Introduction to Crypto Staking

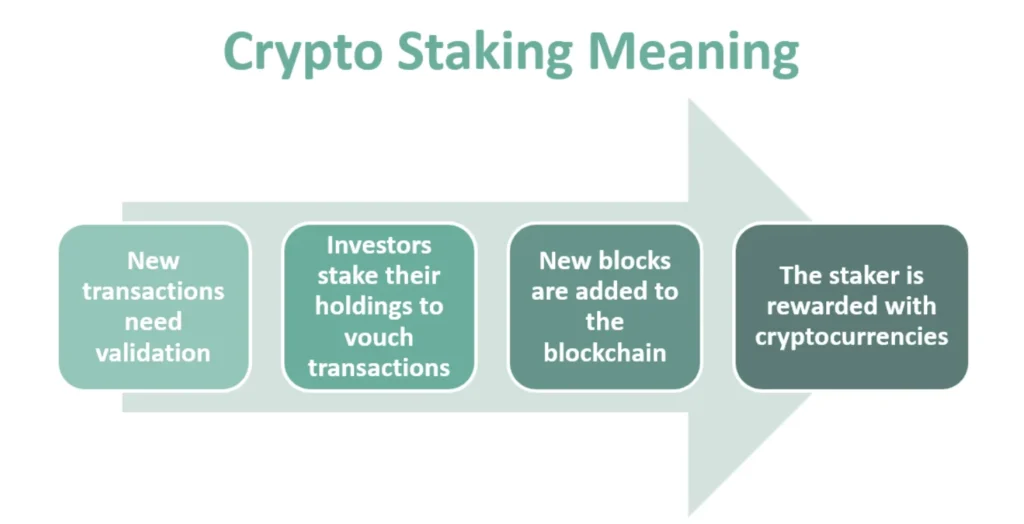

Crypto staking involves locking up your cryptocurrency assets in a blockchain network to support its operations, such as validating transactions.

When you stake crypto, you commit your coins to help maintain the network’s security and operations. In return, you earn staking rewards, which can be additional coins or transaction fees.

This process is crucial for Proof of Stake (PoS) and similar consensus mechanisms used by many cryptocurrencies.

How Does Crypto Staking Work?

To stake crypto, you need to hold coins in a network that supports staking. You then either delegate your coins to a staking pool or run a validator node yourself.

Staking pools allow users to combine their assets to increase their chances of earning rewards.

The more coins you stake, the higher the potential rewards. Staking rewards are typically distributed proportionally based on the amount of crypto each user has contributed to the pool.

Benefits of Crypto Staking

- Earning Rewards: By participating in staking, users earn rewards in the form of additional cryptocurrency. This allows crypto investors to generate passive income without actively trading their assets.

- Supporting Network Security: Staking helps secure the blockchain network. Validators who stake their coins are incentivized to act in the network’s best interest since malicious behavior can result in the loss of staked assets.

- Decentralization: Staking contributes to the decentralization of the network by enabling more participants to become validators. This reduces the risk of centralization, where a single entity could potentially control the network.

- Energy Efficiency: Compared to Proof of Work (PoW) mining, staking is more energy-efficient as it requires significantly less computational power to validate transactions.

- Network Governance: Some PoS networks offer staking participants voting rights on network proposals and changes, allowing users to have a say in the future development and governance of the network.

In summary, crypto staking is an efficient way to earn rewards and support blockchain networks.

It offers benefits like earning passive income, enhancing network security, promoting decentralization, and participating in network governance.

Related: Discover the Best Place to Stake Ethereum: Top 5 Platforms for Ethereum Staking

How to Choose the Best Crypto Staking Platform

Choosing the right platform for staking your crypto assets is crucial for maximizing rewards and ensuring the security of your investments. Here are key factors to consider:

1. Supported Cryptocurrencies

Look for a platform that supports a wide range of cryptocurrencies. This flexibility allows you to stake different types of crypto assets and diversify your staking portfolio.

For example, Binance supports over 180 cryptocurrencies for staking, providing various options for users.

2. Reputation and Security

Choose a platform with a strong reputation and robust security measures. Platforms like Binance and Coinbase are recognized for their security features, including two-factor authentication (2FA) and anti-phishing codes.

