Overview of Catizen

Catizen (CATI) is a cryptocurrency built on the Ton blockchain, designed to offer a unique combination of social entertainment and crypto-driven financial potential.

It aims to create an interactive and engaging platform where users can participate in gamified activities while benefiting from the advantages of decentralized technology. Below, we will take a closer look at its history, tokenomics, use cases, and price trends.

Token History and Background

Launch Date and Founding Team:

Catizen (CATI) was launched to revolutionize the crypto space by merging social entertainment with decentralized finance.

The team behind the project envisions creating an ecosystem that allows users to engage in playful interactions while earning rewards.

While specific names of the founding members aren’t widely publicized, the project is supported by a dedicated group with a clear focus on leveraging the decentralized value economy.

Development Milestones and Roadmap:

Since its inception, Catizen has made several strides in establishing its token within the cryptocurrency ecosystem. The roadmap includes platform upgrades, airdrops, and expanding the ecosystem to offer more use cases for the CATI token.

It also highlights upcoming plans for partnerships and further listings on major exchanges, with projections aimed at scaling its reach by 2027 and beyond.

The project focuses on creating a sustainable ecosystem that blends entertainment and cryptocurrency utility.

Related: Vara Price Prediction 2025: VARA Crypto Market Cap Insights

Tokenomics and Supply Details

Total Supply, Circulating Supply, and Market Cap:

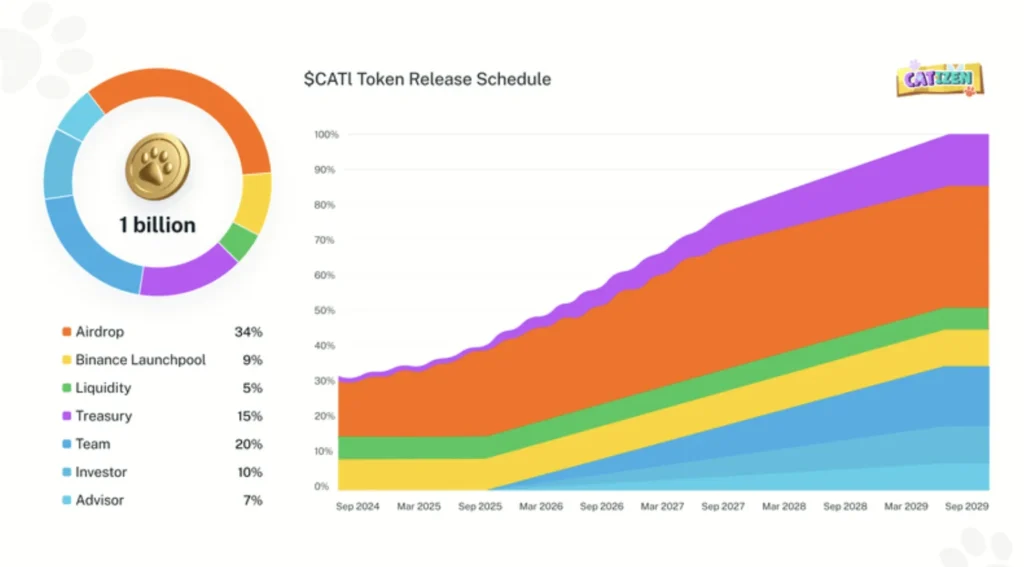

Catizen’s tokenomics are structured to ensure long-term sustainability and value. There is a total supply of 1 billion CATI tokens.

The circulating supply is carefully managed to avoid excess inflation, ensuring that the value of CATI is maintained.

Its market capitalization fluctuates based on the active trading volume, with a current focus on achieving steady growth in the crypto market.

Distribution Model (Mining, Staking, Pre-Mine, etc.):

The CATI token utilizes a mix of staking and liquidity pools to distribute tokens. Users can stake CATI in various decentralized finance (DeFi) platforms to earn rewards.

The token is also available through airdrops, and its distribution model encourages community engagement and participation in the ecosystem. Pre-mined tokens are allocated to development, partnerships, and community incentives.

Utility and Use Cases

Primary Use in Ecosystem or Platform:

The CATI token is central to the Catizen ecosystem, which is built around a cat-themed social entertainment experience. It enables playful interactions, gamified experiences, and decentralized value exchange.

This utility is designed to enhance user engagement while providing financial opportunities in a fun and interactive environment.

Partnerships and Integrations:

Catizen has established partnerships with several crypto exchanges and DeFi platforms to enhance its reach. The token is integrated into the ecosystem of various blockchain applications, including staking platforms and decentralized exchanges.

These partnerships aim to increase its exposure in the broader crypto market and strengthen its value proposition.

Real-World Applications (Payments, DeFi, NFTs, etc.):

Catizen is positioned as a multi-use token that can be leveraged in decentralized finance (DeFi) applications and other blockchain-based platforms.

Its primary application lies in social entertainment and interactive experiences, where users can stake tokens, participate in gamified activities, and even earn rewards through decentralized apps (dApps).

The token also holds potential as a payment method within its ecosystem, and its involvement in the attention economy suggests future expansion into NFTs and other digital assets.

