users.

LimeWire also conducted its first token burn, reducing the total supply by 165 million tokens—about 17.5%—to increase scarcity and value.

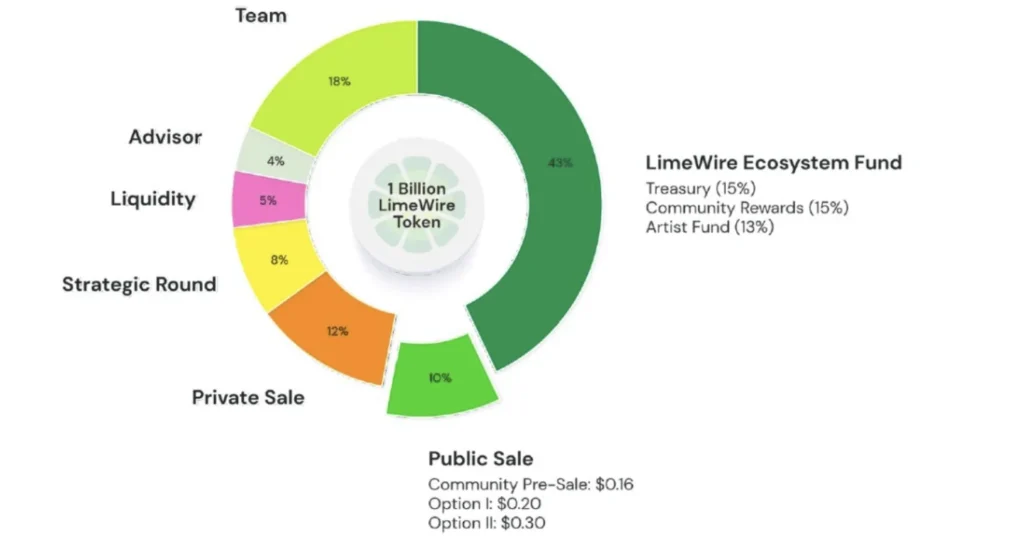

Tokenomics and Supply Details

- Total Supply, Circulating Supply, and Market Cap: LMWR has a fixed total supply of 1 billion tokens, ensuring no inflation. As of now, the circulating supply is approximately 309.38 million LMWR, with a market cap around $77.33 million.

- Distribution Model: The token allocation is as follows: LimeWire Ecosystem Fund (43%18%), Public Sale (10%), Private Sale (12%), Strategic Round (8%), Liquidity (5%), and Advisors (4%).

Utility and Use Cases

The LimeWire platform uses LMWR as its primary transaction token. Users can pay for subscription fees, tip content creators, and purchase digital collectibles.

The token’s integration with Coinbase’s Base network broadens its reach, making it more accessible to developers and traders.

LMWR also supports royalty distribution, providing creators with a reliable way to monetize their content. This use case solidifies its role in building a decentralized creator economy.

Price History and Key Performance Trends

LimeWire Token launched in March 2023 and experienced volatility during its initial trading phase. It reached an all-time high of $1.54 shortly after launch.

Since then, its price has declined, with recent trading values around $0.25.

The price movements have been influenced by major events, including new listings and integrations, such as its adoption on Coinbase’s Layer 2 Base network. These developments have increased accessibility and bolstered investor confidence.

Related: Vara Price Prediction 2025: VARA Crypto Market Cap Insights

LimeWire Crypto Price Predictions and Forecasts

LimeWire Token (LMWR) has drawn attention due to its potential growth in the cryptocurrency market.

Various limewire price predictions provide insights into its future performance, with both short-term and long-term forecasts based on market analysis and trends.

Short-Term Predictions (2024–2026)

Analysts predict a significant increase in LMWR’s value over the next few years. Estimates suggest the price could reach approximately $0.89 by early 2025, reflecting a rise of over 220% from its current price.

Some projections indicate that the token could surpass $1.30 by mid-2024, driven by positive technical indicators and recent market developments.

Market sentiment remains mixed, with indicators reflecting a balance between cautious optimism and growing interest.

Developments like increased accessibility through network integrations and listings have supported price movements.

Long-Term Predictions (2030 and Beyond)

Long-term forecasts highlight the potential for LMWR to achieve substantial growth if adoption and institutional interest continue to rise.

Projections for 2030 estimate average prices reaching around $8.70, with upper targets nearing $13. These estimates are based on the token’s expansion within decentralized finance, new features, and a growing user base.

The platform’s focus on blockchain-based memberships and digital collectibles positions it well for future growth, provided the ecosystem continues to innovate and attract broader adoption.

Price Prediction Table

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2025 | $0.41 | $1.02 | $1.88 |

| 2026 | $0.45 | $1.10 | $2.00 |

| 2030 | $8.70 | $10.00 | $12.98 |

Note: Predictions are based on available data and may vary due to market conditions.

Related: ORN Coin Price Prediction: ORN Outlook for 2025 and 2030 Market Cap

Risks and Opportunities

Investing in LimeWire Token (LMWR) presents both challenges and potential growth avenues. Understanding these aspects is crucial for making informed decisions.

Risks and Challenges

Market Volatility and Liquidity Concerns

The cryptocurrency market is known for its significant price fluctuations, and LMWR is no exception. Investors may experience rapid changes in the token’s value, which can lead to potential losses.

Additionally, limited trading volumes might result in liquidity issues, making it difficult to execute large transactions without affecting the market price.

Security Risks and Regulatory Uncertainty

As a digital asset, LMWR faces security threats such as hacking and fraud. Investors must be cautious about the platforms they use for trading and storage.

Moreover, the evolving regulatory landscape for cryptocurrencies adds uncertainty, as new laws or regulations could impact the token’s legality and its use within certain jurisdictions.

Dependence on Technology and Developer Support

LMWR’s success relies heavily on the underlying technology and the continuous support from its development team.

Technical issues, lack of updates, or insufficient developer engagement could hinder the platform’s growth and the token’s value.

Growth Opportunities

Expanding Use Cases in DeFi, Web3, and Payments

LimeWire’s integration of blockchain and AI technologies positions LMWR to tap into the expanding decentralized finance (DeFi) and Web3 sectors.

This integration enables innovative applications in digital content creation and sharing, potentially increasing the token’s utility and demand.

Institutional Investment and Strategic Partnerships

Collaborations with established entities and attracting institutional investments can enhance LMWR’s credibility and adoption. Such partnerships may lead to increased use of the token within various ecosystems, positively influencing its value.

Scalability Solutions and Emerging Technologies

Implementing scalability solutions and adopting emerging technologies can improve the LimeWire platform’s performance and user experience.

Enhancements in transaction speeds, reduced fees, and expanded functionalities can attract a broader user base, fostering growth in LMWR’s adoption and market presence.

Key Points to Remember

- LimeWire is a blockchain-based platform designed for content creators and digital collectibles, supported by the LimeWire Token (LMWR).

- The token price has shown volatility since its launch, with a price chart reflecting highs around $1.54 and current trading near $0.25.

- Predictions for 2025 estimate the price of LimeWire token could range from $0.41 to $1.88, with long-term forecasts suggesting it may reach higher values by 2030.

- Utility within DeFi, Web3, and payments positions LMWR as a valuable cryptocurrency in the evolving digital economy.

- Growth opportunities include expanding use cases, institutional investments, and scalability improvements, though price volatility and regulatory uncertainties remain challenges.

- Investors should review live price data, market trends, and technical analysis before making decisions based on LimeWire price prediction models.