It is vital to ensure that the platform has a good track record of protecting users’ funds from hacks and breaches.

3. Rewards and Terms (APY, Lock-up Periods)

Evaluate the rewards and terms offered by the staking platform. This includes the Annual Percentage Yield (APY) and the lock-up periods for your staked assets.

Some platforms offer flexible staking options with no lock-up periods, while others may provide higher rewards for longer lock-up periods. Assess these terms based on your investment goals and liquidity needs.

4. User Interface and Experience

A user-friendly interface can significantly enhance your staking experience. Platforms with intuitive designs make it easier to manage your stakes and monitor your rewards.

Binance and other leading exchanges provide comprehensive guides and support to help users navigate their platforms efficiently.

5. Community and Support

Active community engagement and responsive customer support are essential. Platforms like Binance offer 24/7 chat support and extensive FAQ sections to assist users.

A strong community can provide valuable insights and support, helping you make informed decisions about your staking activities.

6. Regulatory Compliance

Ensure the platform complies with relevant regulations in your region. Regulatory compliance adds an extra layer of security and legitimacy to the platform. Binance, for instance, adheres to various regulatory standards globally, ensuring a secure environment for its users.

By considering these factors, you can select a platform that not only maximizes your staking rewards but also ensures the safety and accessibility of your crypto assets.

Top 8 Crypto Staking Platforms

Choosing the right platform for staking your crypto assets is crucial for maximizing rewards and ensuring the security of your investments. Here are the top 8 crypto staking platforms for 2024.

1. OKX

OKX is a prominent cryptocurrency exchange recognized for its robust trading and staking services. It provides a variety of staking options, accommodating both novice and experienced investors. OKX supports a wide array of cryptocurrencies for staking, allowing users to diversify their investments.

The platform is known for its competitive annual percentage yields (APYs) and user-friendly interface. OKX also prioritizes security, implementing advanced measures to protect users’ funds.

Additionally, it offers detailed guides and support to help users navigate the staking process effectively. OKX is considered one of the best platforms for staking due to its comprehensive features and high rewards.

Features:

- Wide range of supported cryptocurrencies.

- Both flexible and locked staking options.

- Competitive APY rates.

- Advanced security measures.

- User-friendly interface with comprehensive guides.

Pros and Cons:

Pros: High rewards, diverse staking options, user-friendly.

Cons: Higher fees for certain staking services.

2. Binance

Binance is one of the largest and most popular cryptocurrency exchanges globally. It offers an extensive staking service supporting numerous cryptocurrencies. Binance is renowned for its low fees, high liquidity, and comprehensive range of products and services.

The platform’s staking options are diverse, including both flexible and locked staking, catering to different investment strategies. Binance provides advanced security features such as two-factor authentication and anti-phishing codes to protect users’ funds.

The user-friendly interface, combined with detailed guides and 24/7 customer support, makes Binance a preferred choice for many crypto investors looking to stake their assets.

Features:

- Extensive range of supported crypto assets.

- Flexible and locked staking options.

- Advanced security features including 2FA.

- User-friendly interface with detailed guides.

Pros and Cons:

Pros: High security, diverse staking options, competitive rewards.

Cons: Can be overwhelming for beginners due to the wide array of features.

3. KuCoin

KuCoin is a well-known cryptocurrency exchange that offers competitive staking services. It supports a variety of staking options, allowing users to choose between on-chain and off-chain staking.

KuCoin is praised for its low minimum staking requirements, making it accessible to a broad range of investors. The platform provides a user-friendly experience with comprehensive tutorials to guide users through the staking process.

KuCoin’s advanced security measures ensure the safety of users’ funds, while its wide range of supported assets allows for diversification. KuCoin is a popular choice among investors looking for a reliable and flexible staking platform.

Features:

- Supports on-chain and off-chain staking.

- Low minimum staking requirements.

- User-friendly platform with comprehensive tutorials.

- Advanced security measures.

Pros and Cons:

Pros: Low minimum staking, wide range of supported assets.

Cons: Occasional technical issues.