Price History and Key Performance Trends

Initial Launch Price and Early Trading Patterns:

Upon launch, CATI was priced at a modest entry point, with initial trading volumes being driven by its niche community of cat-themed entertainment enthusiasts.

Early adoption saw fluctuations as the project gained recognition, with price volatility playing a significant role in its trading patterns.

All-Time Highs and Lows:

CATI’s all-time highs and lows reflect typical volatility seen in early-stage cryptocurrencies.

The price has been subject to sharp rises and dips, primarily driven by market sentiment, social interactions within the Telegram community, and listing events on major exchanges.

Impact of Major Events (Listings, Partnerships, Updates):

Significant events like exchange listings and partnerships have had a marked influence on the price of Catizen. For instance, in September 2024, following a key partnership announcement, the price surged.

Major updates and the increasing trading volume in 2027 are expected to have a similarly strong effect on price movements, with experts predicting upward trends through 2028.

The price of CATI could reach new highs if its decentralized social entertainment platform continues to grow in popularity.

Catizen Coin Price Prediction

Catizen (CATI) is poised for potential price growth due to several catalysts, including its unique ecosystem and increasing market presence. Short-term and long-term predictions suggest upward movement, with anticipated fluctuations based on market trends and developments.

Short-Term Predictions (2024–2026)

According to expert analysis, Catizen’s price could experience moderate growth between 2024 and 2026. The token price is projected to increase gradually due to the expanding ecosystem and increasing user base.

The project’s involvement in the attention economy and decentralized social entertainment platforms has contributed to a bullish sentiment in the market. Price predictions for 2024 suggest that CATI could reach anywhere from $0.08 to $0.12 by the end of 2024.

Analysts expect the token’s value to grow by 20%–30% annually through 2025 and 2026, with possible highs reaching $0.15 by mid-2026.

Market sentiment plays a significant role in determining the price of CATI in the short term. The price chart indicates steady growth, with recent developments, such as the increase in trading volume and partnerships with decentralized finance (DeFi) platforms, acting as growth catalysts.

In the last 24 hours, CATI experienced a 10% price increase, signaling positive market momentum. Investors are encouraged to monitor developments such as staking incentives and community engagement through Telegram, which may further influence price movements.

Long-Term Predictions (2030 and Beyond)

Looking ahead to 2030, Catizen is expected to benefit from increasing adoption, both by individual users and institutional investors. Experts suggest that institutional support could become a key driver for the price increase of CATI, as it establishes itself as a prominent player in the decentralized entertainment space.

The price of CATI may reach $1.00 or more by 2030, provided that adoption continues to grow and DeFi and other sectors integrate the token into their operations. Institutional investors could bring stability and liquidity to the project, further boosting CATI’s value.

Technological advancements, such as better staking options and improved decentralized finance (DeFi) integrations, will likely drive CATI’s price in the long term. Innovations within the Catizen ecosystem, including gamifying the attention economy, should result in a more robust and sustainable network.

The price of CATI could see substantial growth with the introduction of new features that attract more users and enhance its real-world applications.

By 2030, price predictions suggest a range between $1.00 and $2.50, depending on the success of network upgrades and user adoption.

Related: ORN Coin Price Prediction: ORN Outlook for 2025 and 2030 Market Cap

Price Prediction Table

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) |

|---|---|---|---|

| 2025 | $0.12 | $0.14 | $0.17 |

| 2026 | $0.15 | $0.18 | $0.22 |

| 2030 | $1.00 | $1.50 | $2.50 |

Risks and Opportunities

Risks and Challenges

- Market Volatility and Liquidity Concerns: The impact of volatile market conditions on Catizen’s price.

- Security Risks and Regulatory Uncertainty: Addressing concerns related to the safety of funds and any potential regulatory hurdles.

- Dependence on Technology and Developer Support: How much Catizen’s future relies on technological innovations and its developer community.

Growth Opportunities

- Expanding Use Cases in DeFi, Web3, and Payments: Exploring how Catizen could become more integrated in decentralized finance and other blockchain applications.

- Institutional Investment and Strategic Partnerships: The potential for larger financial institutions to invest and contribute to Catizen’s expansion.

- Scalability Solutions and Emerging Technologies: How technical advancements could boost Catizen’s performance and market adoption.

Conclusion

Catizen (CATI) has shown considerable growth potential since its launch, with its unique focus on social entertainment and decentralized finance. Historical price analysis reveals fluctuations driven by market sentiment, partnerships, and technological advancements.

Short-term predictions for 2024 suggest moderate growth, with experts projecting a steady rise in CATI’s value as its ecosystem expands. By 2030, Catizen’s adoption and institutional support could push its price toward significant gains, with potential reaching up to $2.50.

However, predicting the future price of CATI is speculative. It is essential for investors to understand that market volatility can influence price movements. While technical analysis offers insights, the crypto market is unpredictable. Therefore, always conduct thorough research and consider diversifying investments to manage risk effectively.

Ultimately, the long-term prospects for Catizen appear positive if it continues to leverage the attention economy and decentralized technologies. For those considering buying Catizen, it is essential to evaluate market conditions and historical price trends before making any investment decisions.

Note: Price predictions are speculative and subject to market conditions. Investors should conduct their own analysis before making decisions.