What is Fully Diluted Valuation (FDV)?

Fully Diluted Valuation (FDV) refers to the total value of a cryptocurrency, taking into account its maximum supply of tokens. FDV is a critical metric for crypto traders and enthusiasts as it helps assess the potential future value of a cryptocurrency project.

By considering the total supply of tokens, FDV provides a more comprehensive view of a project’s valuation compared to just looking at the current market capitalization, which only accounts for tokens currently in circulation.

This helps investors make more informed decisions about the growth potential and overall market value of a crypto asset.

Calculation of FDV in Crypto

To calculate FDV, you need the current price per token and the total supply of tokens. The formula is straightforward:

FDV= Current Price per Token × Total Supply of Tokens

For instance, if a cryptocurrency’s current price is $5 and the total supply of tokens is 500,000, the FDV would be:

FDV = $5 × 500,000 = $2,500,000

This calculation helps in understanding the valuation of a cryptocurrency project taking into account the future release of tokens. FDV offers a more holistic view of the project’s potential market cap compared to the market cap based on the current token supply.

Related: What is a Bull Run in Crypto? Understanding Market Dynamics

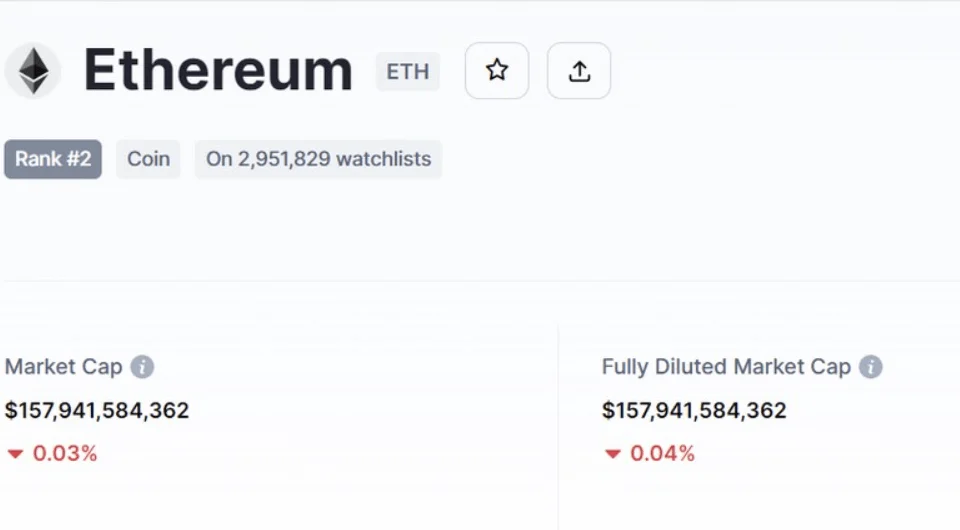

FDV vs Market Cap

Market cap reflects the value of tokens currently in circulation, calculated by multiplying the current price per token by the circulating supply. For example, if a token’s price is $10 and there are 100,000 tokens in circulation, the market cap would be:

Market Cap= Current Price per Token × Circulating Supply

Market Cap=$10×100,000=$1,000,000

FDV, on the other hand, includes all tokens that will eventually be in circulation, providing a future-oriented view. Comparing FDV and market cap helps investors understand the current versus potential future value of a cryptocurrency.

For example, if a project has a low market cap but a high FDV, it indicates a significant number of tokens are yet to enter the market, potentially diluting the value.

Using FDV and market cap together allows crypto traders to make more informed investment decisions, taking into account both the current and future state of the crypto market.

It also helps in evaluating the overall market potential and the impact of token release schedules on the price and valuation of a cryptocurrency project.

The Role and Application of FDV in Crypto

Fully Diluted Valuation (FDV) plays a crucial role in the cryptocurrency space. It helps investors and crypto enthusiasts assess the future potential of a cryptocurrency project by considering the total supply of tokens, including those not yet in circulation.

FDV’s Significance for Investors

FDV helps investors understand the future market size and potential price movements of a coin or token. By considering the total token supply, FDV provides a more comprehensive view of a crypto project’s potential valuation.

For example, if the current token price is $5 and the total token supply is 1 million, the FDV is $5 million. This calculation helps investors see beyond the current market cap, which only reflects tokens already in circulation.

FDV is calculated by multiplying the current price of a single token by the total supply of tokens. This includes all tokens that will eventually enter the market.

For instance, if a token’s current price is $2 and the total supply is 2 million tokens, the FDV would be $4 million. This provides investors with insight into how the market cap of a cryptocurrency project could evolve as more tokens enter circulation.

Related: What is a God Candle? Understanding This Crypto Phenomenon

FDV in Evaluating Crypto Projects

When evaluating a cryptocurrency project, FDV offers valuable insights into its long-term potential. By comparing FDV with the current market cap, investors can gauge the impact of future token releases on the token price.

For example, a project with a high FDV but a low current market cap suggests that a significant number of tokens have yet to be released, which could affect the future market price.

FDV helps in understanding the tokenomics of a project. Tokenomics refers to the economic model that governs the creation, distribution, and circulation of tokens within a blockchain project.

By using FDV, investors can evaluate how the token release schedule might impact the token price over time. This is particularly important for assessing whether the current market price reflects the potential future value of the project.

Additional Insights on FDV in Cryptocurrency

Understanding Fully Diluted Valuation (FDV) is crucial for anyone involved in crypto trading.

It provides a clearer picture of a crypto project’s potential value by considering all tokens that could eventually be in circulation.

Comparing FDV with Other Valuation Metrics

FDV is often compared with other valuation metrics like market cap. Market cap shows the current value of tokens that are in circulation, calculated by multiplying the current price of a single coin by the number of tokens currently available.

FDV, on the other hand, considers the total token supply, including those not yet released. This provides a future-oriented view of a project’s valuation.

For example, if a cryptocurrency has 1 million tokens in circulation at $10 each, its market cap would be $10 million. However, if the total supply is 2 million tokens, the FDV would be $20 million. This comparison helps investors understand the potential future market size and how the token supply could impact the price.

Factors Influencing FDV in Crypto

Several factors influence FDV in the crypto space. The primary factor is the total token supply. A higher supply typically leads to a higher FDV. Another factor is the token release schedule.

If tokens are released gradually, it can prevent a sudden decrease in price per token. Conversely, a large release of tokens can dilute the value and impact the fully diluted market cap.

The current market price and the project’s overall tokenomics also play a role. Tokenomics includes aspects like token distribution, usage, and the economic model governing the token’s ecosystem. These factors help in calculating the fully diluted valuation and understanding the project’s potential.

Practical Implications of FDV for Crypto Investors

FDV gives investors valuable insights into the potential future value of a cryptocurrency. It helps in making informed decisions by providing a more comprehensive view of the project’s valuation.

For instance, if a project has a low FDV compared to its current market cap, it might indicate limited future growth potential. Conversely, a high FDV could suggest significant future dilution risk.

Investors should use FDV alongside other metrics to evaluate the latest crypto projects. This holistic approach ensures a better understanding of the valuation in the crypto market and helps in assessing the risk and reward associated with a particular investment.

By comparing FDV with the market cap, investors can better understand the impact of future token releases. This is crucial for making strategic decisions in crypto trading and avoiding potential pitfalls. Remember that FDV alone does not provide a complete picture, but it is a vital tool in the overall evaluation process.

In conclusion, the use of FDV in crypto trading is essential for understanding the potential value of a project. It offers insights into the fully diluted value, helping investors make more informed decisions. Understanding the concept of FDV and its practical implications can significantly enhance investment strategies in the dynamic crypto space.