4. Gate.io

Gate.io is a cryptocurrency exchange that provides robust staking services with high APYs and flexible options for users. The platform supports a wide range of cryptocurrencies, allowing users to diversify their staking portfolios.

Gate.io is known for its high rewards, offering competitive rates for various assets. The platform’s user-friendly interface and comprehensive security measures make it a reliable choice for staking.

Gate.io also offers detailed guides and support to help users navigate the staking process. The platform’s flexible staking periods and high APYs make it an attractive option for both new and experienced investors.

Features:

- High APY on a variety of crypto assets.

- Flexible staking periods.

- Comprehensive security measures.

- User-friendly interface with clear instructions.

Pros and Cons:

Pros: High rewards, flexible staking options.

Cons: Higher fees for certain staking pools.

5. MEXC

MEXC is a growing cryptocurrency exchange that offers competitive staking services, focusing on new and emerging projects.

The platform supports a variety of new and lesser-known cryptocurrencies, providing high APYs and flexible staking options. MEXC is praised for its user-friendly platform and detailed guides, making it accessible to both novice and experienced investors.

The platform regularly adds new staking options, allowing users to stay updated with the latest opportunities. MEXC’s emphasis on supporting new projects makes it a popular choice for investors looking to diversify their portfolios with high-potential assets.

Features:

- Supports a variety of new and lesser-known cryptocurrencies.

- Offers high APY and flexible staking options.

- User-friendly platform with detailed guides.

- Regularly adds new staking options.

Pros and Cons:

Pros: High rewards, support for new projects.

Cons: Limited liquidity for some assets.

Related: How to Stake AVAX: A Simple Guide to Earning Rewards on the Avalanche Network

6. Bybit

Bybit is a popular cryptocurrency exchange known for its trading services and competitive staking options. The platform supports major cryptocurrencies for staking and offers both flexible and locked staking options.

Bybit is recognized for its advanced security features, ensuring the safety of users’ funds. The platform provides a user-friendly interface with comprehensive guides to help users navigate the staking process.

Bybit’s competitive rewards and extensive support make it a preferred choice for many investors. The platform’s focus on security and ease of use makes it one of the best places to stake crypto.

Features:

- Supports major cryptocurrencies for staking.

- Offers both flexible and locked staking options.

- Advanced security features.

- Easy-to-use platform with comprehensive guides.

Pros and Cons:

Pros: Competitive rewards, user-friendly interface.

Cons: Limited number of supported assets for staking.

7. Coinbase

Coinbase is a leading cryptocurrency exchange known for its ease of use and security. The platform offers robust staking services, supporting major cryptocurrencies.

Coinbase’s user-friendly interface and detailed staking guides make it accessible to both novice and experienced investors. The platform provides advanced security measures, including two-factor authentication and insurance coverage for users’ funds.

Coinbase offers staking rewards for holding assets in its Coinbase Wallet, making it a convenient option for users who want to earn passive income. The platform’s high security and ease of use make it a top choice for staking.

Features:

- Supports major cryptocurrencies.

- Easy-to-use platform with detailed staking guides.

- Advanced security measures.

- Offers staking rewards for holding assets in Coinbase Wallet.

Pros and Cons:

Pros: High security, user-friendly, integrated wallet staking.

Cons: Higher fees compared to some other platforms.

8. Kraken

Kraken is a well-established cryptocurrency exchange offering a wide range of staking options with competitive rewards. The platform supports a variety of cryptocurrencies and provides both flexible and locked staking options.

Kraken is known for its advanced security features, including two-factor authentication and cold storage for users’ funds. The platform offers comprehensive staking guides and support, making it easy for users to get started.

Kraken’s user-friendly interface and high rewards make it one of the best platforms for staking. The platform’s focus on security and ease of use makes it a reliable choice for crypto investors.

Features:

- Supports a variety of cryptocurrencies.

- Offers both flexible and locked staking options.

- Advanced security features including 2FA.

- Comprehensive staking guides and support.

Pros and Cons:

Pros: High security, competitive rewards, user-friendly.

Cons: Higher fees for some staking options.

These platforms offer a range of staking opportunities, making it easier for users to earn rewards on their crypto investments. Each platform has its strengths and weaknesses, so it’s important to choose one that best fits your needs and staking strategy.

Risks and Considerations

Staking crypto can be rewarding, but it’s crucial to understand the associated risks and considerations. Here are the key factors to keep in mind:

Liquidity Issues

Staking typically involves locking up your crypto assets for a specified period. This means your funds are not easily accessible for trading or selling. During this lock-up period, if market conditions change or if you need immediate access to your assets, you may face liquidity issues.

Liquid staking options are available on some platforms, but they often come with different risk profiles and potentially lower rewards.

It is essential to evaluate whether you can afford to have your assets locked up for the staking period offered by the platform.

Market Volatility

Cryptocurrencies are known for their high volatility. The value of the staked cryptocurrency can fluctuate significantly, which can impact the overall value of your staking rewards.

If the market value of your staked assets drops sharply, the rewards may not compensate for the loss in asset value.

This makes market volatility a critical factor to consider when deciding to stake your crypto assets.

Security Breaches

Security is a paramount concern when staking crypto. Even well-established platforms can be targets for hackers. A security breach can lead to the loss of staked assets and rewards.

Therefore, it’s crucial to choose a platform with strong security measures, such as two-factor authentication, cold storage, and insurance for users’ funds.

Additionally, decentralized platforms may have different security dynamics compared to centralized ones, so understanding the security protocols of your chosen platform is vital.

Regulatory Compliance

The regulatory landscape for cryptocurrencies varies significantly across different regions. Regulatory changes can impact staking services, especially if new laws restrict or alter the operations of crypto platforms.

Compliance with local regulations is essential to ensure the legality and security of your staking activities.

Some platforms are more proactive in maintaining regulatory compliance, which can provide an added layer of security and trust.

Understanding these risks and considerations helps in making informed decisions about staking your crypto assets, ensuring that you maximize rewards while minimizing potential downsides.

Conclusion

As the cryptocurrency landscape continues to evolve, staking has emerged as a key strategy for earning passive income. Understanding best practices and anticipating future trends is crucial for maximizing benefits while minimizing risks.

Summary of Best Practices

When choosing a platform for staking, consider the following best practices:

- Research the Platform: Ensure the platform is reputable and secure. Look for established exchanges like Binance and Coinbase that offer robust security features and have a strong track record.

- Understand the Terms: Be clear about the staking terms, including lock-up periods and APY rates. Flexible staking options might be more suitable if you need liquidity.

- Diversify: Spread your assets across multiple platforms and cryptocurrencies to reduce risk. This approach helps mitigate the impact of volatility in a single asset or platform.

- Monitor Regularly: Keep an eye on your staked assets and the platform’s performance. Regular monitoring helps in making timely decisions, especially if the market conditions change.

- Stay Updated on Regulations: Ensure the platform complies with local regulations to avoid any legal issues. Regulatory landscapes can change, impacting staking services.

Future of Crypto Staking

The future of crypto staking looks promising, with several trends and developments on the horizon:

- Increased Adoption of DeFi Staking: Decentralized Finance (DeFi) platforms are becoming more popular for staking. These platforms offer higher rewards and more staking options, although they come with higher risks.

- Integration with Traditional Finance: Traditional financial institutions are beginning to explore staking and other crypto services. This integration can lead to more regulated and secure staking opportunities.

- Enhanced Security Measures: As the staking ecosystem grows, platforms are likely to implement more advanced security measures to protect users’ funds and build trust.

- Expansion of Liquid Staking: Liquid staking allows users to stake their assets while still having access to liquidity. This trend is expected to grow, providing more flexibility and opportunities for investors.

- Development of New Protocols: New blockchain protocols are being developed to support more efficient and rewarding staking mechanisms. Innovations in smart contract technology and consensus algorithms will continue to enhance the staking experience.

By following best practices and staying informed about future trends, investors can effectively leverage staking to earn passive income and contribute to the security and efficiency of blockchain networks.

Article Sources

At UncryptoNote, we prioritize accuracy and integrity in our content. Our writers are required to utilize primary sources to substantiate their work. This includes white papers, government data, firsthand reporting, and interviews with experts in the industry. We also incorporate original research from other credible publishers when relevant. This rigorous approach ensures that we deliver content that is both precise and impartial.